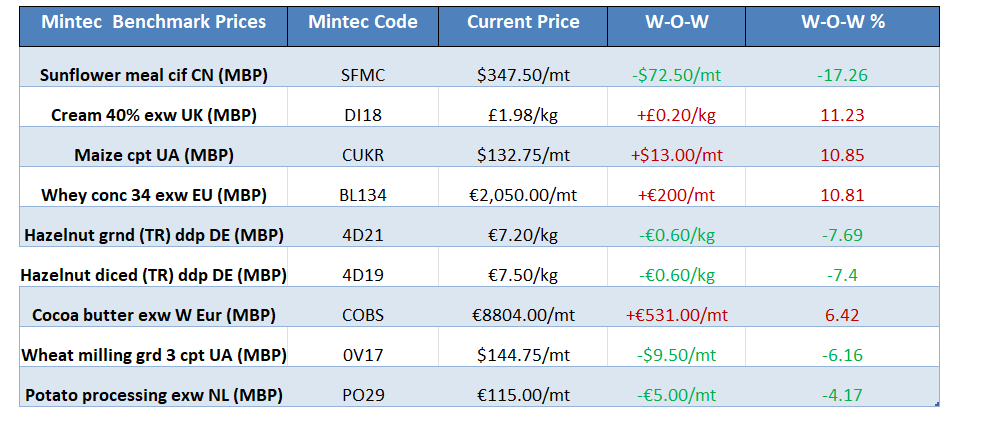

*The table displays the highest week-on-week price movers among Mintec Benchmark Prices, focusing solely on absolute values and excluding differentials.

Sunflower meal

- Market Sentiment: At the close of trading last week, market sentiment in the Chinese sunflower meal market was bearish.

- Sunflower meal prices in China came under pressure due to a lack of recovery in demand amid high stock levels of seed.

- Market Observations: According to market players, Chinese demand remains limited after the Golden Week holiday in early October.

- Price Assessment: The Mintec Benchmark Prices for Chinese sunflower meal cif (Mintec Code: SFMC) was assessed at $347.5/mt, down $72.50/mt compared to the previous week.

UK Cream

- Market Sentiment: At the close of trading last week, market sentiment for the UK cream was bullish.

- Market Observations: The upward trend of UK cream prices was largely supported by stable demand and tight supply. Reduced milk intakes have negatively impacted the supply of liquid dairy commodities, such as cream. Further, the reduced processing capacity, linked to regular maintenance of several large dairy processors during the last two weeks, has returned to normal as maintenance work is now largely completed, according to multiple market sources.

- Price Assessment: The MBP for UK Cream DDP 40% [Mintec Code: DI18] was assessed at £1.98/kg, an increase of £0.20/kg compared to the previous week's assessment.

Corn (Maize)

- Market Sentiment: At the close of trading last week, market sentiment in the corn market was bullish.

- In Ukraine, grain loadings are continuing at deep-sea ports, despite the suspension of the corridor in July. Thus, the gradual recovery in trading activity in the Black Sea port of Ukraine provided support to corn prices.

- Market Observations: According to the market players, the resumption of trade flows is enabling grain to leave the country more quickly, whereas traffic on the Danube ports has slowed in recent weeks following the government's decision to no longer authorise certain types of contracts.

- Price Assessment: The Mintec Benchmark Prices for Ukrainian corn (maize) cpt (Mintec Code: CUKR) was assessed at $132.25/mt, up $13.00/mt compared to the previous week

EU Whey Protein Concentrate 34%

- Market Sentiment: At the close of trading last week, market sentiment in the EU Whey Protein Concentrate 34% continued to be bullish.

- Market observation: Higher domestic demand, along with steady international demand, supported prices. This price rise was exacerbated by tightness in the market. End users who were bearish and took a ‘wait-and-see' approach returned to the market and had to accept higher prices.

- Price Assessment: The Mintec Benchmark Prices for EU Whey Protein Concentrate 34% [Mintec Code: BL134] was assessed at €2,050.00/mt, up €200.00/mt compared to the previous week.

Hazelnuts

- Market Sentiment: At the close of trading last week, market sentiment in diced hazelnuts was bearish.

- Market Observations: Ferrero, the largest hazelnut buyer, reportedly came back to the market with an improved bid of TRY 95/kg for in-shell product. However, this was lower than the market speculated ahead of the announcement.

- Price Assessment: The Mintec Benchmark Prices for Turkish origin diced hazelnuts (Mintec Code: 4D19) was assessed at €7.5/kg, down €0.6/kg compared to the previous week.

Cocoa Butter

- Market Sentiment: At the close of trading last week, market sentiment in cocoa butter was bullish.

- Market Observations: Cocoa butter climbed 6.4% w-o-w as both cocoa bean futures and cocoa butter ratios rose on the back of tighter supply and persistent demand. In London, cocoa futures returned to 44-year highs after a brief respite, following the announcement of better-than-expected Q3 grindings figures. With the higher ratios, the COBS Mintec Benchmark Prices series has reached its highest level since the price history began in 2004.

- Price Assessment: The Mintec Benchmark Prices for Cocoa butter EXW western Europe (Mintec Code: COBS) was assessed at €8,804/mt, up €531/mt compared to the previous week.

Wheat Milling

- Market Sentiment: At the close of trading last week, market sentiment for the Ukrainian milling wheat was bearish.

- Wheat prices remain under pressure due to plentiful supply but also a slowdown in both demand from exporters and supply from farmers.

- Market Observations: Market players have told Mintec that wheat is getting too cheap in the market and some players are opting for holding until the new year when prices may be slightly better.

- Price Assessment: The Mintec Benchmark Prices for Ukrainian milling wheat grade 3 cpt (Mintec Code: 0V17) was assessed at $144.75/mt, down $9.50/mt compared to the previous week.

Processing Potatoes Netherlands

- Market Sentiment: Since the last trading week, market sentiment for Dutch processing potatoes remains firm.

- Market Observations: Processing demand from manufacturers was up m-o-m in September and, according to market sources, demand continues to be strong. There have been quality issues with some of the crop, which has led to growers trying to sell quickly into the market. Harvest yields have been forecasted higher in October by the EU Commission.

- Price assessment: The Mintec Benchmark price for processing potatoes exw NL (Mintec Code: PO29) was assessed at €115.00/MT, down 4.1% w-o-w.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)