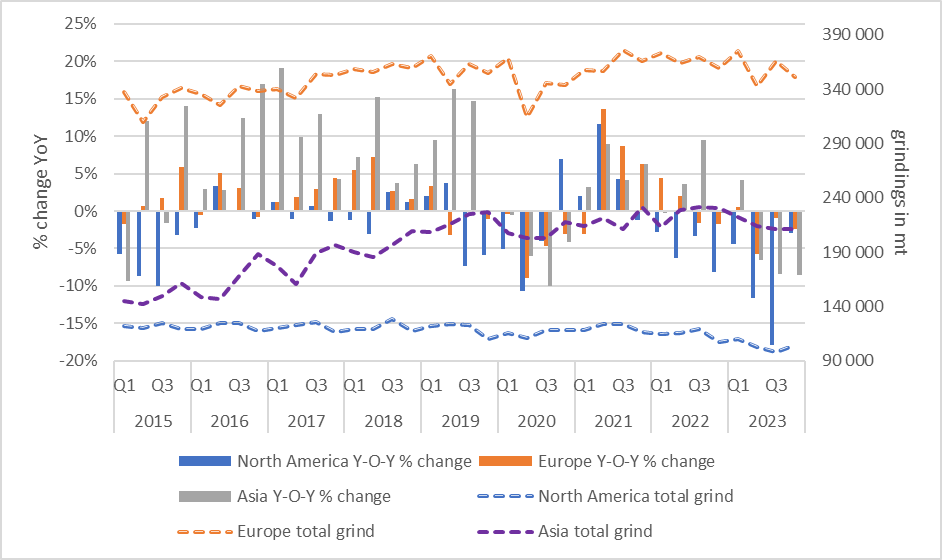

Over the past several days, major cocoa grinding regions have released their Q4 grindings statistics. While Asian grindings were slightly below expectations, down 8.5% y-o-y in Q4, European and North American grindings figures were above industry estimates.

Source: NCA, ECA, CAA

European cocoa grindings in Q4 fell 2.5% y-o-y, slightly above industry expectations, whilst North American cocoa grindings fell just 2.95% y-o-y, well above most industry expectations in the -6% to -10% range. Prices on the exchange were swift to react, with the second month ICE London Cocoa futures contract (May 2024) settling at £3,656/mt on 19th January, up 5.2% w-o-w. The reaction was slightly stronger in New York, where the ICE NY Cocoa second month futures contract (May 2024) settled at $4,528/mt, an increase of 5.8% on the week.

With product ratios largely unchanged in recent months, the product prices have continued to rise with terminal prices. The Mintec Benchmark Prices (MBP) for Cocoa Butter Spot EXW Western Europe were last assessed at €10,046/mt on Wednesday 17th January, up 9.1% on the week, before the grindings releases and the first time the cocoa butter spot price has ever been assessed above €10,000/mt. Likewise, the MBP for Cocoa Liquor Spot EXW Europe was last assessed on 17th January at €6,871/mt, an increase of 8% on the week.

A more in-depth analysis of recent price action will be published in Mintec’s Monthly Cocoa Market Insight Report on 31st January.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)