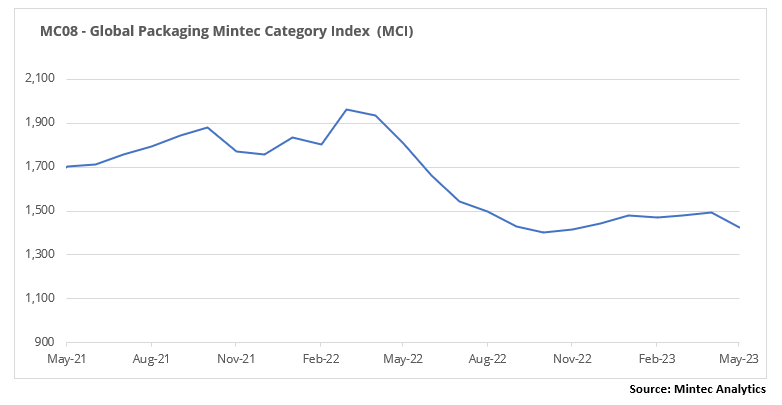

The Mintec Global Packaging Category Index (MCI) fell 4.8% month-on-month (m-o-m) in May, constituting the fastest rate of decline since August 2022. The index decreased 21% year-on-year (y-o-y), reaching $1,423/MT. The packaging market was characterised by weak demand and an oversupply, or overstocking. In the plastics market, cheaper raw materials were the main driver. Metals prices fell as consumers await a price bottom and minimised purchases. Paper prices in Europe were relatively stable but production costs decreased and buyers are set for further price declines.

Plastics

The main price driver was falling prices of raw materials, such as ethylene and propylene, which declined by €80/MT m-o-m. Manufacturers were thus able to offer discounts to customers due to lower production costs. Demand in the plastics market was sluggish in May; despite declarations by many plastics manufacturers in the EU that production was decreasing, the last production minimum was overcome in December 2022, after which EU plastics packaging production started to increase in Q1 by 5% quarter-on-quarter, falling by only 2% compared to the previous year. US plastics production started to grow in March and April, but the total plastics index fell by 4% in the first four months of 2023.

In May, HDPE prices in the EU experienced a 4% m-o-m decrease, down 31% y-o-y, reaching €1,502/MT. These price drops were influenced by weak market conditions and the decline in raw material prices. In May, ethylene (C2) contract prices fell by 6.5% m-o-m. Similarly, LDPE prices in the EU reacted to lower raw material prices, decreasing by 3% m-o-m and 28% y-o-y, reaching €1,872/MT in May. Market players anticipate further price declines as there are no signs of demand recovery. In the US, HDPE prices fell by 1% m-o-m, reaching USc 79/lb. However, the downward price trend accelerated at the end of the month, so market sources expect a definite continuation of the decline in June. Weak demand and high supply in the market has led to a surplus and inventory buildup. LDPE prices in the US followed a similar downward trend to HDPE, decreasing by 1% m-o-m in May to USc 95/lb. Market sources also highlight the potential impact of the hurricane season on the supply chain, which could lead to reduced supply and potentially affect prices.

In May, EU PET prices fell markedly by 4% m-o-m, reaching €1,255/MT. This decline was one of the steepest among the packaging materials reviewed in this report. The market did not get the boost it had expected at the end of spring as warm weather, which would normally drive consumer purchases of water and beverages, was replaced by rain and cooler temperatures. In addition, producers have seasonally increased supply, further contributing to lower prices. PET prices in the US market followed a comparable pattern in May, declining by 3% m-o-m to USc 73/lb. Despite the overall price reduction, demand in the market has been robust. Moreover, the price reduction caused a surge in buying activity, leading suppliers to respond with price increases at the end of May.

In May, PP prices in the EU fell by 2% m-o-m to €1,487/MT, primarily due to weak demand and the availability of cheaper raw materials. Reductions in plastics production across Europe were not enough to rebalance the market. Following a notable increase since February 2023, the US PP price started to decline in May, experiencing a 7% m-o-m decrease to USc 89/lb. Lower commodity prices have become a general trend in all regions of the world, putting considerable pressure on plastics prices. This was particularly true for PP in the US market, where prices had risen significantly in recent months, primarily due to higher prices for propylene, which was in short supply.

