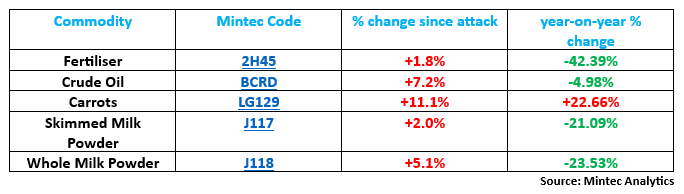

The rising tensions following the Hamas attack on Israel are being monitored by market participants. Nearly three weeks into the conflict, the impact on commodity prices remains limited. However, players are watching closely, with the chief concern being geopolitical escalation through the potential involvement of Iran and Saudi Arabia. While this intervention is possible, regional sources believe it is improbable. With the continuing attacks, though, Mintec has collated a list of commodities that are now being partly driven by the conflict.

Fertiliser

While the events in the Middle East are being observed by market participants, sources report that there has been no disruption to exports of fertiliser from Israel. However, the Middle East and North Africa (MENA) region is responsible for around 30% of global nitrogen fertiliser exports, with Qatar and Saudi Arabia being two of the top five exporters. Russia is also a major exporter of fertiliser, and the conflict in Ukraine has already impacted supply; with a military escalation in the Middle East, market players believe supply could become even tighter. Furthermore, there are significant potash resources in the south of Israel, which may be at risk from any conflict spillover, thus highlighting the vulnerability of the fertiliser market to the tensions in Israel and Palestine.

Market sources believe that the conflict, and any potential escalation, will likely further drive up the cost of fertilisers and energy. In turn, players in the grains complex anticipate higher grain prices when elevated fertiliser prices begin to filter into the market.

Crude Oil

In the days and weeks after the initial attack, many global markets were visibly choppy, notably crude oil.

Market players have been extremely concerned that the transport of crude oil would be negatively impacted because of the conflict. However, Israeli freight activities appear to be continuing, albeit with rapidly changing risk premiums due to the war.

Currently, the major risk to the crude oil market, and the broader economic environment, is an escalation of the war, particularly if Iran were to become involved. Regional sources say that this is possible, but not probable, with the greatest chance of a wider conflict depending on how Iran chooses to support Hezbollah in south Lebanon. There have been reports of skirmishes between the IDF and Hezbollah in recent days.

Contacts pointed out that although direct Iranian involvement is unlikely, if this were to materialise, the crude oil price would likely spike on supply fears and potential large-scale freight disruptions through the Strait of Hormuz.

Fruit and Vegetables

Farmers in Israel cultivate a diverse range of fruit and vegetable crops, many of which are destined for export markets. A significant portion of these crops are grown in the northern regions, which have been significantly affected by recent conflict events involving Hamas and Hezbollah. The ongoing conflict has placed immense pressure on agricultural supply chains.

Market sources report that many growers have faced challenges accessing their fields due to safety concerns, and a substantial number of local farm workers have been called up for reserve duty while foreign workers have left Israel, which has constrained labour availability. As a result, those farmers who can work in their fields are operating at limited capacity. Currently, the harvesting of citrus crops and avocados is underway, although progressing slowly. For field crops such as tomatoes, carrots, onions, cucumbers, and most other vegetables, the harvest and storage window are significantly narrower, as they tend to be more perishable. Prolonged conflict could lead to substantial crop losses as agricultural produce may never reach final markets. There have been reports of the Israeli government asking the public to purchase locally-grown produce in a drive to support the Israeli agricultural sector.

The conflict has also disrupted logistical operations, with transport routes experiencing delays, and truck drivers encountering difficulties reaching certain farms. These disruptions have led to a loss of valuable time between harvest and consumption. Even for the produce that does make it to packhouses, packing rates have been affected, with many packhouses operating at reduced capacity or remaining closed. Consequently, some market sources anticipate shortages of fruits and vegetables in Israel, as well as export produce never reaching its end markets.

Milk Powders

The MENA region is one of the most important regions for the global and European dairy market, with Algeria as the biggest importer in the region. The EU, NZ, and UK supply about 63% of the dairy imports generated in the region, as the MENA region has become a critical marketing region for Dairy producers. However, as the current conflict in Israel does not directly involve any of the major importing markets in the region, both NZ and EU market participants have stated limited concerns surrounding a potential impact on trade flows.

Mintec will endeavour to provide details on how the conflict in the Middle East is impacting commodities in the coming weeks and months, as more information becomes available.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)