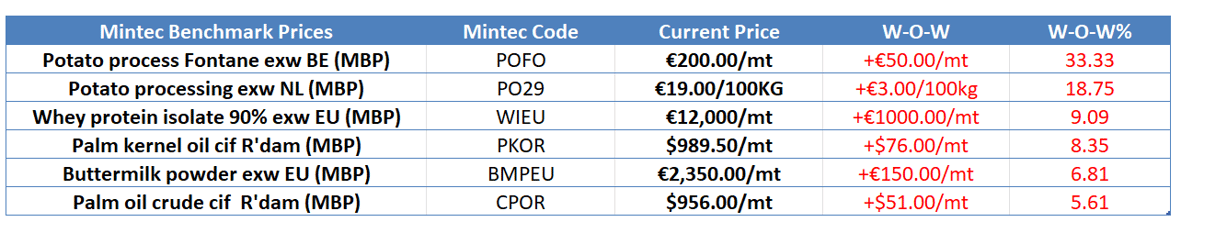

*The table displays the highest week-on-week price movers among Mintec Benchmark Prices, focusing solely on absolute values and excluding differentials.

Fontane Processing Potatoes

- Market sentiment: Market sentiment in the Belgian processing potato market was bullish at the close of trading last week.

- Market Observation: European potato prices are supported by supply concerns regarding wet weather in the NEPG region harvest. Market sources express concerns regarding crop loss due to high rot levels. In the worst affected areas of Belgium, in the Northern Flanders and Flemish region, it was reported last week that up to 30% of the crop remains in the ground.

- Price Assessment: The Mintec Benchmark Prices for Fontane EXW Belgium [Mintec Code: POFO] was assessed at €200/mt, an increase of 33.3% week-on-week.

EU Whey Protein Isolate 90%

- Market Sentiment: market sentiment for Whey Protein Isolate (WPI) 90% remained bullish at the close of trading last week.

- Market observation: Tight availability continued to drive prices up during this week, along with healthy domestic and international demand. Most EU producers are reportedly sold out of WPI 90% for the remainder of Q4 2023.

- Price Assessment: The Mintec Benchmark Prices for EU Whey Protein Isolate 90% Instant [Mintec Code: WIEU] was assessed at €12,000/mt, up €1,000/mt compared to the previous week.

Crude Palm Kernel Oil

- Market Sentiment: Market sentiment for Crude Palm Kernel Oil CIF Rotterdam (MBP) was bullish at the close of trading last week.

- Market observation: The price hike in crude palm kernel oil ensued in conjunction with demand for the commodity, following months of market inactivity. This pause was due to existing player coverage, eliminating the need to seek additional volumes.

- Price Assessment: The Mintec Benchmark Prices for crude palm Oil CIF Rotterdam [Mintec Code: PKOR] was assessed at $989.50/mt, up $76.00/mt compared to the previous week.

EU Buttermilk Powder (BMP)

- Market Sentiment: Market sentiment for Buttermilk powder EU (MBP) remained bullish at the close of trading last week.

- Market observation: Prices rose this week, supported by strong domestic and foreign demand, combed with tightness in EU.

- Price Assessment: The Mintec Benchmark Prices for Buttermilk powder exw EU [Mintec Code: BMPEU] was assessed at €2,350/mt, up €150/mt compared to the previous week.

Crude Palm Oil

- Market Sentiment: At the close of trading last week, market sentiment for Crude Palm Oil CIF Rotterdam (MBP) remained bullish.

- Market observation: The surge in palm oil prices stems from the anticipation of reduced production and a rebound in demand from key buyers. Boosting bullish sentiment was the price disparity between palm oil and alternative oils, particularly soybean oil, a close substitute.

- Price Assessment: The Mintec Benchmark Prices for crude palm Oil CIF Rotterdam [Mintec Code: CPOR] was assessed at $956.00/mt, up $51.00/mt compared to the previous week.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)