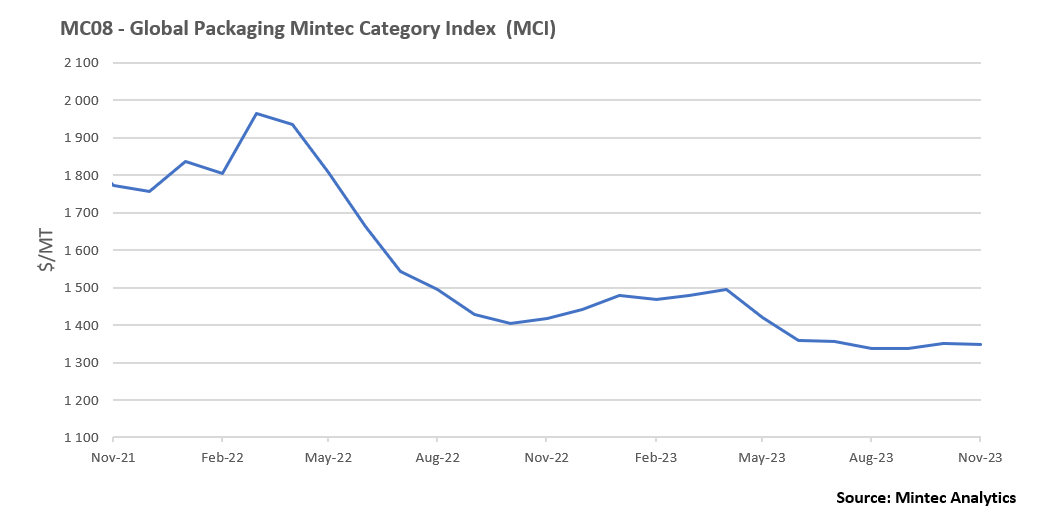

The Mintec Global Packaging Category Index (MCI) fell by 0.4% month-on-month (m-o-m) to $1,347/MT in November. The main contribution to the decline was attributed to the commodity component of the index, especially in the plastics and paper industry. According to market sources, demand for packaging materials remains weak, so raw material and energy prices will continue to play a key role in pricing.

Plastics

In November, plastics price movements were mixed, depending on the segment and region. Robust supply has consistently been reported by market participants across the US and the EU, with sources anticipating declines in the prices of raw materials following the decreasing crude oil price. Some plastic product prices rose through November, mainly due to isolated supply uncertainties.

In the US, the price of HDPE [Mintec Code: 2O81] declined 3.3% m-o-m in November to USc 75.4/lb. The m-o-m decrease was largely driven by weak demand in the region, with producers noting that orders remain minimal. In addition, buyers hold ample stock, and cheaper Asian imports have again started to be offered into the market, contributing to the monthly price decline. In the EU, the HDPE price [Mintec Code: 2O49] rose 0.2% m-o-m in November, settling at €1,445/MT. Despite the slight monthly price rise, the supply situation has improved, with market sources reporting good availability. In addition, falling input costs, namely declining crude oil and ethylene prices, have been cited by market participants as factors for anticipated future price declines in HDPE.

US PET [Mintec Code: 2O89] prices fell by 3.4% m-o-m to USc 64/lb in November. Market sources indicated that the US PET market is well supplied. Additionally, cheaper imported material from Asia continues to challenge domestic producers. The price of paraxylene, a key component for PET production, softened throughout the month, weighing on prices. EU PET prices [Mintec Code: 2O52] rose by 0.6% m-o-m to €1,165.60/MT in November. The price increase in November is attributable to tariffs on Chinese imports into the EU. Additionally, the uncertainty surrounding production by a major PET plant in Belgium has added upward pressure to the EU PET price. However, the slump in EU paraxylene prices, a key raw material for PET production, has limited price rises.

US PP prices [Mintec Code: 2O85] rose 6.5% m-o-m to USc 102.8/lb. The monthly price increase can be attributed to the drawdown of inventory throughout the market, which has resulted in a tight supply. Additionally, producers have lowered production since September, thus tightening the market. PP prices in the EU [Mintec Code: 2O53] decreased €1,374/MT in November, down 1.4% m-o-m. The fall in EU polypropylene prices resulted from weak demand in the region due to the lack of desire by converters to acquire additional product in advance of the Christmas holidays. Supply has also increased in the EU, applying further downward price pressure.

