-

Expect prices for finished goods to stabilise at higher levels than those seen before the start of the Ukraine-Russia conflict.

Expect prices for finished goods to stabilise at higher levels than those seen before the start of the Ukraine-Russia conflict.

-

Crops which are grown under contract, rather than sold on a free-market, prices are expected to remain elevated in the coming season (2023/24)

Crops which are grown under contract, rather than sold on a free-market, prices are expected to remain elevated in the coming season (2023/24)

-

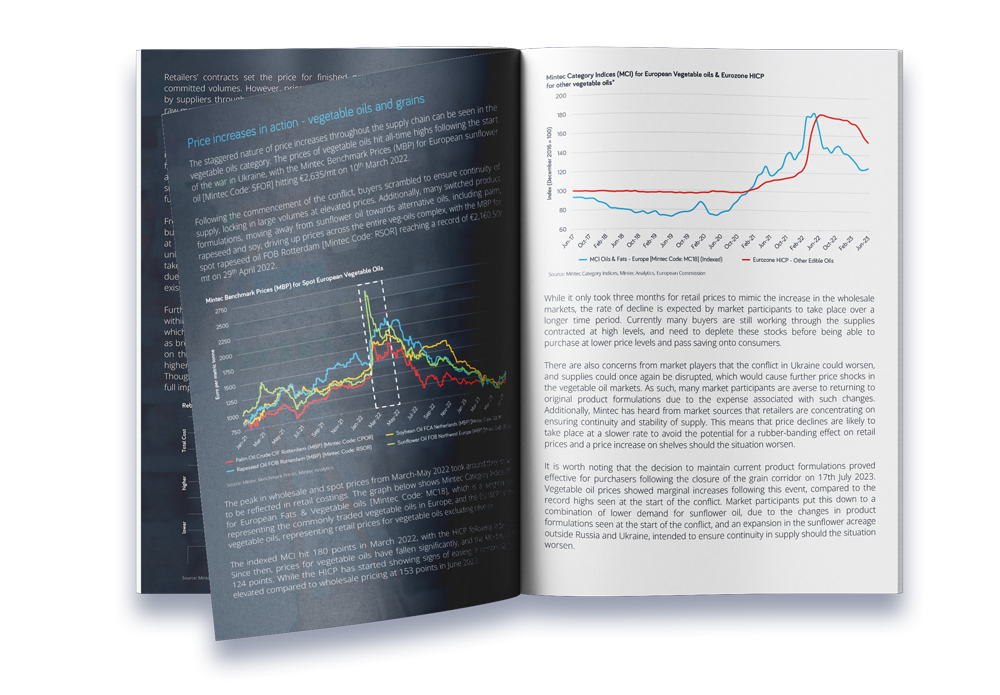

Declines in wholesale markets will take time to filter through to a retail level and longer for stabilisation to occur.

Declines in wholesale markets will take time to filter through to a retail level and longer for stabilisation to occur.