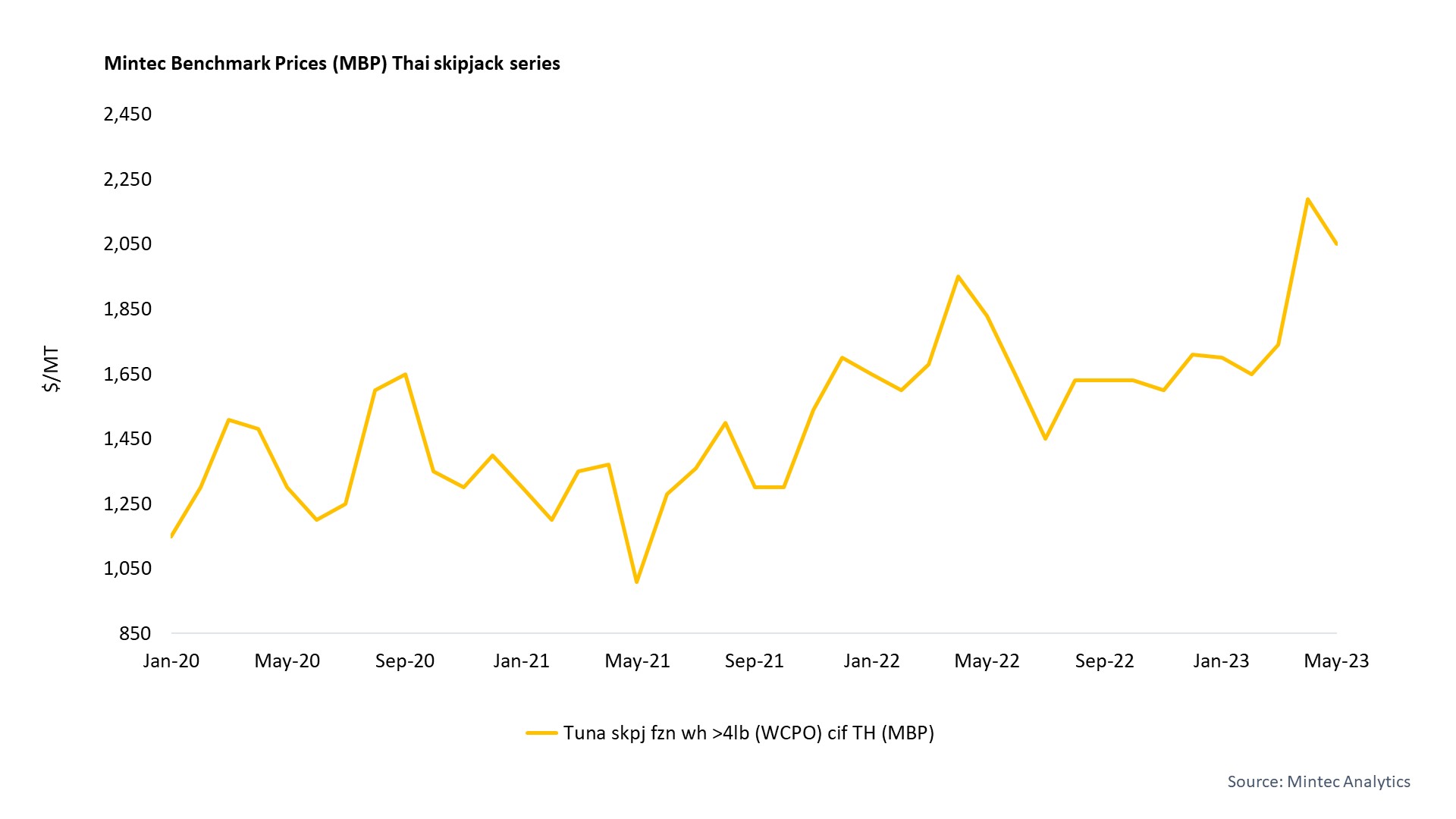

The Mintec Benchmark Prices (MBP) for Thai skipjack increased by $450/MT (+28.1%) between Dec ’22-May ‘23, gaining support from strengthening demand for tuna raw materials from canneries in the Western Central Pacific Ocean (WCPO) region and Europe. It also reflected a tighter supply of tuna raw materials from canneries in the WCPO region and the Indian Ocean. The Thai skipjack price rose by $220/MT (+12.0%) y-o-y in May 2023, which is mainly attributed to tighter inventory pressures in the WCPO amid a reported slowdown in fleet activities.

At 114,678 tonnes, Thai exports of processed skipjack contracted by 12,849 tonnes (-10.1%) y-o-y in Q1 2023. According to the Global Trade Tracker (GTT), this was the lowest volume of first-quarter exports since at least 2007, caused by various factors. April and May are historically poor months for tuna catches in the Indian Ocean, which increases the pressure on the WCPO supply. This trend has been maintained in 2023 and boat owners in the Indian Ocean have sold more skipjack to Bangkok, as processors in the Indian Ocean have been more reluctant to pay higher prices for the raw materials. Traders noted poor US demand for Thai skipjack in Q1 2023, compared with previous years, while shipments to North Africa and the Middle East are anticipated to boost sentiment among Thai exporters through July 2023.

