Animal Products | Currencies & Freight | Energy | Grains & Oilseeds | Metals | Plastics | Softs | Steel

A sophisticated and proven forecasting methodology that has delivered results to clients for over 15 Years. As a result, overall organisational performance is transformed, delivering sustainable organisational excellence and procurement cost savings.

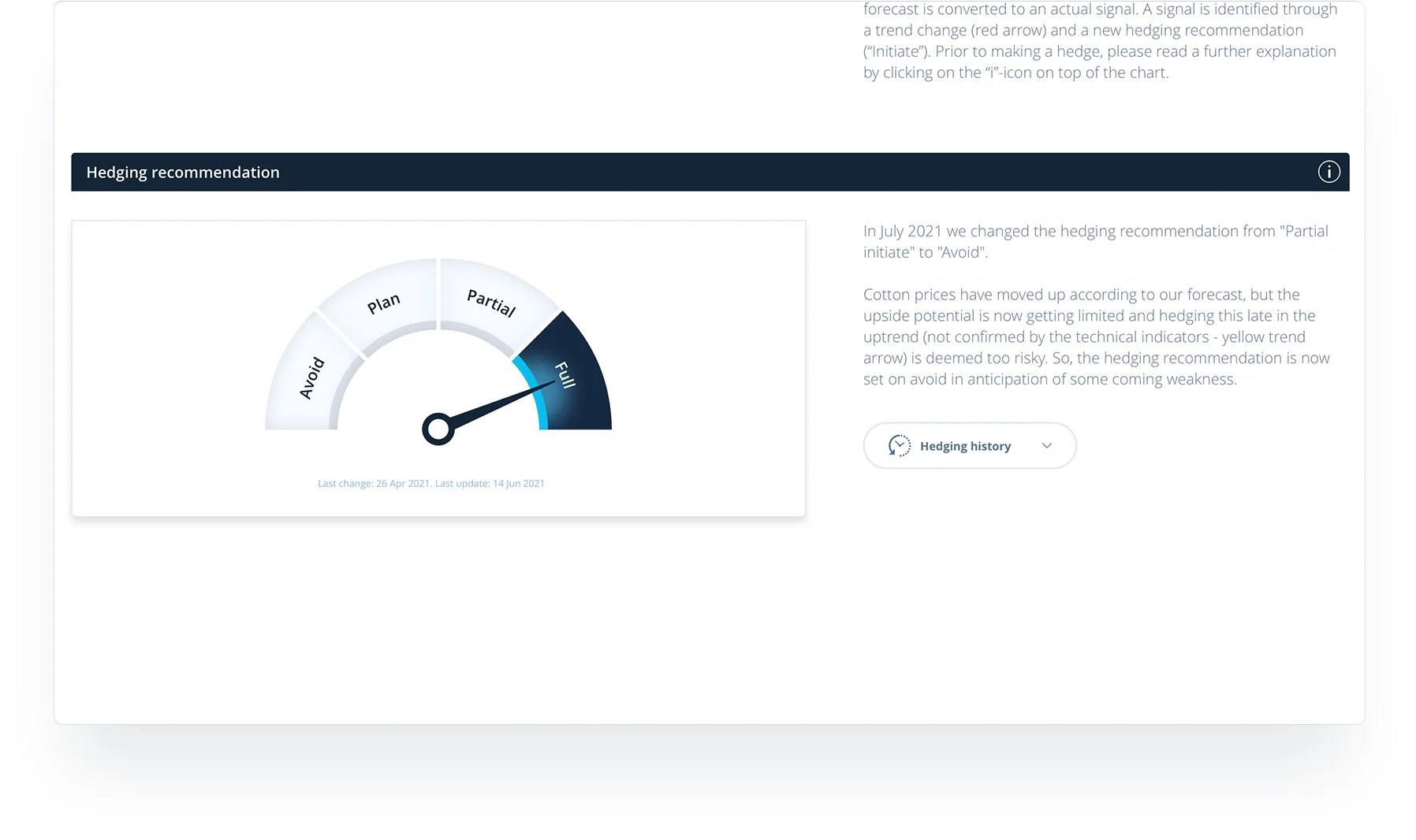

Give buying teams better purchase options by advising them of the best time to hedge with clear explanations for each of four options

Forecasts improve the timing of purchases to reduce material costs and price risk

Enhance budget planning and deliver higher-quality updates to key stakeholders

Shared market knowledge with a reduced dependence on suppliers’ information

Manage risk exposure & develop buying strategies for essential energy, agri-food & commodity raw materials.

