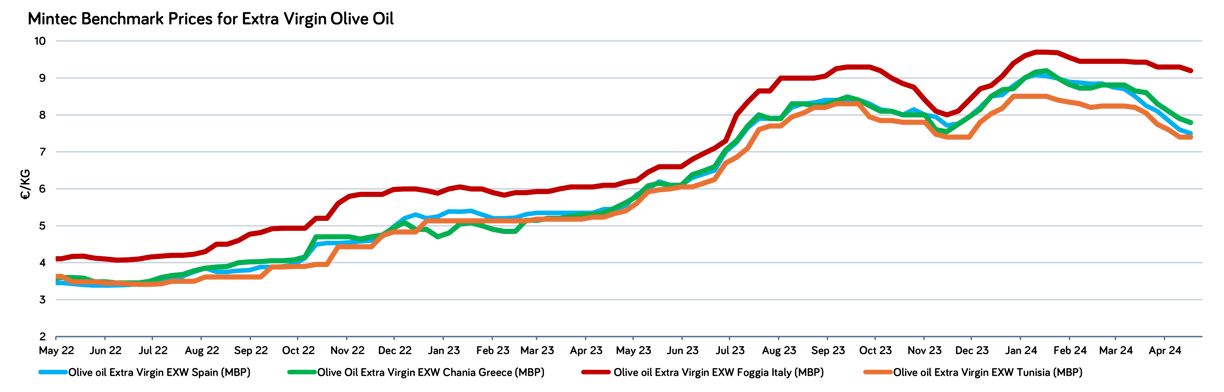

The Mintec Benchmark Prices (MBP) for extra virgin olive oil have been on a downward trajectory, with the MBP for Andalusia settling at €7.80/kg as of April 19th. This decline follows several weeks of decreases after the MBP reached an unprecedented price of €9.20/kg in January 2024, in part due to an uptick in production estimates for Spain's 2023/24 season. Market players surveyed by Mintec now predict a production range of 830,000-850,000 metric tonnes, marking an increase of approximately 40,000 metric tonnes from previous estimates provided by market players in early March. While seemingly modest, this adjustment, coupled with recent beneficial rains in March and April, prompted some sellers to liquidate stocks to avoid further price declines. However, this triggered a 'bearish price spiral', with sellers offering cheaper prices in response to rapid offloading by others, leading to cascading prices, especially as buyers remained largely absent from the market, expecting further price drops.

Concerns regarding consumption trends have also emerged, with market players noting a decrease influenced by the comparatively high retail prices of olive oil compared to alternative cooking oils such as sunflower or rapeseed. This concern is compounded by fears of an economic recession within the EU, historically leading consumers to seek more affordable alternatives, potentially dampening demand for olive oil at current price levels.

Source: Mintec Analytics

Total EU olive oil production is estimated by the European Commission to reach 1,488,000 metric tonnes in the 2023/24 season, representing a 7% increase from the prior season. However, this is far below the five-year average and carryover into the new season, particularly in Spain, is notably low at approximately 200,000 metric tonnes, compared to the usual figure of around 500,000 metric tonnes, reflecting the impact of lower production volumes in the previous season.

Furthermore, Greece has faced significant challenges with heat and the olive fly, leading industry insiders to predict olive oil production of around 120,000 metric tonnes in 2023/24, a significant decrease from the previous year's production of approximately 340,000 metric tonnes. Additionally, Turkey, a key supplier to the EU, is expected to produce as little as 180,000 metric tonnes of olive oil, compared to approximately 410,000 metric tonnes in the prior season. The extension of Turkey's olive oil export ban, initially set to expire in November 2023 due to local pricing concerns, has dashed hopes for increased Turkish exports to the EU once the ban was lifted, given the significant decrease in production potential.

The combination of varying production estimates and external factors such as export bans and economic conditions within the EU adds further complexity to the olive oil market outlook. Some market players have commented that the olive oil market is on a knife edge, poised to break either way, as sellers pin their hopes on improved output in the coming months, coupled with diminished stocks, to bolster prices, while buyers cautiously anticipate the maintenance or even further reduction of prices.

Compounding these challenges is the dwindling oil reserves, with some market players having sold over 70% of their supply, heightening the risk of sudden demand spikes when purchasing requests arise. Despite the prevailing market downturn, there exists a reluctance among stakeholders to replenish stocks, leaving the market susceptible to potential supply shortages.

In conclusion, the olive oil market faces a period of uncertainty, with stakeholders navigating through fluctuating prices and supply dynamics. While short-term forecasts may suggest stability, the market's resilience hinges on the interplay of various factors, making it imperative for industry players to adapt and strategize accordingly.

💡Do you want to explore this topic further?

Watch on demand our webinar "Steering the Olive Oil Landscape - Supply, Quality, and Sustainability Insights".

I delve into challenges in the olive oil market, providing valuable insights to help you navigate the changing market dynamics.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)