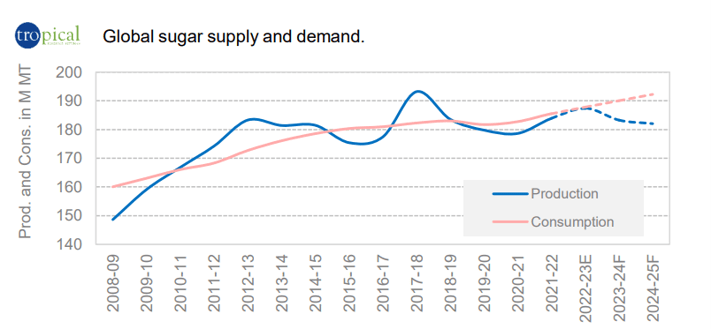

An increasingly ‘super tight’ world sugar market driving sugar prices higher.

While the world's leading sugar producer and exporter is operating at peak capacity, the global sugar market faces a looming crisis. The outlook is straightforward: ultra-bullish. Mintec’s Tropical Research Services ('TRS') explore how recent substantial deficits in the next two crop years will impact sugar prices.

Unpredictable Weather Hits Asia

Persistent erratic sugar weather has materially compromised sugarcane development in both India and Thailand, negatively affecting sugar production in the 2023-24 MY and potentially further forward.

The impact of the drier-than-normal weather in 2023 on sugarcane development in Asia was worse than previously expected.

TRS' estimates for sugar production in 2023-24:

➡️ India: 29.4 million metric tons tel quel (TQ)

➡️ Thailand: 7.7 million metric tons tel quel (TQ)

Brazil's Sweet Surprise

The higher-than-expected CS Brazil sugarcane agricultural yields to date, together with CS Brazil mills prioritizing the allocation of the “mix” towards sugar production, led us to increase our estimate of sugar production in the 2023-24 CS Brazil national crop year.

The Brazil domestic fuel market is most likely to remain subject to the populist machinations of the Brazilian Government, perpetuating a scenario of artificially-low domestic fuel prices. This is reflected by our base-case scenario of CS Brazil mills maintaining their production profiles in favor of sugar, resulting in a “higher high” record sugar production.

TRS' estimates for sugar production in 2023-24:

➡️ Brazil: 39.7 million metric tons tel quel (TQ)

Massive Supply & Demand deficit

'TRS' projects a material deficit of 6.8 million metric tons raw value (RV) for the 2023-24 MY global sugar S&D balance-sheet. This is set to swell to an even larger deficit of –10.2 million metric tons raw values (RV) in the 2024-25 MY signalling the likelihood of a sixth consecutive supply & demand deficit, and the largest deficit on record since the 2008-09 marketing year.

TRS’ estimates of the global sugar stocks-to-use ratio at the end of 2023-24 and 2024-25 MYs:

➡️ 38.2% and 32.5% stocks-to-use ratios, respectively

The latter being the lowest in at least 25 years (as far back as our records go) and, critically, lower than in the 2010-11 MY, when world market sugar values peaked at 31-year highs of 35.31 C/LB on 2nd February 2011.

Anticipating Record-High Prices

As a result, Tropical Research Services estimate that prices have the potential to break through the US$ 30 C/LB threshold.

The range of the fair value of world market sugar prices stands at US$ 30.00-32.00 C/LB in the 2023-24 MY versus US$ 31.00-34.00 C/LB in the 2024-25 MY.

To explore the supply & demand dynamics, and unlock exclusive production forecasts giving you competitive edge in sugar markets, get in touch with Mintec's Tropical Research Services experts at info@tropicalresearchservices.com.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)