According to the United States Department of Agriculture (USDA), Russia is estimated to export 33 million tonnes of wheat in the 2021/22 marketing year (July’21-June’22), which is 16% less than in the 2020/21 season. According to the Russian Grain Union, Russia exported 1.26 million tonnes of wheat in May 2022, up 87% from the same period last year. At the same time, the export of maize (corn) fell to 404,000 tonnes against 640,000 tonnes a year ago. The main export destinations were Egypt, Turkey, Nigeria, Iran, Israel, and Libya.

For the 2022/23 season, the USDA estimates Russia to be the largest wheat exporter, reaching 39 million tonnes, up 18.2% year-on-year (y-o-y). This is attributed to expectations of higher y-o-y production and strong global demand for affordable Black Sea wheat as exports from Ukraine (a key wheat exporter) are curtailed. Currently, Ukraine is unable to export via seaports due to the ongoing war, but it is using alternative routes, primarily by rail and exporting via neighbouring European countries.

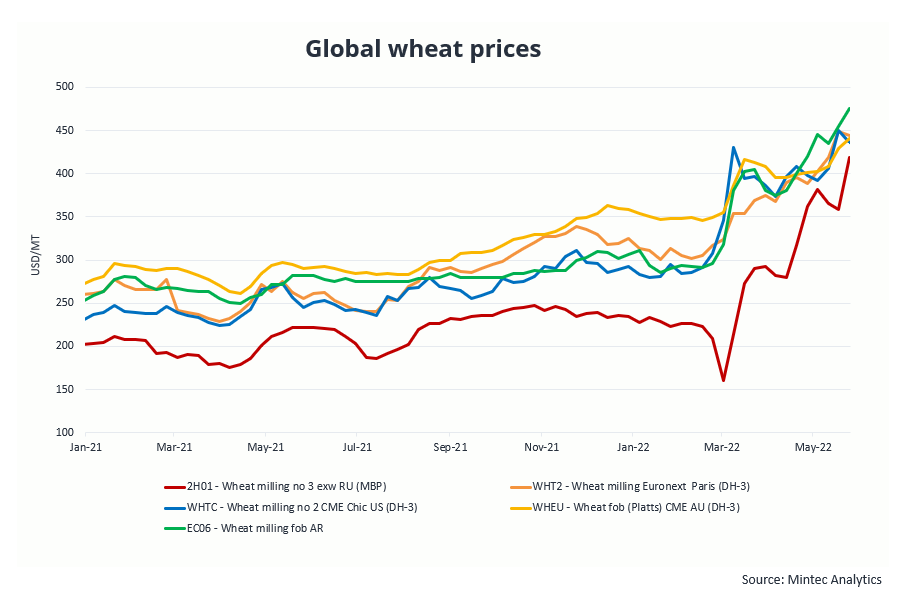

The Mintec Benchmark Prices (MBP) for Russian wheat rose to USD 419/MT from USD 359/MT a week earlier on the 25th of May 2022, up 17% due to the export restrictions of Indian wheat and a significant reduction in export potential from other key wheat growing areas such as the US, Canada, and France (due to adverse weather). Nevertheless, Russian wheat continues to maintain a price advantage on the world market.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)

.jpg)