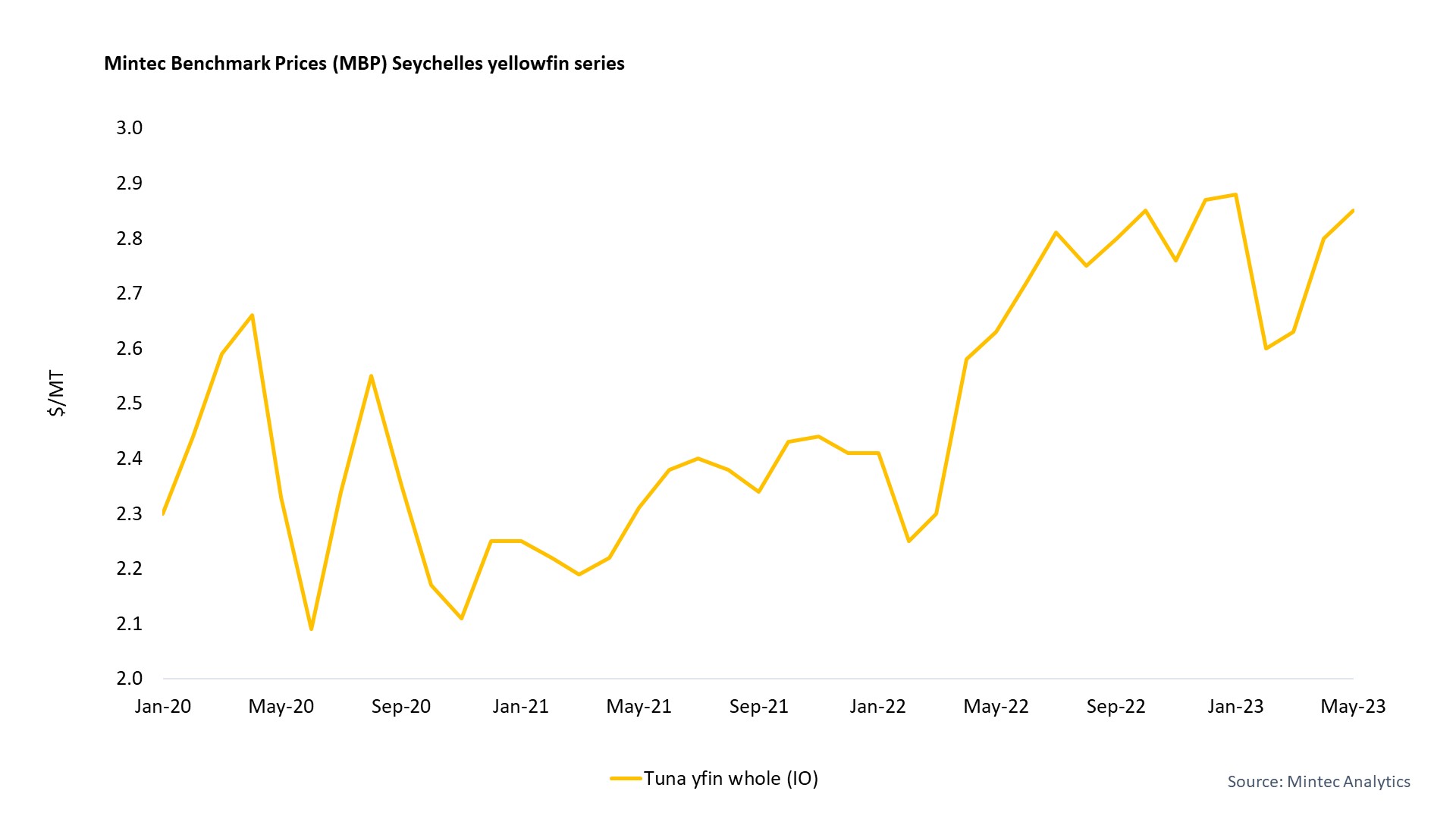

The price of Seychelles yellowfin tuna exhibited consistent upward momentum from Dec ’22-May ‘23, increasing by $0.09/kg (+3.3%) through this period. At $2.80/kg, the May 2023 price rose by $0.22/kg (+8.5%) y-o-y. Yellowfin tuna prices are being supported by slower catch activities in the Indian Ocean, in conjunction with growing demand, with wholesalers looking to stock up ahead of the peak seasons in Mediterranean Europe and East Asia.

Most market sources say that demand for yellowfin tuna is currently in the acceleration phase, which is typically the case from late-April, as the summer approaches in Mediterranean Europe, which is the main consumer of the species. Indeed, exports to Spain and Italy increased by 5.6% and 6.3% respectively during Jan-Apr ’23. Sources say that European processors want to secure as much volume as possible, as there is a strong possibility of scarcity from late-June onwards, due to raw material shortages in the Indian Ocean. There is also strong lobbying from the World Wildlife Fund (WWF) for the Indian Ocean Tuna Commission (IOTC) to reduce its annual Indian Ocean yellowfin tuna catch by 30%, further supporting bullish market expectations.

The commentary and data was extracted from Mintec’s latest tuna market update, which includes supply, demand and price sentiment, is available to Mintec subscribers here

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)