The global economy is currently at a crossroads, with various indicators signaling a potential recession on the horizon. The forecasting department at Mintec has been closely monitoring the situation, and while the macroeconomy has indeed witnessed a decline in GDP growth, the question of whether this downturn will escalate into a full-blown recession remains uncertain. In this blog post, we will examine the factors contributing to this economic uncertainty and offer our perspective on the matter.

The global economy is currently at a crossroads, with various indicators signaling a potential recession on the horizon. The forecasting department at Mintec has been closely monitoring the situation, and while the macroeconomy has indeed witnessed a decline in GDP growth, the question of whether this downturn will escalate into a full-blown recession remains uncertain. In this blog post, we will examine the factors contributing to this economic uncertainty and offer our perspective on the matter.

Our analysis draws from both fundamental and technical perspectives, considering factors such as GDP growth, demand, construction, employment, and more.

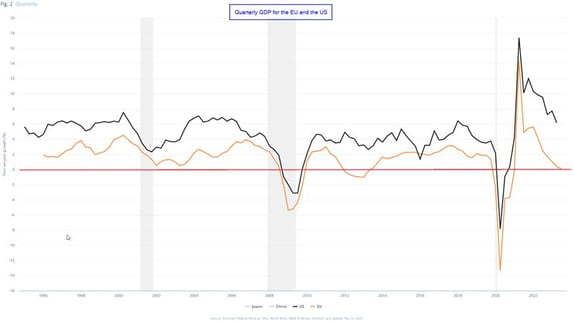

GDP Growth

One of the key indicators that have sparked concerns is the decline in GDP growth, particularly in the European Union and the United States. Since Q2 2021, both regions have experienced a steep decline in GDP growth rates. While the United States has managed to maintain positive GDP growth, the European Union is teetering on the brink of zero growth. This implies that the EU is perilously close to experiencing negative GDP growth, a significant red flag for the global economy.

Fundamentals

A critical aspect of the current GDP growth decline is the drop in demand, which is notably reflected in the decreasing Purchasing Managers' Index (PMI) for industrial orders and demand since the summer of 2022. This prolonged decline in demand has created headwinds for economic growth.

In addition to dwindling demand, we must also consider the health of the construction and employment sectors. Construction spending has been on a downward trajectory for over a year, and building permits have plummeted for 2.5 years, reaching historically low levels. This indicates a bleak outlook for future construction activity, further weighing on GDP growth.

The last line of defense has been the remarkably low levels of unemployment. Despite the GDP's decline, a robust labor market has prevented a full-scale economic collapse and staved off the looming recession. However, there is a technical signal in the US labor market, which typically foreshadows an increase in unemployment. Historically, this signal has proven accurate, suggesting that we might face a period of rising unemployment for approximately two years or more. While past performance is not a guarantee of future outcomes, if this signal is accurate once more, the last pillar supporting a strong labor market may crumble.

The labour market in the European Union, while not experiencing the same signal as the US, is not far behind in terms of economic challenges. Historically, the labour market in the EU tends to follow the US market with a time lag, implying that it may be in for a rough patch as well. When we combine falling demand, a bleak construction outlook, and a potential rise in unemployment, it becomes evident that the risk of a recession is now considerably higher.

The global economy stands at a critical juncture, and the question of whether it will descend into a recession in 2024 remains unanswered. The declining GDP growth and the various fundamental factors contributing to this economic uncertainty necessitate close monitoring and careful planning.

The road ahead is fraught with challenges, and it is essential for governments, businesses, and individuals to stay informed and adapt to the evolving economic landscape. While history provides some guidance, the unique circumstances of the present should not be underestimated.

As we continue to navigate these uncertain times, it is crucial to remain vigilant and proactive in our approach to mitigate the potential impact of a looming recession on our economies and livelihoods.

Explore Mintec to learn how leveraging extensive forecast data and insight on commodities can help you mitigate risks and maximize opportunities.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)