Last week, the US announced that it was easing sanctions that had targeted Venezuela’s oil and gas industry since 2019. The temporary cessation of sanctions for an initial six-month period will allow additional production, sales and exports of crude oil into the global market. As part of the deal, Venezuelan President Nicolás Maduro committed to free and fair elections.

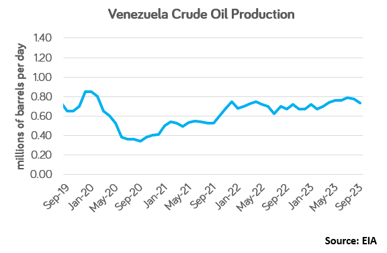

While the lifting of sanctions will likely result in more crude oil entering the global market, sources believe that production and exports from the country will be limited following a period of underinvestment. Thus, much of the oil and gas infrastructure in Venezuela requires upgrading. Indeed, the Energy Information Agency (EIA) forecasts that the country’s crude oil production growth will be less than 200,000 barrels per day (b/d) next year, a potential increase of just under 30% compared to current levels.

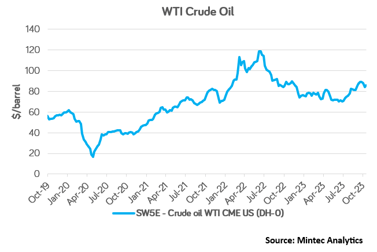

Despite the challenges facing the oil and gas industry in Venezuela, the country had been exporting crude oil to countries, such as Iran and China. The news of sanctions relief adds a degree of bearish pressure to the oil market, against the backdrop of the bullish Organization of Petroleum Exporting Countries (OPEC) output cuts, amounting to over 2 million b/d in addition to 1.3m b/d of voluntary cuts by Saudi Arabia and Russia, and potential military escalation in the Middle East.

For reference, the WTI crude oil (DH-0) [Mintec Code: SW5E] price was $86.82/barrel on 20th October, down 2.6% month-on-month, representing a 0.4% year-on-year rise. Mintec will provide updates on the lifting of sanctions against Venezuela as more information becomes available.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)