Contributing to the bearish momentum within the soybean complex is new season production levels from Brazil. The crop is estimated to be the largest ever produced by the nation at 152 million metric tonnes, up from 127 million metric tonnes in the 2021/22 season. If realised come harvest in February, it would mean that global soybean production would outweigh consumption by 11 million metric tonnes. This would be the largest surplus since the 2018/19 season and the first surplus in two seasons. With a surplus of this level, it may mean that farmers are ‘forced’ to sell beans for lower prices to attract buying interest and thus could cause prices of beans and, as a result, soybean oil to fall in the coming months.

A South American analyst told Mintec, “it's obvious at this point that the Brazilian crop is more than 150 million metric tonnes. A lot of beans are going to be sold on a spot basis as farmers will need to move beans quickly to be able to get the rest of the harvest in. This is going to mean that domestic and international price pressure is going to come fast and strong. Farmers may very well run into covered crushers and a stocked China. The only option then is to reduce prices to draw buyers in. I am bearish for soy and soy oil despite the issues that are currently plaguing the Argentinian crop.”

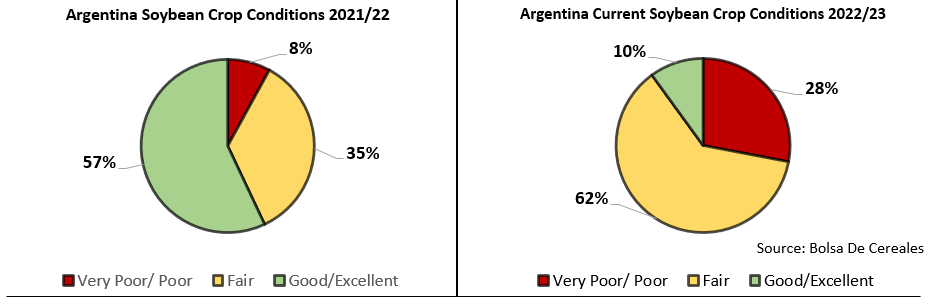

Yet, turning to Argentina, hot and dry weather has raised concerns about how much soybean production may drop with the new harvest. The poor weather has led to 28% of the current soy crop being rated poor to very poor, 62% rated fair and just 10% rated good to excellent. This is in stark contrast to the 2021/22 season, where 8% were rated poor to very poor, 35% fair and 57% good to excellent. Due to the poor crop rating, market players have told Mintec that it is likely that Argentina will produce 35-40 million metric tonnes of soybeans. If realised, this is a sharp decline compared to 2021/22 when the nation produced 43.9 million metric tonnes. Despite the lower expected crop from Argentina, market players do not expect it to have a significant bullish impact, because the increase in the Brazilian crop is likely to offset any losses in Argentina.

A trader commented to Mintec, “in a year where Brazil was producing more normal volumes rather than this huge crop, the Argentinian situation would be much more of a concern, but right now it isn't likely to matter if volumes decline from Argentina. The caveat is that soymeal supply is going to be affected and players may be ‘forced’ to turn to the US and Brazil for these needs. This could keep soymeal prices sustained, as strange as it may be, because soymeal may have more interest than soy oil at this stage.”

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)