Metals

In November, carbon steel prices rose m-o-m in most markets. This was partly due to higher production costs related to higher raw material prices, and partly due to higher imported steel prices and also reflecting a surge in demand after a prolonged pause. LME aluminium prices in November rose slightly to the previous month, yet global supply is growing steadily and prices weakened fell i in the first half of December.

The CME's US steel hot-rolled coil (HRC) [Mintec Code: HRCN] three-month price rose significantly in November by 20% m-o-m and 46% y-o-y to $1,133/MT. The pace of price growth is significantly ahead of prices in other regional markets and local market sources say that the market is overheated, especially in the run-up to the Christmas holidays, business activity should be reduced and few believe in strong prices. Tinplate spot prices [Mintec Code: PA02] interrupted a long decline and rose 12% m-o-m to $1,962/MT following HRC prices, which are the main raw material.

HRC prices in the EU [Mintec Code: 1K01] rose by 4% m-o-m in November to €649/MT. Prices were increased by EU producers due to rising production costs. In addition, imported steel was increasingly expensive, so consumers were forced to accept the new price level due to lack of alternatives. However, market sources expect that as soon as external factors, such as rising benchmark raw material prices and imported steel prices weaken, demand for steel will not be able to keep prices from falling.

The LME aluminium 3-month price [Mintec Code: LN02] rose to $2,219/MT in November, up by 0.6% m-o-m, however, in y-o-y comparison, the price decreased by 5%. Primary aluminium global production continued to grow, nevertheless, the market expects that rising demand in Asia will prevent a surplus in the market. The demand for aluminium, especially in China, is growing dynamically due to the transport structure and new technologies in the field of sustainable development in the energy sector. Aluminium foil prices in the EU [Mintec Code: PA30] declined slightly in November, while aluminium foil prices in the US [Mintec Code: PA28] increased by 1.3% m-o-m. Aluminium can prices in the EU [Mintec Code: PA25] decreased by 1% m-o-m in November, and increased by 0.4% m-o-m in the US market [Mintec Code: PA27].

Paper

In November paper packaging prices in the EU market were unchanged, however, market sources say they expect a slight increase in Q1. The main argument in favour of higher prices is the increase in production costs due to raw materials. Cellulose suppliers have already reduced supply to match demand and the market is now close to balance. Consequently, raw material suppliers will be keen to raise prices and restore sales margins. Pulp prices are also likely to recover as low prices favour exports and reduce the market surplus. However, weak demand was still the dominant factor in November, preventing prices of paper packaging products from rising.

French Kraftliner 175g [Mintec Code: SZ173] and French Testliner 2 [Mintec Code: SZ176] prices in the EU were stable m-o-m at €815/MT and €640/MT, respectively, in November. After a slight improvement in demand in September-October, in November-December demand is unexpectedly weak, nevertheless, producers refuse to reduce prices on the grounds of high costs, so despite consumer attempts, prices have remained at last month's level.

Semi-Chemical Fluting [Mintec Code: SZ179] prices remained stable m-o-m at €793/MT in November. However, market participants say that market conditions are better than they were in the summer as supply has been reduced adequately to meet demand, so they are optimistic about 2024. According to preliminary data prices for cardboard have remained at October levels. The GD2 [Mintec Code: SV90] price was at €1,415/MT, and the price of GC2 [Mintec Code: SV86] was €1,955/MT. At the same time, there are Asian products on the market at attractive prices, and as the Christmas sales did not lead to the expected results, there is a high probability that prices on the EU market will decrease further.

Glass

Market sources have reported that the availability of container glass is improving and gradually returning to normality. However, persistently elevated inflation and high interest rates have dented consumer demand. Participants anticipate further price declines due to falling production costs, including the decreasing price of natural gas. Additionally, the price of soda ash [Mintec Code: WY31] declined 5.6% m-o-m in November to $321/MT. The price of another important raw material for glass production, silica sand, rose 2.4% m-o-m in November to $57.62/MT, at the same time market players expect a price correction as labour and transport costs begin to fall.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)