European processing potato prices have increased due to worries of tightening market fundamentals driven by the anticipation of a smaller crop for the upcoming market year. The Mintec Benchmark Prices for Dutch processing Potatoes [Mintec Code: PO29] at €190/mt, up 65.2% month-on-month (m-o-m), down 19.1% year-on-year (y-o-y). Belgium’s Fontane potatoes [Mintec Code: POFO] are presently priced at €200/mt, an increase of 100% m-o-m, down 11.1% y-o-y. Market sources describe the supply-demand situation across the industry as stable, while processors largely rely on contractual agreements to meet their requirements. However, the scarcity of good-quality potatoes has led to heightened competition among processors seeking superior stocks.

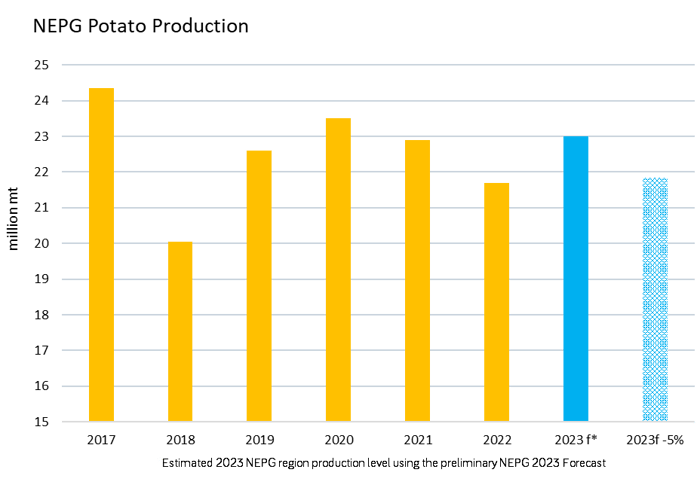

Rainfall in large parts of Northern Europe has hindered growers from lifting their crops, resulting in potatoes left in saturated ground being affected by rot. This has contributed to quality concerns within the industry. Estimates suggest that about 10% of the current crop in the NEPG region, consisting of the Netherlands, Belgium, France, and Germany, remains unharvested. However, the expected drier weather ahead is anticipated to assist growers in lifting their delayed crop. Market sources have said that yields will be 5-10% lower than the NEPG forecast of 23 million tonnes, which was made in September.

Global demand for processed potato products is robust, offering opportunities for potato growers and sellers of potato-related products in North America with expectations of a larger crop; this increased supply from North America could limit any rise in European finished product prices.

Source: NEPG

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)