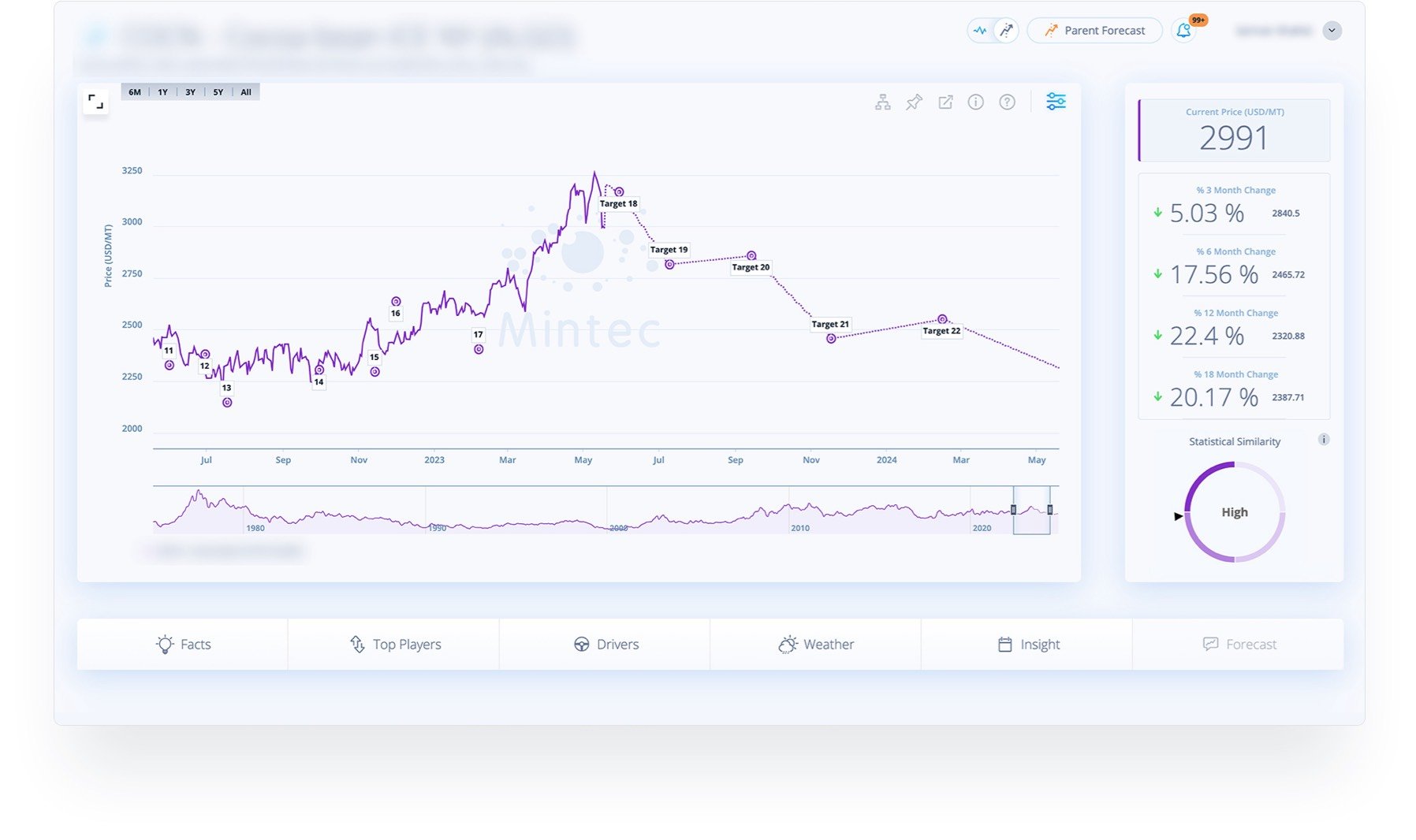

Mintec’s Algorithmic Price Forecasts are calculated based on a robust methodology that applies advanced statistical analysis to leverage Core Forecasts to generate price predictions.

Our algorithmic forecasts cover a wide range of commodities, including but not limited to:

Agricultural Products, Metals & Minerals, Energy & Transport, Soft Commodities, Processed Foods and Packaging & Textiles.

