The Mintec Benchmark Prices for Turkish sultanas (type 9, fob Turkey) moved up $30/MT in the week of 19th July to $1,600/MT, an increase of 2% week-on-week (w-o-w). This followed a turbulent two weeks in Turkey when some sellers withdrew offers due to concerns over adverse wet weather in Turkey’s western provinces impacting production yields.

Some market players have described the recent market developments in the sultana segment as “unexpected” or “crazy”. Earlier in July, before the Turkish Grain Board (TMO) halted its sultana sales, some of the most aggressive sellers in Turkey were reportedly able to offer sultanas around $200/MT cheaper than the current price levels, with Dollar-denominated prices pressured by the weak Lira.

“Last week, we could temporarily buy some volumes at $1,425/MT cfr UK if we wanted. These offers are no longer there,” a UK-based trader told Mintec in the second week of July.

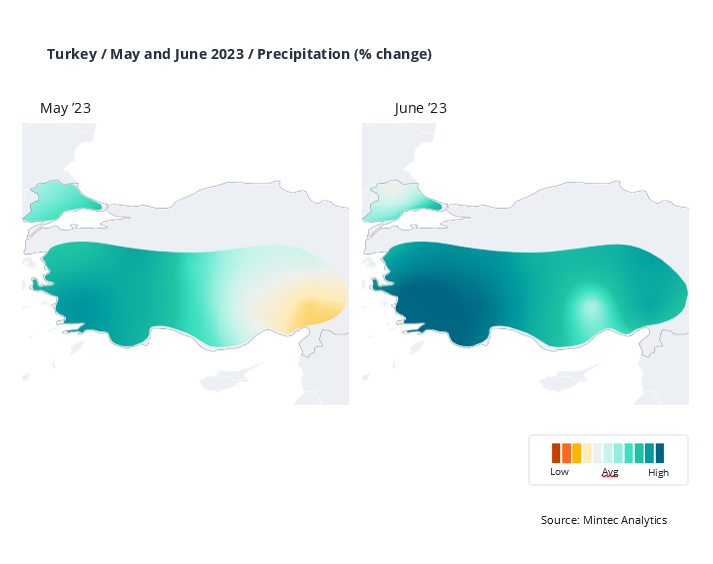

The mixture of bad weather in May and June and the subsequent change in market sentiment has sent prices higher despite the continued Lira weakness.

Turkey’s western areas received sustained and widespread rainfall for an extended period, with the higher humidity likely to cause diseases in grapes. “Rains were strong in May and June, and there are concerns over disease outbreaks,” a European trader said. “We have seen a sudden dramatic increase in temperatures which has triggered a serious mildew issue in the vineyards. As a result, we are now seeing a bunch count drop as the grapes are shrivelling and dropping, which will clearly result in a much lower yield,” a UK-based trader noted in their recent report.

According to Mintec weather data and based on the readings from three independent weather stations in the west of the country (Balıkesir, Aydın and Burdur), rains in May were, on average, 200% greater than the 30-year average. In June, the average precipitation exceeded the 30-year average by 470%. Half the days in June had over three times as much rain as the long-term average, and the worst of the rain was between 12th and 18th June, where the precipitation exceeded the long-term average by over 800%, or 53mm of rain more than normal across the three observed weather stations.

The adverse weather has led to many Turkish packers withdrawing their offers. “We stopped offering two weeks ago after negative reports from vineyards and concerns over diseases spreading on the fruit due to the rains,” a large Turkish packer told Mintec. “Big packers are offering cautiously depending on who is asking,” a UK-based buyer clarified.

The bad weather news from vineyards has driven additional interest from packers for the TMO-held inventory. The agency is now estimated to have sold a substantial proportion of its 2022/23 crop. Market sources peg the TMO’s remaining stock at 20,000-30,000 tonnes which will be brought into the next campaign. “A lot has been contracted to packers. They now have a say about where the market should be,” a UK-based trader noted. “The TMO has sold almost all of its inventory. They are left with only 20,000 tonnes which they will use for their internal strategies,” a packer said. Some market sources now speculate that the agency is well placed to purchase in the 2023/24 campaign should this become necessary.

Following the rains, a downward revision to the INC’s 2023/24 Turkish sultana production estimate of 310,000 tonnes is highly likely.

Discussing the crop prospects for the upcoming sultana harvest following the May and June rains, Mintec has heard several opinions from both sides of the supply chain.

A large Turkish exporter commented in the third week of July, “growers could not penetrate vineyards with pesticides. Based on the information we have managed to gather so far, we expect a shortfall on the previous estimate, with the crop likely ranging from 250,000-280,000 tonnes.” Another Turkish seller agreed that the crop will be shorter than last year. A UK-based trader noted in their July report that a crop of 270,000 tonnes was now expected. Another UK trader said, “the quality of table grapes is not looking good. This is a concern for the dried fruit.”

Still, there are some market players who are more hopeful for the new crop prospects. “This year, the rains have been a little more widespread, but no one is reporting what the damages are. I think we are still in for a good crop,” a UK-based trader commented in the third week of July. A Dutch trader expanded further, “there is a lot of speculation about the size of the crop right now. Yes, rains will have some influence, but I think it is too early to say that we will see less than 300,000 tonnes.”

The Lira depreciation, the increase in the minimum wage and the lack of cash liquidity among some packers due to high interest rates remain other key market features.

Please contact me by phone on +44 78 280 33 956 or email jara.zicha@mintecglobal.com if you would like to discuss these issues in greater detail.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)