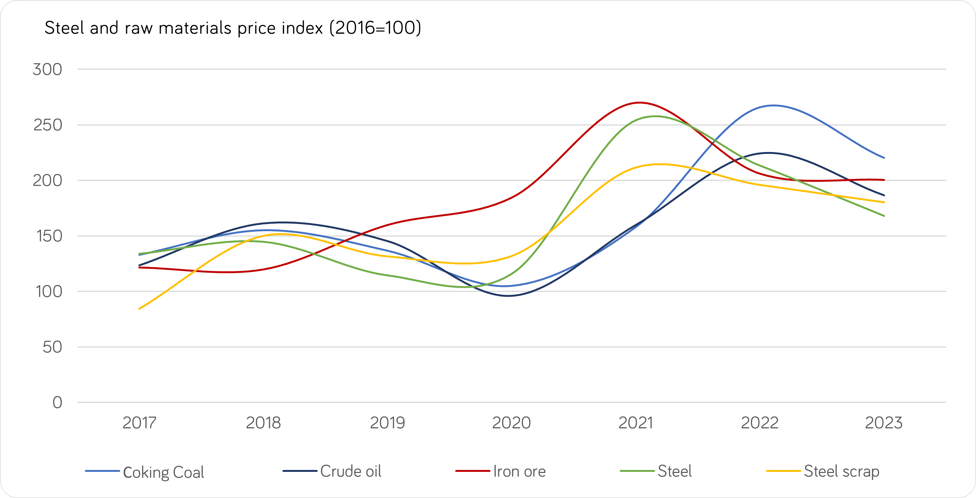

Comparison of steel and raw material price indices

The steel price index for 2023 declined by 21% year-on-year (y-o-y), showing the most dynamic decline among other raw materials considered. Thus, the past year was a significant blow to the profitability of steelmakers.

First of all, the European steel industry was under pressure from cheap steel imports from Asia and weak domestic demand. Under the influence of weaker demand in the Chinese domestic market, steel exports from China are reached a 7-year high in 2023. Thus, the import pressure was exacerbated by lower prices in the markets of importing countries, where the market was in steady surplus amid falling demand.

The US market was characterized by reduced share of imported steel and relative stabilization of domestic supply. In the first 10 months of 2023, US domestic steel shipments fell by only 1% y-o-y, while imports of finished steel products (excluding semi-finished products) fell by 14% y-o-y. Consequently, demand for raw materials for steel production in the US market remained relatively stable, in particular demand for steel scrap. The US is one of the largest exporters of steel scrap to the world market, so strong domestic demand resulted in LME steel scrap prices falling by only 8% y-o-y in 2023.

Other raw material price indices also declined dynamically, except for iron ore prices, which declined by only 3% y-o-y in 2023. The price of iron ore imported by China, the global benchmark, was supported by relatively strong demand on the back of strong production performance in H2 2023. Chinese demand also supported coking coal prices, however, as the price was overpriced in 2022, the price index decreased by 17% y-o-y in 2023.

Source: Mintec Analytics*

Weak global demand

Weak demand for steel was the most significant factor in the steel market in 2023. Europe, North America and South America showed a decline in steel production reflecting the fall in demand. Above all, the construction industry, which consumes more than half of the world's steel, is showing a negative performance. In the EU, for example, the Construction Confidence Indicator started to decline in H2 2023 and reached -11 points by December, the worst in three years. Construction steel consumption is only supported by infrastructure projects, while residential construction is going through a bad period. In the US, from the beginning of the year to August, an upward trend of new building permits was maintained, however, since September the indicator has turned downwards again. The main pressure on the construction industry is created by high interest rates on mortgage loans, which reached 8% on30-year mortgages.

