On 24th February, 2022, Russia invaded Ukraine causing prices across key commodities to rise to unprecedented levels due to disruptions to supplies from the Black Sea region. Particularly impacted by the on-going war in the 2022 calendar year (CY) were global vegetable oil prices as historically, Russia and Ukraine combined, account for over 50% of global sunflower oil production and exports. A year after the invasion, prices in the global vegetable oils market have declined significantly from these record levels due to various factors, including improved supply conditions, higher year-on-year (y-o-y) global output and falling freight rates compared to the same period last year.

Vegetable oil prices typically move in tandem and are often substituted for one another as costs fluctuate. As such, limited supply of sunflower seed and oil coming out of the Black Sea region due to disruptions, and damages to ports and infrastructure, caused many buyers to source alternative supply from other regions to meet demand. Also, prior to the invasion, Russia and Ukraine were key exporters of rapeseed and rapeseed oil. Similarly, disruptions to Black Sea supply of rapeseed and derivative products, combined with a y-o-y decline in output for the 2021/22 marketing year (MY) from Canada, led to higher prices. Further supporting vegetable oil prices in the 2022 CY were various export policies made on the back of the war with major palm oil producer, Indonesia, completely banning exports of palm oil and derivative products on 28th April 2022 to limit domestic prices. As Indonesia produces more palm oil than it consumes, this led to a supply glut which resulted in the ban being revoked barely a month later, thereby putting pressure on vegetable oil prices. Adding on to the pressure on prices was the implementation of the grain corridor deal in July 2022, to allow for exports of key commodities out of the Black Sea region. The deal, which was extended beyond the initial cut-off date of 19th November, 2022, has resulted in sizeable amounts of agricultural products being shipped out of the Black Sea.

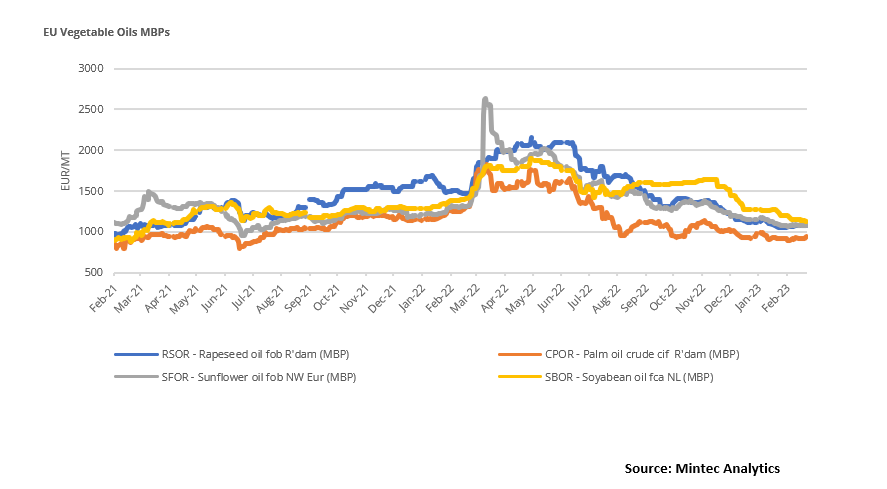

While vegetable oil prices have begun to converge since H2 2022, comparing current price levels to year-ago prices, a significant decline is evident. In the rapeseed oil market, the Mintec Benchmark Prices [MBP] of Rapeseed Oil FOB Rotterdam was assessed at €1,080/MT on 22nd February 2023, a 50% decline from the record high of €2,161/MT reached on 29th April. A significant increase in crop this season, particularly from Canada and huge stock accumulated last year has pressured prices. Similarly, high stock levels and increased crushing activity in the EU have led to the MBP for EU sunflower oil declining by 59% from the record high reached in H1 2022, to €1,082/MT on the same day. Record Brazilian soybean output for this season has pressured soybean oil prices, with the MBP for Soybean Oil FCA Netherlands assessed at €1,135/MT on 22nd February, 2023, down by from the H1 2022 record high and narrowing the price gap between the other rival oils. Lastly, palm oil prices have also declined significantly. On 23rd February, 2023 with the MBP for Crude Palm Oil CIF Rotterdam recorded at €937/MT, down by 49% from record high reached on 14th March, 2022.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)