Palm oil market dynamics - Insights Ahead of MPOB Report

Insights gathered from market players suggest that the release of the latest Malaysian Palm Oil Board (MPOB) report on 13th February may hold few surprises.

Palm production decline

Market participants surveyed by Mintec, indicate a potential 11% to 13% decline in palm production in Malaysia for January compared to December.

This decline has been attributed to unusually heavy rainfall, causing flooding in key production areas and increasing difficulties in transporting Fresh Fruit Bunch (FFB) to processing centres.

According to Mintec calculations using data submitted by market players, Malaysia's palm oil production for January could potentially reach 1.36-1.38 million metric tonnes, marking the lowest monthly output since April 2023.

If realised in the MPOB report, this low production may lead to upward price pressure on palm oil prices in the coming weeks according to sources familiar with the situation, with many industry insiders anticipating gains of $20/mt to $50/mt as a possibility.

Decreasing end stocks

Market players submitted estimates to Mintec that end stocks are poised to decrease to between 2.05-2.15 million metric tonnes in January, marking a circa 10% decline from December.

This shift could have significant ramifications for the market in the remainder of February, as dwindling palm oil stocks might drive prices higher, according to market players. Furthermore, industry insiders have noted to Mintec that if stocks fall towards the lower end of their estimated range, heightened price volatility could ensue as buyers respond to the tightening supply by potentially seeking additional volumes.

Market dynamics

However, a resumption of bullishness in the market is likely to require increased demand with submitted estimates for exports in January coming in at a decline of between 6% and 10% as compared to December, according to industry insiders.

Careful monitoring of the situation in the coming weeks is likely to be essential to determine market direction, with particular note on how Chinese demand may evolve after returning from Lunar Festival celebrations towards the end of February.

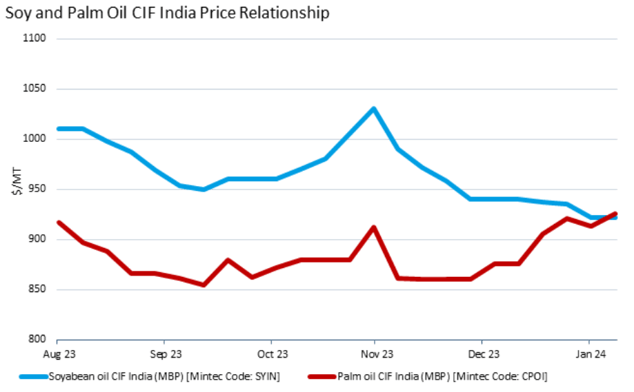

Moreover, market participants in key buying nation India continue to express a preference for soybean oil over palm oil. This preference is largely driven by the minimal price difference on a Cost and Freight (CNF) basis into India, which at the time of writing stands at $11/mt. This significant deviation from the typical price range of $50/mt to $100/mt raises speculation that India may persist in favouring soybean oil unless a wider price gap emerges. Such a preference for soybean oil in the Indian market could potentially lead to a reduction in palm oil demand potentially tempering some of the upside potential predicted by market players.

In conclusion, the forthcoming MPOB report and subsequent market developments will be closely watched for their potential impact on palm oil prices, export trends, and market dynamics, with particular attention paid to factors such as demand shifts and supply constraints.

Mintec plans to issue an update on this narrative following the release of the MPOB report.

---

Want to stay in touch with palm oil market dynamics? Watch our latest oilseed market expectations webinar to gain valuable insights into current market drivers.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)