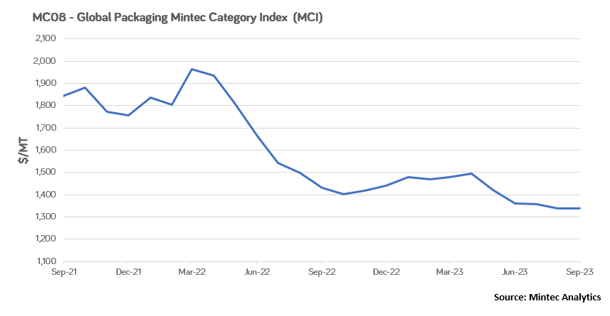

The Mintec Category Index (MCI) for global packaging rose by 0.2% month-on-month (m-o-m) in September to $1,339/MT. The index increased in September primarily due to higher plastic raw material prices. On a year-on-year (y-o-y) basis, the index gap will narrow as the 2022 packaging index low was reached in October after a significant decline from the highs reached in H1 2022.

Plastics

Plastics prices in the US and EU markets started to grow in September and continue rising in October, judging by the price dynamics in the first half of this month. As expected, the main price driver was the increase in raw material prices, which started to rise following crude oil prices. Crude oil prices continue to climb in October, providing the foundation for further increases in plastic prices. With raw materials set to rise in line with crude oil, many consumers have started to purchase plastics, but overall demand remains weak compared to last year.

EU HDPE and LDPE prices followed the common trend and increased by 3% m-o-m in September to €1,379/MT and €1,675/MT, respectively. It should be noted that the price growth continues, and in the second week of October, the HDPE price was already €1,433/MT, and the LDPE price was €1,738/MT. Such dynamic growth has not been visible in the market for more than a year, so consumers are increasing purchases, realising that the price will likely be even higher in the coming days and weeks. Contract prices for ethylene are slowing down but still grew by €65/MT m-o-m. In the US, HDPE and LDPE rose 4% m-o-m in September to USc 74/lb and USc 89/lb, respectively. In October, the price rise continues, with HDPE and LDPE prices reaching USc 79/lb and USc 94/lb, respectively, in the second week of the month.

The EU PET price rose by 2% m-o-m to €1,116/MT in September. The slower price growth compared to polyethylene is mainly due to weaker demand and the slower price increase of paraxylene, a key raw material for PET. In October, however, the price increase continues, and the contract price for paraxylene rose by €50/MT. In the US, PET prices continue to decrease, against the general trend for plastic, primarily due to overproduction and relatively weak demand. Thus, the average monthly price decreased by 6% m-o-m to USc 65/lb in September. Market players expect the average monthly PET price to increase in October, referring to the price increase in early October.

PP prices in the EU and the US increased by 2% m-o-m in September to €1,318/MT and USc 87/lb, respectively. A recovery in business activity in the segment and rising propylene prices led to price increases, and producers are looking positively at October, expecting prices to continue to rise.

Metals

Steel and aluminium prices are under pressure from overproduction. In the steel segment, demand is depressed, especially in the EU, where mills have accumulated such large volumes of finished products that there is nowhere to sell, especially for steel used in the construction sector. As a result, several smelters in the EU announced temporary plant shutdowns in October. In the aluminium market, demand is growing primarily from the transport and green technology sectors. Still, supply is growing faster, and in August, there was a new all-time high in primary aluminium production.

The CME’s US steel hot-rolled coil (HRC) price rose by 4% m-o-m to $852/MT in September. Against the backdrop of rising production costs, producers have increased prices, and consumers have been forced to agree in the absence of alternatives. Nevertheless, the world market is surplus, and there is a high probability that against the backdrop of price growth in the US market, import supplies will be increased. At the same time, demand for packaging materials remains weak, and tinplate prices fell again by 1% m-o-m to $1,821/MT in September.

In the EU, the market did not receive any strong signals of seasonal demand growth, and producers' attempts to raise prices failed. Prices collapsed again at the beginning of October. HRC prices in the EU rose by 2% m-o-m to €660/MT in September, but in the second week of October, the price was already €625/MT. Mills are again insisting on the need to increase prices due to rising costs, while consumers are buying little and appealing to relatively cheap imports.

LME aluminium 3-month showed a 2% m-o-m rise to $2,220/MT for the first time in five months. However, in October, prices fell rapidly again to $2,170/MT on 17th October, significantly reducing producer optimism. Aluminium foil prices in the EU and US markets were relatively stable in September. Aluminium can prices in the EU declined by 2% m-o-m, down 3% m-o-m in the US market.

Paper

The cost of paper production is pushing producers to raise packaging paper prices, and after a seasonal downturn in production in August, sources believe it is highly likely that the market will balance out and allow prices to rise. Pulp prices rose by an average of €10/MT during the month, and the upward trend is likely to continue into October as Svenska Cellulosa Aktiebolaget of Sweden said in a press release that pulp demand is increasing and it is raising Northern Bleached Softwood Kraft (NBSK) prices to $1,200/MT. Recycled paper prices are still stable at a low level, but market sources say there is good demand in the export market and expect this to help lift prices. In addition, energy prices seem to be on an upward trend, which also increases the cost of paper production.

French Kraftliner 175g and French Testliner 2 prices in the EU were stable at €815/MT and €640/MT, respectively, in September. Demand in the market remains weak, so market players report that this will be the main argument against a possible price rise. There is a high probability that with rising raw material and energy prices, low-efficiency producers will be forced to stop production, thus balancing the market.

Semi-Chemical Fluting prices remained at €793/MT in September. Prices for cardboard were also stable: the GD2 price was €1,435/MT, and the price of GC2 was €1,985/MT. Despite expectations of increased demand in September, purchases were atypically sluggish. Purchasers intend to continue to minimise orders by seeking discounts from suppliers.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)