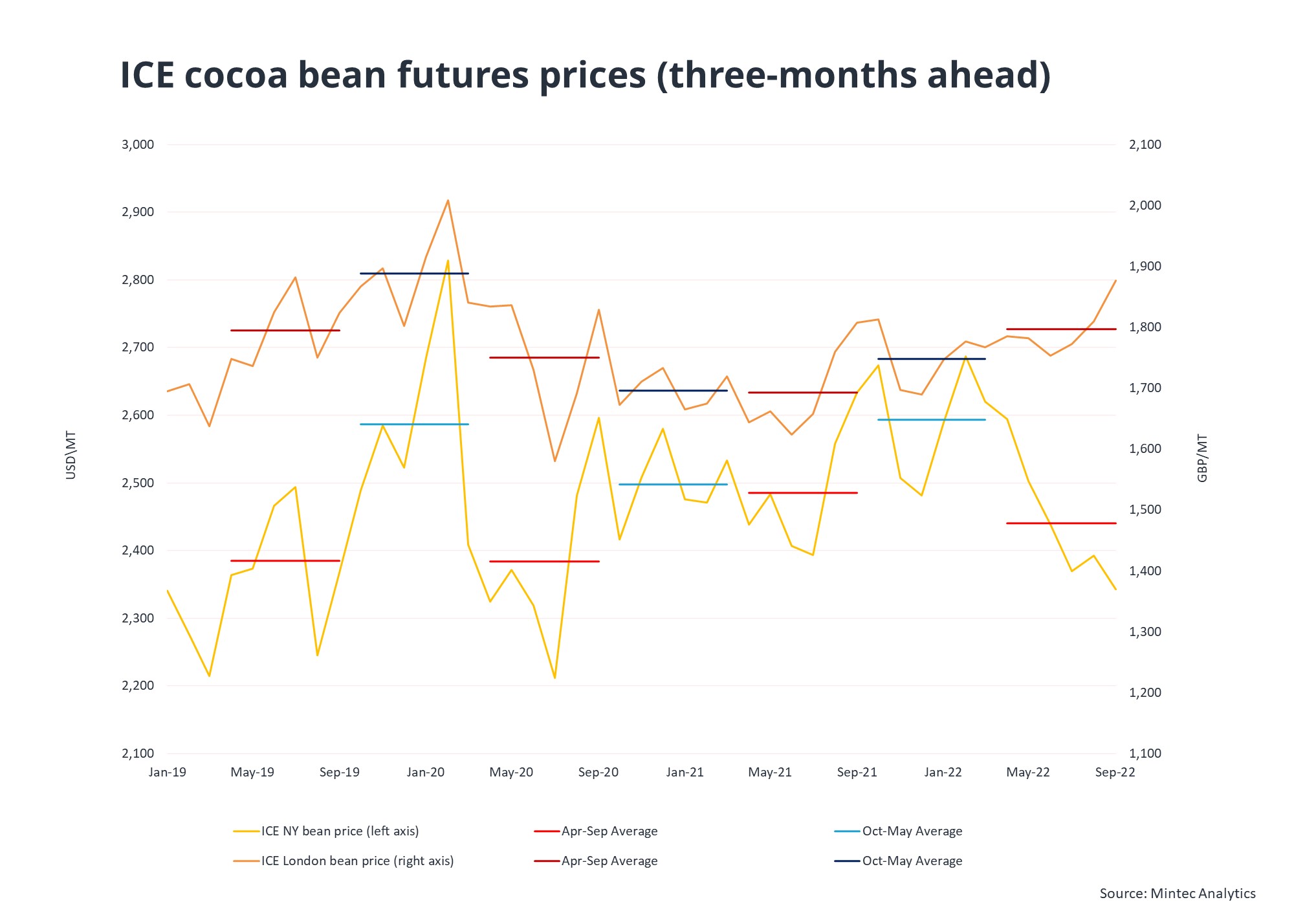

The respective ICE Cocoa futures prices at London and New York (NY) charted divergent paths through Apr-Sep ‘22. The London price rose steadily from June onwards, averaging a two-and-half year high of GBP 1,877/MT for September. Prices in London have risen almost entirely due to the deterioration of the GBP/USD rate, which plummeted by 19% between Apr-Sep ‘22. Indeed, the GBP fell to an all-time low of USD 1.07 on 28th September, in response to UK Chancellor Kwasi Kwarteng’s “mini-budget” introduced on 22nd September, which included drastic tax cuts and large increases in public spending. At GBP 1,796/MT, the ICE London average price for Apr-Sep ’22 rose by GBP 48/MT (+2.7%) half-year-on-half-year ( h-o-h), and by GBP 104/MT (+6.2%) year-on-year (y-o-y).

By contrast, the ICE NY cocoa price averaged a 26-month low of USD 2,342/MT in September, which contributed to the Apr-Sep ’22 average price falling by USD 153/MT (-5.9%) h-o-h, and by USD 45/MT (-1.8%) y-o-y. Market participants expressed the view that the relatively neutral fundamentals are continuing to be reflected in the movement of NY prices in New York. The Ivoirian government – the world’s largest cocoa supplier – reported a moderate 0.4% y-o-y increase in cocoa port deliveries during the 2021/22 season (Oct-Sep), while North American cocoa grindings were seen as flat-to-slightly-firm y-o-y during H1 2022.

All eyes will be on West Africa during the 2022/23 crop season that runs from Oct-Mar, most notably Ghana, where production is expected to rebound to around 0.85 mn tonnes, after contracting by an estimated 0.3-0.4 mn tonnes y-o-y in 2021/22. However, excess rainfall presents a key supply risk for farmers in Ghana and Cote d’Ivoire if beans band become damaged by damp and fungal diseases.

Demand side fundamentals are also uncertain, as the squeeze on real incomes caused by the ‘cost-of-living’ crisis across global markets is likely to test the historical resilience of chocolate consumption to economic downturns.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

Download Report

Download Report