There was activity within the tin market amid the threat of a supply disruption from Myanmar, which is one of the world's largest tin producers, in April. According to statements by the Central Economic Planning Committee of the Wa State in Myanmar, mining will be halted in August to conserve the remaining resources. This could lead to a shortage of raw materials and a sharp increase in the price of the metal, according to market players.

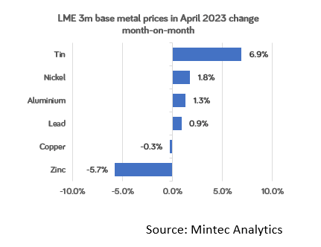

As a result, tin had the most significant 3m price increase among base metals in April, up by 7% m-o-m to $25,744/MT. Between the last week of March and the end of April 2023, LME tin stocks were down 50%, reflecting higher demand for the metal in the world market.

At the same time, fundamentally, the global tin market balance has shifted to surplus as consumption declined and supply was high. This is confirmed by the fact that in comparison with April 2022, tin prices have fallen by 40% - a record drop among base metals.

Myanmar is the largest producer of tin metal in the world after China and Indonesia. Soldering metal is estimated by the International Tin Association to account for about 50% of global tin consumption. China is the largest consumer of soldering metal in the world and a cut in supply from Myanmar, which borders China, would have a significant impact on the market and likely increase Chinese demand for tin from other supplier countries

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)