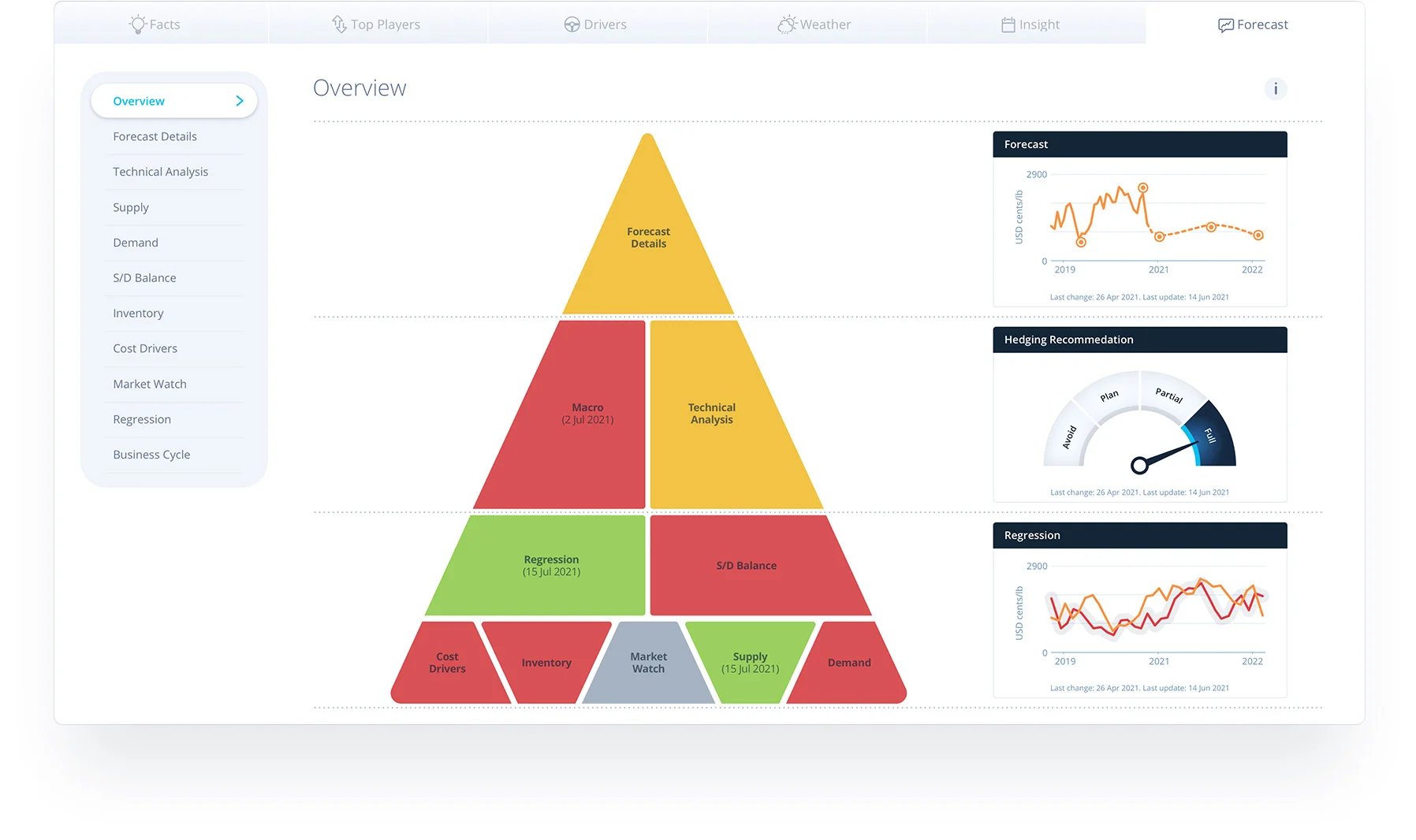

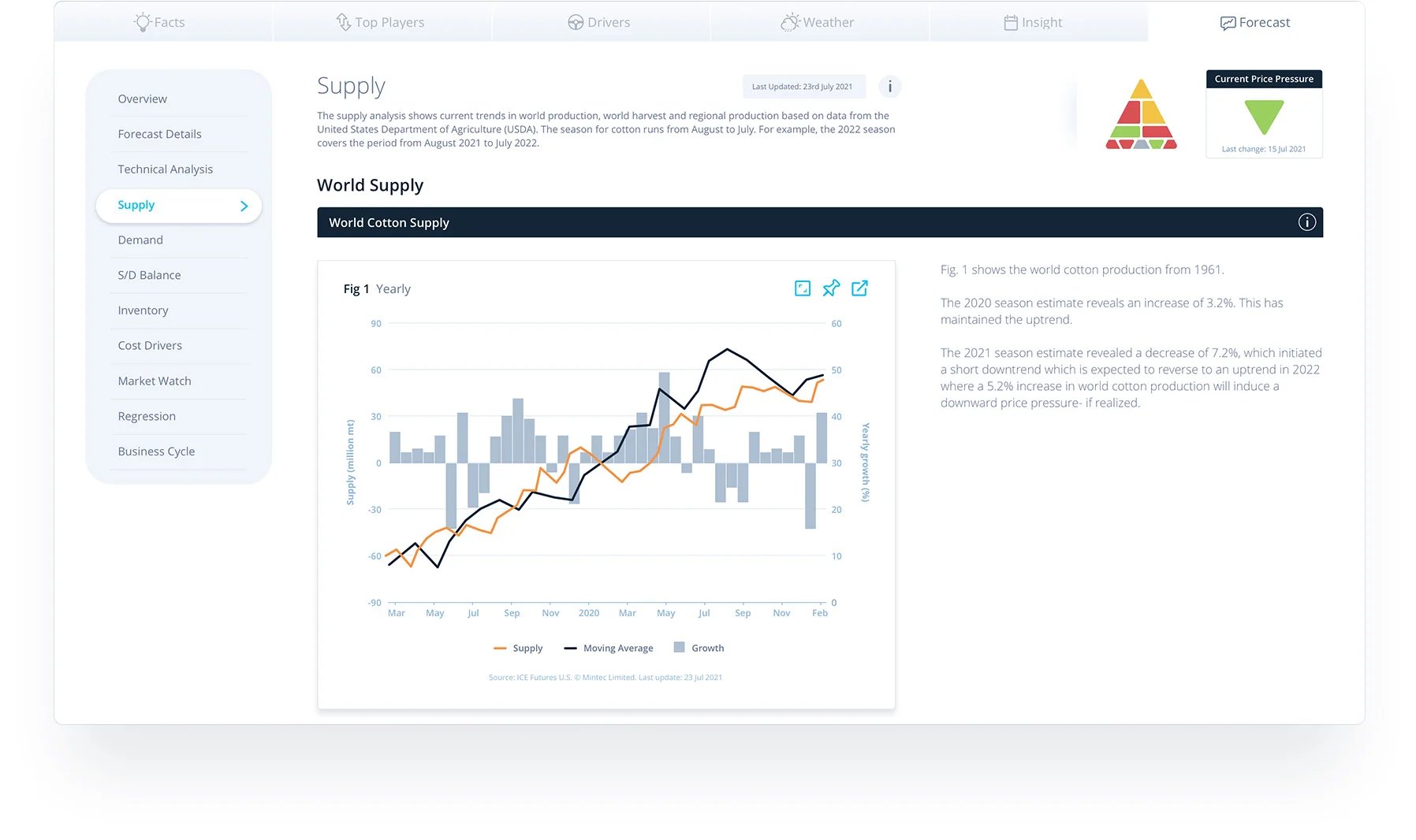

The price forecasts are delivered by a team of leading commodity analysts using a proprietary combination of fundamental, statistical and technical analysis. All our forecasting results are transparent. We show a record of all our price forecasts and hedging recommendations so you can compare them to reality. No other provider does this.

Alerts for changes to forecasts and hedging recommendations

Commentaries explaining fundamental and technical analysis

Dashboards that include forecast and hedging recommendations

API enabled to optimise integration

Understand key procurement performance indicators. Our Macro Economic Forecasts are distinct from other commodity analysis because they use a range of indicators, including GDP and CPI, from key regions to forecast the global economy, demonstrating the strong relationship between global manufacturing activity and commodity price movements.

Avoid: Prices at the top or a confirmed downtrend means hedging is not recommended

Plan: Anticipated uptrend. Need to plan for a future recommendation to hedge

Partial: Recommendation to hedge only part of the total volume due to possible “fake signals”

Full: A confirmed buy signal validating an uptrend suggests the need to hedge

CONTACT DETAILS

Mintec Ltd

Mintec LtdHEAD QUARTERS

Copyright © 2026 Mintec Limited

Copyright © 2026 Mintec Limited