Airstrikes by the US and the UK against strategic sites in Yemen, Syria, and Iraq have been launched in recent days as Houthi militant continue attacks on commercial shipping in the Red Sea. The escalating tensions caused many shipping operators to reroute around the Cape of Good Hope, causing journey times to lengthen significantly.

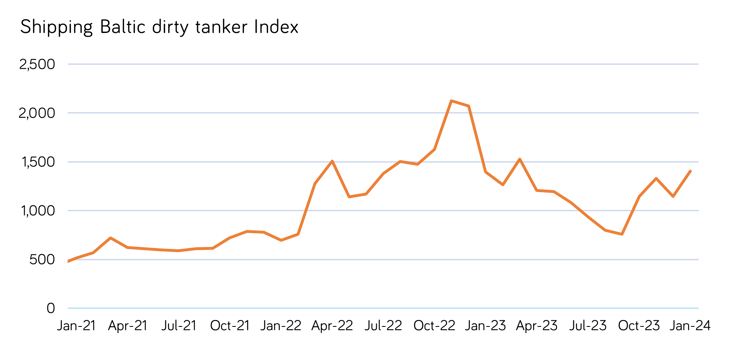

The shipping Baltic dirty tanker index [Mintec Code: EK51] rose 23% m-o-m in January as market players continue to adjust to greater risk premiums for vessels travelling through the area. Meanwhile, the shipping Baltic clean tanker index [Mintec Code: EK50] increased 12% m-o-m.

Source: Mintec Analytics

The price of crude oil, transported via dirty tanker, has not been greatly impacted by the military confrontation, rising by 2.1% m-o-m in January. However, market sources believe that any broader and protracted conflict would cause the price to spike due to supply fears, as states in the Middle East are key producers within the global crude oil market. In such a scenario, according to market players, freight rates for tankers would also rise sharply, as happened during the US-Iraqi conflict in 2003.

The Shipping 40ft container index China - Northern Europe [Mintec Code: ZQ34] fell 6% week-on-week to $4,660/unit as of 31st January, as the market begins to adjust to logistical delays bypassing the Red Sea and easing panic in the shipping container market.

Carriers are introducing idle capacity into the market to cover shortages, which has helped stem the rise in ocean freight prices. In addition, exporters in China were inactive ahead of China's Lunar New Year celebrations in February, which reduced order flow to ocean carriers.

An importer in Europe told Mintec that ocean freight costs are likely to trend downwards as speculation in the shipping market is easing and certainty is returning to the market regarding delivery times and longer haul costs.

For further insight sign up for early access to our H1 Industrial Materials 2024 eBook. Equip your business with strategic intelligence to navigate a challenging industrial materials market. This eBook delves into high-level macroeconomic trends, industry impacts, and the reflection of these dynamics on industrial commodity prices.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)