Last month, the US State Department announced the expiration of General License 44, which authorized “transactions related to oil or gas sector operations in Venezuela.” The expiration allows for a 45-day wind-down period for companies to cease operations.

The expiration of the license came after the official opposition bloc was prevented from fielding two consecutive candidates. However, in a more recent development, former ambassador, Edmundo Gonzalez Urrutia, has been successfully nominated as the Democratic Unitary Platform coalition candidate, in a move that has been well-received by the US. To that end, some industry sources anticipate that sanctions may be relaxed again in the coming weeks.

Source: EIA

The US State Department relieved sanctions on the oil and gas sector in Venezuela in October 2023 in return for a fair electoral process in the country. Mintec previously reported on the removal of sanctions, and how this may result in around a 30% increase in Venezuela’s crude oil production over the coming years. However, market sources noted that years of underinvestment in infrastructure would limit Venezuela’s ability to process and export crude oil.

Source: EIA

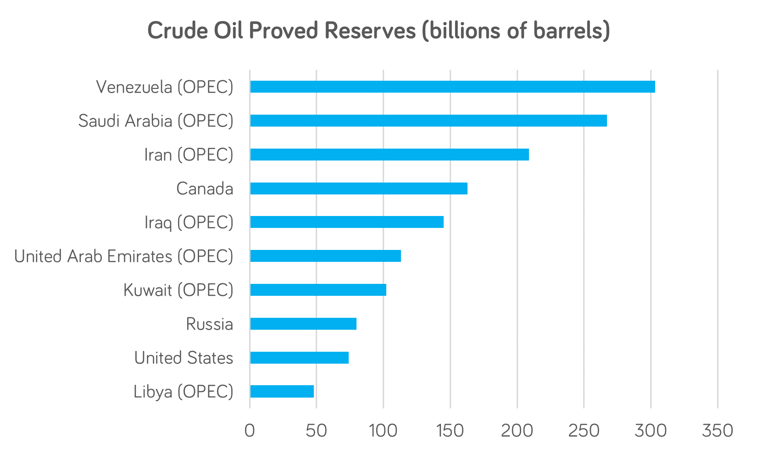

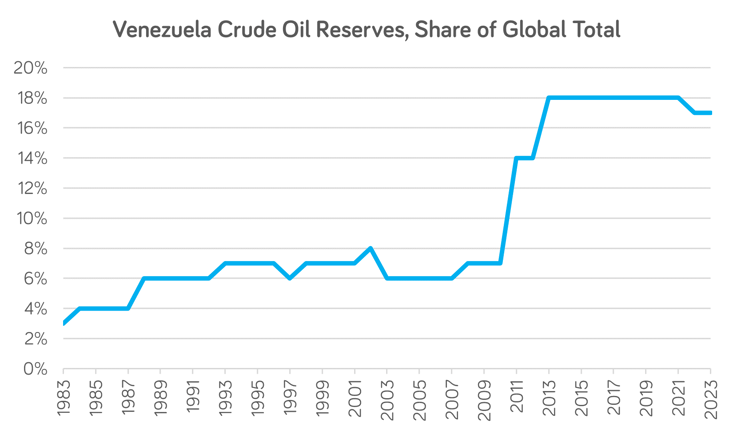

Holding around 17% of global crude oil reserves, with just over 300 billion barrels of crude oil in Venezuela, Venezuela is the largest holder of crude oil in the world. The decision by the US to relieve sanctions on the oil and gas sector in the country, therefore, could have a significant long-term impact on the crude oil market.

Mintec will provide updates on this very fluid situation as more information becomes available following the nomination of Urrutia.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)