Last year was unique for the EU dairy market, with the war in Ukraine leading to record-high dairy prices across the EU. It is now one year since Russia invaded Ukraine and, as Mintec highlighted weeks after the invasion, the conflict has had a little mid-term impact on prices, only an initial short-term spike in prices. This is attributed to the low dependency of the EU on the Russian and Belarussian dairy markets. The EU broke commercial ties with Russia when Russia banned dairy products from EU member states in response to EU sanctions over Ukraine in August 2014. At that time, these retaliatory measures had a profound impact, because Russia was a strong partner for neighbouring countries, such as Finland, and the result was an imbalance between supply and demand across the whole dairy sector until mid-2016. Consequently, dairy prices plummeted and the EU Common Agricultural Policy (CAP) countered the market disturbances, supporting prices by temporarily removing surpluses, including direct payments, to stabilise farmers’ income.

Belarus filled the gap left by the EU, which is responsible for 85% of total Russian dairy imports. In 2021, Russia ranked as the second largest global importer of butter and cheese. To put this in context, Russia imported more butter than the US and UK combined. Consequently, the beneficiary of the conflict was Belarus, which had the world’s highest milk production per capita in 2021, and whose dairy exports totalled around $2.5 billion in 2021. Since Western nations imposed sanctions on Russia and Belarus, there is no available trade data for 2022, but estimations are that dairy trade between Belarus and Russia has further intensified, supported by the strengthening of the rouble. As with the EU, Russian dairy prices peaked in 2022 due to increases in production costs, according to market sources.

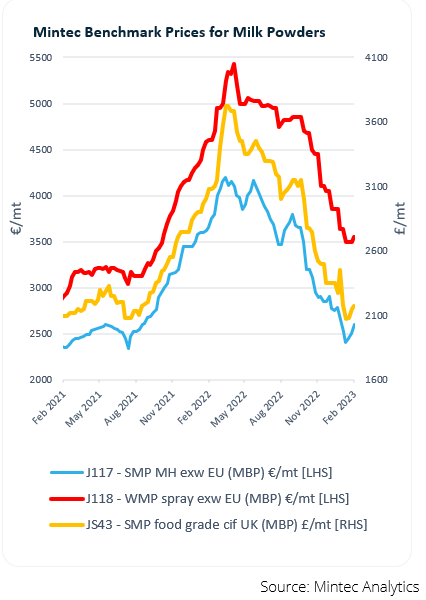

Meanwhile, EU dairy prices rallied until the end of Q3 2022, when prices rapidly started to ease to reach seven-year lows in some commodities, such as EU gouda. As Mintec anticipated, dairy prices did not experience any mid-term impact, as there was no drastic change in the fundamentals, unlike in 2014. However, panic in the market, driven by surging input costs and potential fears of shortages, drove prices to record-highs across all dairy products. For instance, the Mintec Benchmark Price (MBP) for EU butter reached €7,300/mt on 14th September 2022, up €800/mt since the last price peak in September 2017. Currently, dairy commodity price levels are lower than when Russia invaded Ukraine and are similar to price levels prior to the COVID-19 pandemic. On 16th February 2023, the EU butter MBP stood at € 4,750/mt, down 20% year-on-year. As such, pricing is sometimes dictated by market sentiment, but in the mid-term, valorisation supported by fundamentals is appearing to prevail.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)