Malaysian palm oil production skyrockets 11% in July, defying expectations: MPOB

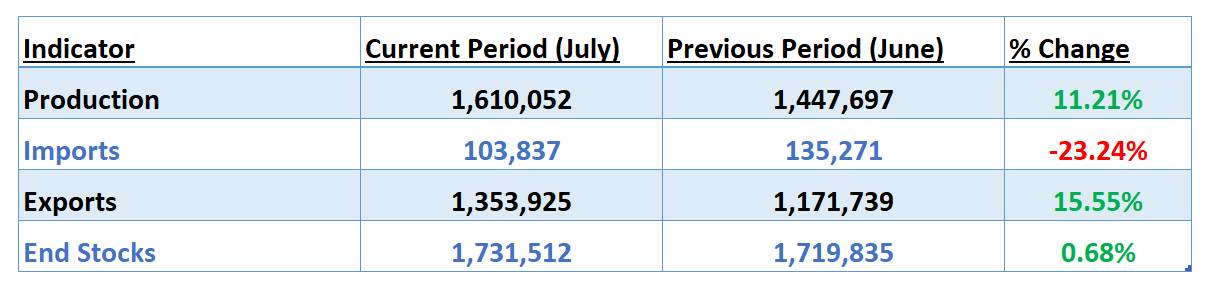

The latest Malaysian Palm Oil Board Report (MPOB) for July has been released, and according to the report, palm oil stocks at the end of the month were approximately 1.73 million metric tonnes. This figure significantly deviates from the estimate provided to Mintec before the report's release, where the consensus among market players pointed to a stock increase of about 4% to 6%. In stark contrast, the officially unveiled data shows a mere 0.68% rise in stocks. Nonetheless, the present stocks are slightly elevated compared to the recorded 1.719 million tonnes in June 2023.

However, the surprise within the report lies in the robust 11.21% surge in production. This figure significantly surpasses the projections forwarded by market participants to Mintec, which had anticipated a more modest 7% to 8% increase before the report's official release. The actual rise in production not only outperformed these optimistic forecasts but also exceeded the ambitious projection of 10.73% by the Malaysian Palm Oil Association; this particular estimate had been met with scepticism by some market players before the report's release. Furthermore, July's exports surged to 1.35 million metric tonnes, far beyond estimates submitted to Mintec, indicating a 6% to 8% rise from the figures observed in June. The official data, however, reveals a remarkable 15.55% surge, shedding light on India and China's notable stockpiling activities ahead of their respective holidays and festivals.

The MPOB report, in Mintec’s view, is moderately bullish. Yet, the course of the market in the upcoming months hinges crucially on August's performance. Insights conveyed by market players to Mintec unveil a remarkable 18.65% surge in production during the first five days of August, compared to the same timeframe in July. The pivotal question of numerous market participants is whether the demand from key players, notably India and China, throughout August will effectively counterbalance the robust production levels and avert the risk of significant stock accumulation over the month. While European demand is poised to be supportive, it is unlikely to underpin prices in a significant way.

MPOB Figures and Month and Month Changes in metric tonnes:

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)