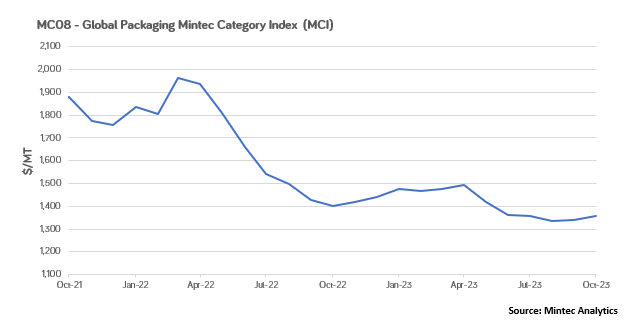

The Mintec Category Index (MCI) for global packaging maintained an upward trend, and increased by 1% month-on-month (m-o-m) in October to $1,357/MT. Plastic prices continued to rise in October, while metals prices were mixed and paper product prices remained relatively stable. Market players do not expect significant price changes in the market for the coming month, as demand for packaging products in the EU and US markets remains weak, although elevated production costs are keeping prices from falling further.

Plastics

Plastic prices in the EU and the US moved in a general upward trend. Demand remained weak, although rising production costs, caused by elevated crude oil prices, drove plastic prices upwards. Against the backdrop of weak demand, manufacturers continue to reduce plastic production. The US Plastic Products Index fell 2% m-o-m, and 8% y-o-y, in October, reaching the lowest point since June 2020, when the COVID-19 pandemic was in full swing the EU plastic packaging production index is available for September, and shows improved results, when compared to August, increasing by 13% m-o-m, although dipping lower by 3% y-o-y.

HDPE prices in the EU continued to rise in October, increasing by 4.5% m-o-m to €1,442/MT. LDPE prices rose by 4% m-o-m to €1,746/MT. Some market sources stated that there was a shortage of the product due to supply reduction; some believe that the supply reduction was insignificant and that the increase in ethylene prices was the main driver. The US HDPE price increased by 5% m-o-m to USc 78/lb in October, while LDPE prices reached USc 93/lb, increasing by 4.5% m-o-m primarily due to rising raw material costs. Accordingly, in October-November oil prices started to fall again and the plastics market is expected to see a corresponding reduction in raw material prices.

PET prices in the EU rose by 4% m-o-m in October to €1,159/MT, reflecting bullish with the market currently in short supply. PET prices in the US showed the weakest growth of 1.5% m-o-m, to USc 66/lb in October, after a prolonged decline. The downtrend continued in October and market sources expect prices to reach decline further in November.

PP prices showed the most significant increase in October, and it is possible that the upward trend will continue in the US through November. Thus PP prices in the EU reached €1,393/MT in October, up 6% m-o-m. PP prices in the US market increased by 11% m-o-m in October to USc 97/lb. There is a deficit of the main raw material propylene in the US, due to low supply market sources say that, unlike other types of plastics on the PP market, the US price increase may last.

Metals

Prices for packaging metals moved multidirectionally. In general, the market remained under pressure from weak demand and oversupply. In the EU steel market, steel demand remained low, although steel producers are seeking to raise prices, in response to high costs. The US steel market recovered, mainly because producers implemented a significant price increase for flat-rolled products. Iron ore is a significant driver of steel prices, and is becoming more expensive, on the back of higher-than-expected demand in China. Demand for aluminium is growing, although a global market surplus is evident due to surplus production outpacing demand.

The CME’s US steel hot-rolled coil (HRC) three-month price rose by 11% m-o-m in October to $944/MT. However, spot market prices rose marginally by 2% m-o-m, although the price is likely to rise dramatically in November, mirroring the futures market. Higher factory prices was the main driver of growth. In addition, the automotive industry, which has recently exhibited solid demand growth, had a more positive sentiment, as production resumed, following strikes at the automotive factories. However, tinplate spot prices continued to fall in October, falling by 4% m-o-m to $1,753/MT, due to weak demand.

HRC prices in the EU fell by 5% m-o-m in October to €624/MT. However, producers raised prices in early November under pressure from high production costs. At the same time, the market continues to be pressured by cheap imports, so some market sources do not believe in a sustainable price increase, nevertheless expect sustained growth in November. Tinplate prices remain stable.

The LME aluminium 3-month price remained stable in October at $2,219/MT. The global aluminium market is in a state of sustained surplus, as production is ramping up in most regions and another historic high in primary aluminium production was reached in August. Nevertheless, aluminium prices have been relatively stable for several months, as with the cost of production preventing prices falling. Aluminium foil prices in the EU continued to rise by 2% m-o-m in October, while US aluminium foil prices, in contrast, continued to decline, dropping by 1.3% m-o-m. Aluminium can prices in the EU also rose by 2% m-o-m in October, while falling by 1% m-o-m in the US market.

Paper

Paper packaging prices remain stable m-o-m in the EU. At the same time, the upward trend in paper production costs continues. Northern Bleached Softwood Kraft (NBSK) prices reached $1,105/MT in October, up 4% m-o-m. Corrugated paper prices rose by 20% m-o-m in October to reach $59.6/MT exw France. On the energy side of paper production costs, it is also worth noting that electricity and natural gas prices are at the start of seasonal increases according to many producers, so expectations of higher packaging paper prices remain.

French Kraftliner 175g and French Testliner 2 prices in the EU were stable at €815/MT and €640/MT, respectively, in October. Demand in the market remains weak and production is high, yet producers are trying to rebalance by reducing production to raise prices.

Semi-Chemical Fluting prices remained stable m-o-m at €793/MT in October. Prices for cardboard were down slightly: the GD2 price fell by 1.4% m-o-m to €1,415/MT, and the price of GC2 fell by 1.5% m-o-m to €1,955/MT. Orders were considerably lower than forecasted on the market so the offers decreased due to competition.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)