The main countries that showed growth in steel production were China and India. Moreover, China with weak demand in the domestic market, especially in the segment of steel used in construction, showed growth in steel exports, which according to preliminary estimates was the highest in the last eight years. China has a surplus housing market, which directly affects new housing construction. Nevertheless, the country's government has been introducing new incentives to revive demand and investment in construction. However, according to steel market players, the results of the incentives will probably only affect the construction market in H2 2024, so expectations for H1 2024 are subdued. India showed continued growth in domestic steel consumption and production. Given the high domestic market prices, steel exports from India are becoming less attractive than domestic shipments. At the same time, with steel production in the country reaching 128 million tonnes in 11 months, a 12% year-on-year increase, hence the demand for steel is growing, which means that India, like China, is only strengthening its position in the global market as consumers of raw materials for steel production, which together consume more than 72% of iron ore.

Market balance

Importantly, producers have already adapted to market uncertainty and weak demand. Consequently, market players expect that the market surplus in H1 2024 will be insignificant, so a more balanced market will respond better to changes in demand and production costs, so market prices will be volatile. No significant changes in the supply structure are expected in H1 2024, and demand according to market sources has already passed the minimum in 2023.

Macroeconomic environment

The fight against inflation by central banks has led to a significant increase in interest rates, which above all puts significant pressure on all businesses globally. In addition to the fact that the cost of credit for consumers in the EU and the US has risen significantly, credit for businesses has also risen several times last year, which in turn significantly constrains both investment and trade finance.

Market sources expect US and EU interest rates to fall in 2024, with a time lag, which will subsequently revitalize businesses and consumers. Nevertheless, as of December, inflation reached target levels in the EU and the US and discount rates have remained stable. At its monetary policy meeting on 13 December, the Federal Reserve again suspended interest rate hikes amid slowing inflation. Fed Chairman Jerome Powell, while not ruling out further rate hikes or the possibility of a recession next year, said: "The question of when it would be appropriate to begin to reduce the amount of policy restraint is beginning to loom." On 14 December, the ECB left all three key interest rates unchanged, citing a continued slowdown in inflation. However, the ECB warned that it is too early to consider cutting rates. Hence the future remains uncertain in H1 2024. Even if rates are lowered and the cost of borrowing money decreases, it will take some more time for consumer demand to reflect. Therefore, many expect improvements from H2 2024.

The opposite situation is observed in China, where consumer prices fell to -0.5% year-on-year in November after -0.2% year-on-year in October. The main drivers of accelerating deflation are falling domestic food prices and lower crude oil prices. In addition, domestic demand remains sluggish. In contrast, the Chinese government has been gradually cutting the discount rate to revitalise the economy. Nevertheless, although market sources expect further liquidity injections, there is currently little likelihood of further rate cuts.

Key insights

• Steel prices fell most dynamically relative to raw materials

• Global steel demand was weak in 2023, however it is likely that the low has already been passed

• Steel producers have adapted to weak demand and the market will be more balanced in 2024

• China and India are increasing steel production. Asian market players are confident of further growth in steel production in India and moderately optimistic on China

• China and India are becoming increasingly influential players in the raw materials market and with demand for iron ore and coking coal rising, a moderate rise in raw material prices is likely

• Macroeconomics is driving weak consumer demand and complicating the business environment. Improvements will only come with a time lag once US and EU central bank interest rates start to decline

For further insight sign up for early access to our H1 Industrial Materials 2024 eBook. Equip your business with strategic intelligence to navigate a challenging industrial materials market. This eBook delves into high-level macroeconomic trends, industry impacts, and the reflection of these dynamics on industrial commodity prices.

*Methodology: Benchmark Price Selection for Index Calculation

To ensure accuracy and comparability, the following benchmark prices were selected for calculating the indices presented in this analysis:

• Steel Price: Hot rolled coils in the northern European market were chosen as the benchmark for steel prices. To facilitate comparison, all steel prices have been converted to USD.

• Iron Ore and Coking Coal: The prices used are based on imports at Chinese ports, reflecting global trends in these raw materials.

• Scrap Metal: The import price from Turkey, the world's largest importer of steel scrap, serves as the benchmark for scrap metal prices.

• Brent Crude Oil Price: Included as a general indicator of the world economy's health.

The year 2016 was selected as the base year for calculating the indices, providing a consistent reference point for tracking price movements over time.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)