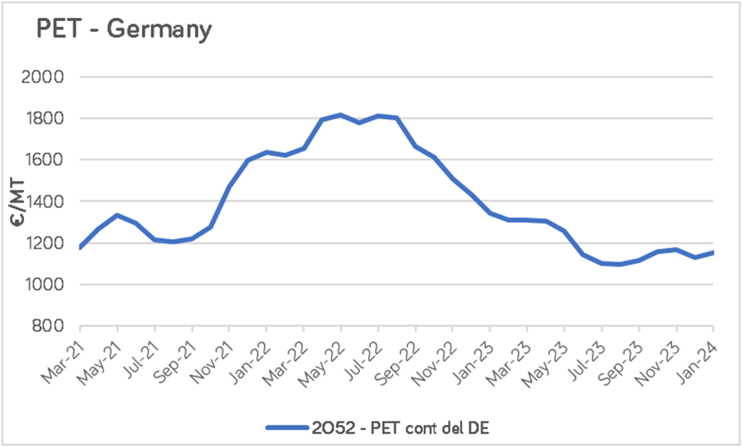

Since peaking in summer 2022, plastics prices have been in a visible downtrend as production costs and supply/demand began to stabilize. However, the German PET price (a strong representation of European prices) [Mintec Code: 2O52] reached an average monthly price of €1,154/MT in January, a 2.2% m-o-m increase, representing a 13.9% y-o-y decrease. Market sources believe it is only a matter of time before HDPE and LDPE prices follow a similar trend.

Source: Mintec Analytics

One of the factors behind the price increase is the rising cost of production. The price of paraxylene [Mintec Code: QW44], a crucial material for producing PET, rose 8.7% m-o-m in January; accordingly, buyers of polymers are facing higher prices.

Similar price trends are visible in the European propylene and ethylene markets. The price of crude oil, which influences plastic raw material prices, also remains a major watch-out factor for market participants; recent tensions in the Middle East have increased players’ concerns about crude oil supply and the possibility of shortages, which they anticipate could result in further rises in plastics prices.

Military tensions in the Middle East are also influencing the plastics market through shipping disruption. The attacks on shipping, which have been reported by Mintec, have resulted in delays and spikes in logistics costs as shipping firms have rerouted around the Cape of Good Hope.

As a result, more Europe-based buyers have reportedly sourced plastic products from Europe instead of Asia to avoid shipping disruptions. This dynamic has supported, and continues to support, plastics prices. Mintec will provide updates when more information becomes available.

For further insight sign up for early access to our H1 Industrial Materials 2024 eBook. Equip your business with strategic intelligence to navigate a challenging industrial materials market. This eBook delves into high-level macroeconomic trends, industry impacts, and the reflection of these dynamics on industrial commodity prices.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)