Metals

In the metals market, monthly average prices continued to fall in May, partly because buyers were cautious and minimised purchases in anticipation of lower prices. But the situation changed at the end of the month when the Chinese metals market began to show an increase in prices, due to an optimistic forecast of growth in metal consumption in China due to government stimulus. This has led to rising commodity prices, which will affect the rest of the world market, as commodity prices in China are the global benchmark. As a result, China, which has been the main driver of global price weakness over the last few months, could become the export price driver for Asian metals, with a time lag reflected in price increases in Europe and the US. However, inside China, some market players do not support this optimism, expecting that the price growth wave is likely to end in 3-4 weeks as expectations of growth in the consuming sectors are overestimated.

The CME's US steel hot-rolled coil (HRC) monthly average price fell by 11% m-o-m to $905/MT, but by the end of the month, the rate of decline slowed. Participants believe that the market is likely to be close to hitting a price bottom, and once buyers are confident, they will resume buying as steel consumption is slowly recovering. Tinplate prices on the spot market reacted by falling 5% m-o-m to $2,028/MT in May, while contract prices remained stable.

HRC prices in the EU started declining in May, decreasing by 6% m-o-m, to €800/MT. Market players expect lower domestic prices to last until at least the end of June and are cautious in their forecasts, as seasonal business activity falls in the region during summer months. Contract and spot tinplate prices have remained stable.

There was reduced volatility in aluminium prices in May, but the trend remains predominantly downward and the price is close to the previous low of autumn 2022. The LME aluminium 3-month price was down by 4% m-o-m to $2,270/MT, with the high LME aluminium stocks putting pressure on the price. The price of aluminium cans in the EU decreased by 0.5% m-o-m and aluminium foil prices declined by 2% m-o-m. Aluminium can prices in the US decreased by 1% m-o-m, and aluminium foil prices dropped by 2% m-o-m.

Paper

Demand for paper in the EU is weak, so production fell by 7% m-o-m in April after a 16% m-o-m surge in March. Lower supply kept prices from decreasing in May, with many producers reporting that further price falls would result in negative profitability of production. At the same time, the decline in paper production is mirrored by a surplus of raw materials on the market that continues to actively depreciate. Therefore, buyers of paper products, seeing the falling prices of waste paper and cellulose, expect production costs to decline again and manufacturers to be able to offer discounts next month.

In May, there was a halt in the price decrease for French Kraftliner 175g, with prices remaining steady at €815/MT, the same level as in April. Prices for French Testliner 2 remained unchanged in May, maintaining the same level as the previous month at €640/MT. Demand levels in the market are still weak; producers argue that prices have already reached a point where they would incur losses in production. Nevertheless, buyers anticipate further price reductions because of the 6% m-o-m decline in northern bleached softwood pulp prices observed in May. Also, there was a 73% m-o-m decrease in waste paper prices as demand from converters is very low, and there is a lot of raw material on the market. Additionally, low energy prices are anticipated to stay unchanged in the near future.

The price for Semi-Chemical Fluting stabilised at €838/MT, at last month's level. However, the market is characterised by low demand, and manufacturers have received minimal orders. Market sources suggest that significant price changes are not expected in the short term, but there remains a possibility of slight price decreases.

The condition of the Cartonboard market was unchanged in May. GD2 prices saw a 1.6% m-o-m decline, reaching €1,510/MT, while GC2 prices were stable at €2,005/MT. In central Europe, the demand continues to be low. In addition, demand from the pharmaceutical and beauty industries is weak, although these industries were previously characterised by stable demand. However, there has been a slight increase in consumer activity in Poland, but it has not impacted prices. Market sources consider it unlikely that demand will recover during the summer months but rather expect purchasing activity to decline further during the summer holiday period.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)