Simultaneous presidential and parliamentary elections were held in Turkey on 14th May. The results are set to have a significant impact on several commodities, including nuts, dried fruit, and steel, of which Turkey is a key exporter, and the Turkish lira.

The incumbent Justice and Development Party (AKP), together with its People’s Alliance coalition, looks set to retain a parliamentary majority in the Grand National Assembly according to preliminary results, with over 99% of ballot boxes opened.

Meanwhile, at the time of writing (16th May), no presidential candidate has achieved a majority, so this will result in a run-off on 28th May between incumbent Recep Tayyip Erdoğan and challenger Kemal Kılıçdaroğlu. The president may appoint the Minister of Treasury and Finance and thus strongly impact the Turkish economy. Mintec will provide a detailed analysis of the impact of the presidential election on commodity markets later in the month.

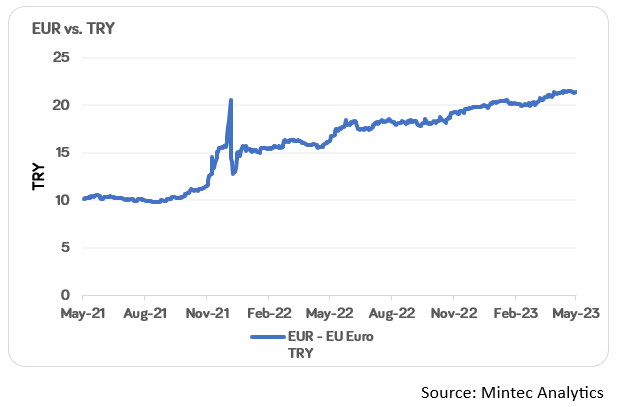

During trading on 15th May, the Turkish lira decreased 0.3% against the US Dollar, down nearly 1.5% month-on-month (m-o-m). It also fell 0.5% against the Euro on the same day, a 5.6% m-o-m decline.

Market players have suggested that the relative weakness of the Turkish lira has been sparked by disappointment across a variety of asset classes that President Erdoğan’s economic policies in Turkey, where inflation currently stands at 43.7% y-o-y, have not yet come to an end from these elections.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.png)