According to preliminary data from the General Administration of Customs of China and Mintec calculations, China imported an average of 10.79m barrels per day (bpd) in January and February 2024, up from 10.44m bpd during the same period in 2023. This represents a 3.3% year-on-year (y-o-y) increase. The January and February figures are jointly released in March due to the Lunar New Year celebrations in China.

The y-o-y rise in crude oil imports by China is significant, as this trend shows gradually increasing demand from the world’s largest crude oil importer. In recent months, steady growth in crude oil imports by China has been a bullish driver within the broader crude oil market.

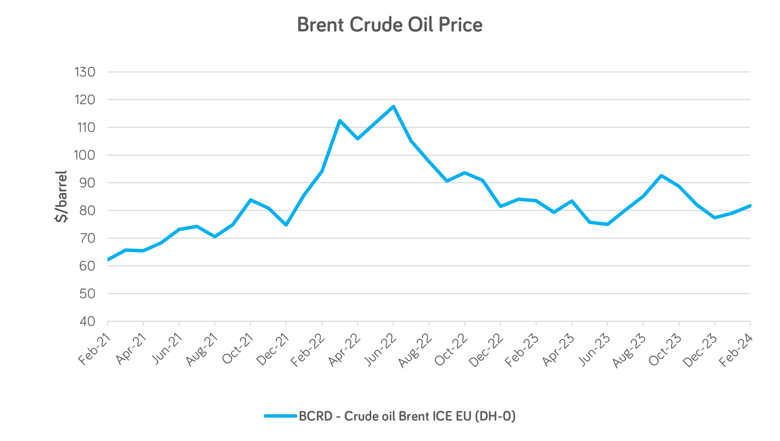

Source: Mintec Analytics

Additionally, economic data released in the past month has struck an optimistic feeling among market participants about China’s economic prospects. For instance, the Caixin manufacturing purchasing managers’ index (PMI) rose to 50.9 in February, up from 50.8 in January. Including the US and Eurozone, China has been the only major economy that has had an expansion reading (above 50.0) over the last several months. Furthermore, the Chinese economy returned to inflation at 0.7% y-o-y after a few months of deflation. Within the crude oil market, sources believe that these economic results and the import data could be early signs of an economic recovery in China, thus strengthening oil demand and supporting prices.

The steady increase in China’s crude oil imports is set in a fairly balanced wider market, with record-high US production limiting the upside price potential borne of continued output cuts by the Organization of Petroleum Exporting Countries (OPEC) and supply concerns caused by tensions in the Middle East.

For reference, the monthly average Brent crude oil price (DH-0) [Mintec Code: BCRD] for February 2024 was $81.72/barrel, up 3.4% month-on-month (m-o-m), representing a 2.2% y-o-y increase.

Mintec will provide more updates as they become available. Further insights can be explored on Mintec Analytics, where you’ll find real-time price tracking, expert commentary, and customized alerts. Book a demo today to unlock the actionable intelligence you need to stay ahead of the curve.

.png)