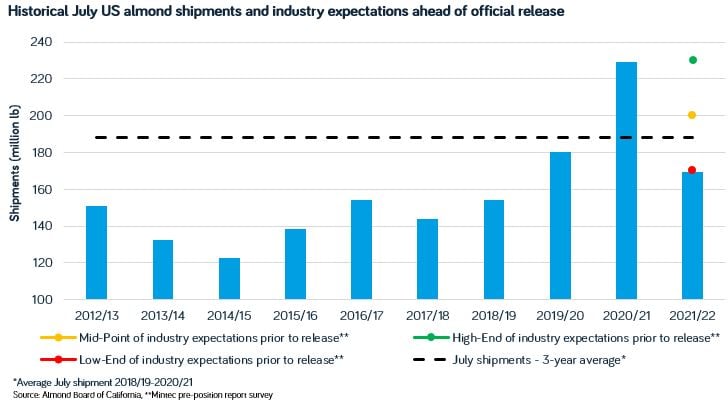

July saw a steep downturn in US almond shipments, following several record months, due to closures at the Port of Oakland (click here to read more). The July position report, released on August 12, saw total shipments at 169.42 million pounds, below industry expectations.

Prior to the release of the July position report, a survey conducted by Mintec saw estimates for July shipments reported in a range of 170-230 million pounds. The majority of market participants returned figures of 190-210 million pounds. The full results of the Mintec pre-Position Report survey can be found via this link.

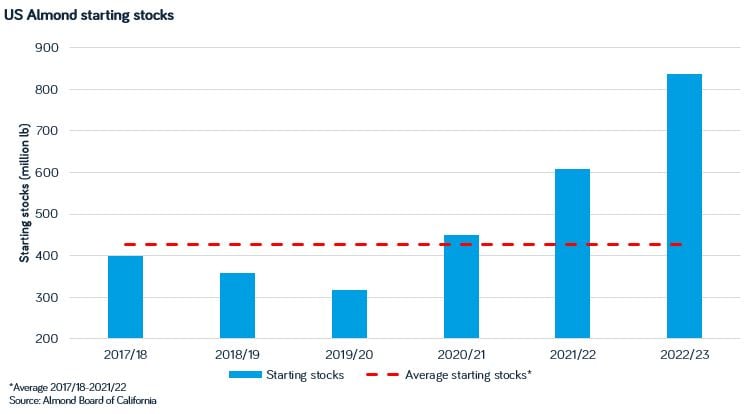

The lackluster shipments place the carry-in for the 2022/23 season at 837.75 million pounds, the highest on record. Most of this stock is thought to be smaller sized material, with a large proportion only fit for industrial usage. Sellers are aggressively marketing this portion of the carry-in to free up storage space for new crop almonds that are currently being harvested. As such, old crop industrial grades are very attractively priced with the Mintec Benchmark Prices for standard 5% almonds FAS US [Mintec Code: NAL1] assessed at $1.55/lb on August 18, 10 cents/lb below prices for new crop supplies.

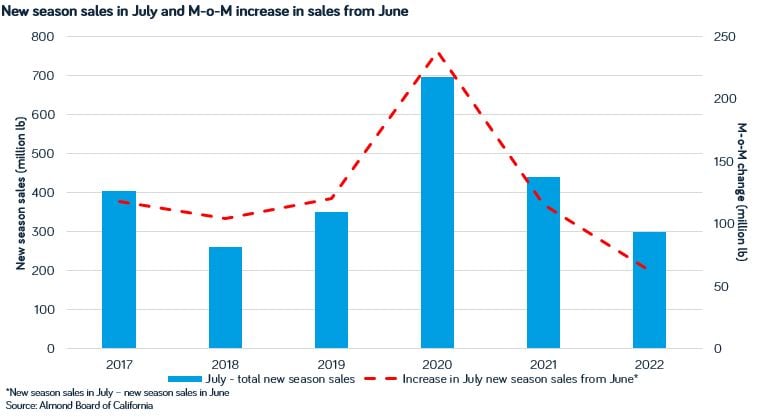

Attractive old crop pricing has weighed on new season sales with only 297.47 million pounds for 2022/23 shipment committed at the end of July, the lowest since July 2018. The rate of sales has also slowed significantly with only 62.41 million pounds sold during July, a drop of 42% from the month prior; and the lowest on records back to July 2017 when new season sales began to be reported.

Many purchasers have reported intentions to utilize old crop well into Q4 2022 which is expected to eat into demand for new crop supplies until Q1 2023. On this topic, a European trader said to Mintec, “our customers are stocking up on old crop while sellers still need to shift stock. At the same time, demand is uncertain due to the economic situation, so I wouldn’t expect buyers to lock in large volumes for 2023 until they have a better handle on consumption.”

To stay up to date on developments in the almond markets, subscribe to the Mintec Weekly Almond Report by emailing PRA@Mintecglobal.com. The report, which is released each Thursday, provides in-depth information on pricing and market dynamics.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)