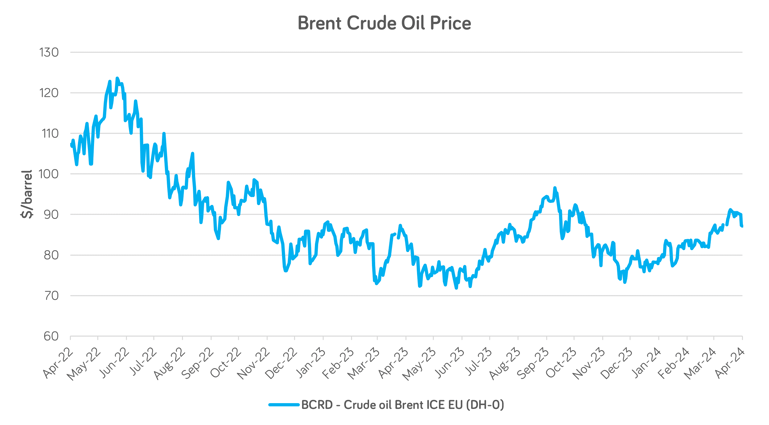

With explosions heard during the night of 19th April, Iranian state media cite unconfirmed reports of explosions in the central province of Isfahan, but have downplayed reports of an attack. Israel has not officially commented. Heightened regional tensions over recent months have concerned players within the crude oil market. Crude oil prices have been in a well-defined uptrend since December 2023, with a sequence of higher highs and higher lows.

Rising Tensions

Conflict in the Middle East intensified following the Hamas attack on Israel in October 2023 and the resulting Israeli retaliation. The consequence of the latter military action, and of airstrikes by the UK and the US, was that Houthi rebels from Yemen began attacking commercial shipping through the Red Sea, causing disruption to global supply chains.

Since then, tensions have been persistently elevated, culminating in direct military confrontation between Israel and Iran, a country aligned with Hamas in Palestine and Hezbollah in Lebanon.

Israel bombed part of the Iranian Embassy in Damascus, Syria, killing 16 people on 1st April. Iran’s response was to launch missile and drone strikes on Israel on 13th April, causing no deaths, which was followed by the 19th April attack. Regional sources noted that both countries provided advanced warning of attacks, and some reported that the recent exchanges were limited in scope.

Crude Oil

The tensions have added notable bullish sentiment to energy markets in recent weeks, with market participants concerned about the impact that missile strikes and a wider conflict may have on oil prices. Countries in the Middle East produce a significant amount of the world’s oil, with Iran exporting much of this to countries in the East, including China.

Source: Mintec Analytics

For reference, the Brent crude oil price (DH-0) [Mintec Code: BCRD] was $87.11/barrel on 18th April, up 1.6% month-on-month, representing a 7.4% year-on-year rise. However, market sources indicate that further conflict involving Israel and Iran could result in prices definitively breaking the $90/barrel resistance level.

Mintec will provide updates as more information becomes available. Further insights can be explored on Mintec Analytics, where you’ll find real-time price tracking, expert commentary, and customized alerts. Book a demo today to unlock the actionable intelligence you need to stay ahead of the curve.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)