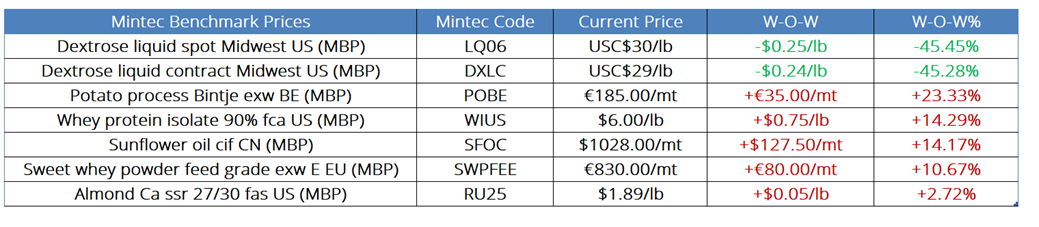

*The table displays the highest week-on-week price movers among Mintec Benchmark Prices, focusing solely on absolute values and excluding differentials.

US Liquid Dextrose Spot and Contract

- Market Sentiment: At the close of trading last week, market sentiment for US liquid dextrose spot and contract was bearish.

- Market observation: Participants note that dextrose prices have declined significantly as domestic producers attempt to compete with Chinese import values.

- Price Assessment: The Mintec Benchmark Prices for US liquid dextrose spot [Mintec Code: LQ06] was assessed at $0.30/lb, down 45% from the previous week. US liquid dextrose contract [Mintec Code: DXLC] was assessed at $0.29/lb, a 45% decrease week-over-week.

Bintje Processing Potatoes

- Market sentiment: At the close of trading last week, market sentiment in the Belgian processing potato market was bullish.

- Market Observation: Delays to harvesting due to poor conditions led to sellers prioritising fulfilling contracted agreements, with limited supplies being made available for the free-buy markets.

- Price Assessment: The Mintec Benchmark Prices for Bintje EXW Belgium [Mintec Code: POBE] was assessed at €185/mt, an increase of 23% week-on-week.

US Whey Protein Isolate 90%

- Market Sentiment: At the close of trading last week, market sentiment for Whey Protein Isolate (WPI) 90% continued to be bullish.

- Market observation: Reportedly, most of the US producers of WPI 90% are sold out for the remainder of Q4 2023. Additionally, they are holding out on Q1 2024 offers in anticipation of price rises. Hence, tight availability continued to drive prices up during this week, along with healthy domestic and international demand.

- Price Assessment: The Mintec Benchmark Prices for US Whey Protein Isolate 90% Instant [Mintec Code: WIUS] was assessed at $6/lb, up $0.75/lb compared to the previous week.

Sunflower Oil

- Market Sentiment: At the close of trading last week, market sentiment in the Chinese sunflower oil market was bullish.

- Market Observations: According to market sources, dwindling stocks led to a surge in demand for sunflower oil as international buyers, including China, looked to secure volumes.

- Price Assessment: The Mintec Benchmark Prices for Sunflower oil cif China (Mintec Code: SFOC) was assessed at $1,028/mt, up $127.5/mt compared to the previous week.

US Almonds California Type SSR

- Market Sentiment: At the close of trading last week, market sentiment for smaller-sized almond kernels was bullish.

- Market observation: A combination of larger average kernel sizing this season and high levels of serious damage has tightened supplies of smaller-sized kernels. As a result, prices for smaller-sized kernels have moved upwards, while prices for larger-sized kernels are firm, which has led to increased price compression between size grades. One market participant contacted by Mintec suggested that they expected a reduction of half a billion pounds of kernels sized 27/30 and under compared to last season.

- Price Assessment: The Mintec Benchmark Prices for Almond Cal SSR 27/30 FAS US [Mintec Code: RU25] was assessed at $1.89/lb on 16th November, up 5 cents/lb on the week.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)