Rapeseed oil Prices Fall while Palm Oil Sustainability Issues Emerge

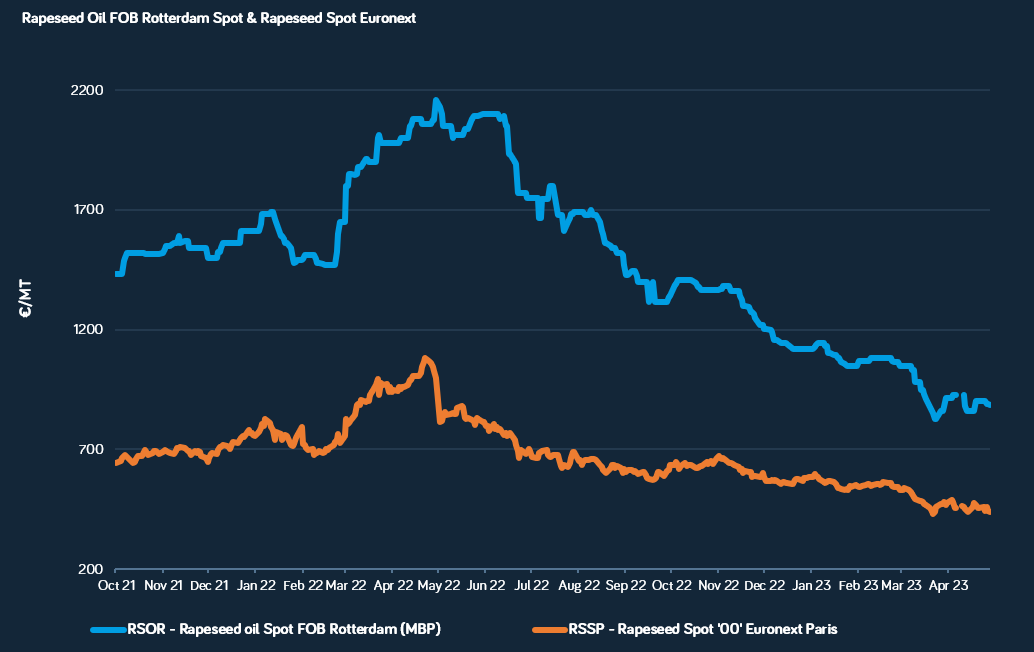

The Mintec Benchmark Prices [MBP] for Rapeseed Oil FOB Rotterdam [Mintec Code: RSOR] was assessed at €859.50/mt on 4th May, down €20.00/mt on the week. The price decline was due to a continued lack of buying interest from the food sector, which is well covered until late 2023, and biodiesel players who are similarly uninterested in purchasing rapeseed oil and instead importing second-generation biofuels from China.

Source: Mintec Analytics, Mintec Benchmark Prices (MBP)

The price over April had briefly rebounded due to extensive Chinese buying of EU rapeseed oil, estimated by Mintec to be more than 200,000 metric tonnes. However, due to poor import margins and cheaper alternatives such as Russian rapeseed oil, shipments have slowed, removing the demand that many market players thought could be the sign of a price revival for rapeseed oil.

A trader commented to Mintec, “there doesn't seem to be any bullish momentum for rapeseed oil coming. Coverage is good, and the key buyers simply are not interested in purchasing. Therefore, you have to question where demand emerges from, and the current answer is nowhere. Adding to all this, we have large stocks and good oncoming supply. Need I say more?”

Mintec learned that stocks held by Canada, Europe, Ukraine and Australia continue to be high, providing further bearish sentiment. In addition, current high stocks are combined with the fact that a large EU and UK rapeseed crop is imminent, estimated at 21.5 to 22 million metric tonnes according to market players. Critically, these estimates are shedding prior concerns that emerged around dryness in some European growing areas, such as southern Germany, and how much this may impact yields come to harvest in June and July. Since the EU is already experiencing a supply glut due to large imports from Ukraine and Australia, it is hard to ascertain where this additional large oncoming supply may be used.

A trader told Mintec, “stocks are high and oncoming supply is also high from not only the EU but Canada, which has seeded a very large area. I think the only bullish signal I can find is the concern over the Chinese exports of ‘green’ fuel into the EU.”

It has been reported to Mintec that imported green fuel for biodiesel usage from China, labelled as Used Cooking Oil (UCO), may not be pure UCO and instead be ‘polluted’ with significant amounts of palm oil, meaning that it would not qualify as a green fuel. Although this story is still developing, if this is indeed the case, market players have mused that increased scrutiny on green fuel exports is very likely or even a ban in its entirety. Increased scrutiny or a ban would likely have a significant impact on the market as UCO has been favoured for supposed sustainability and being competitively priced compared to other biodiesel-useable vegetable oils and could ‘force’ biodiesel players to seek these oils, again increasing demand and potentially prices. The situation is made all the more difficult by the EU’s rallying against products which may cause deforestation, more detail of which can be found here, naturally significant amounts of palm oil being mixed with used cooking oil flies in the face of sustainability.

Mintec will provide updates on this story as more details emerge.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)