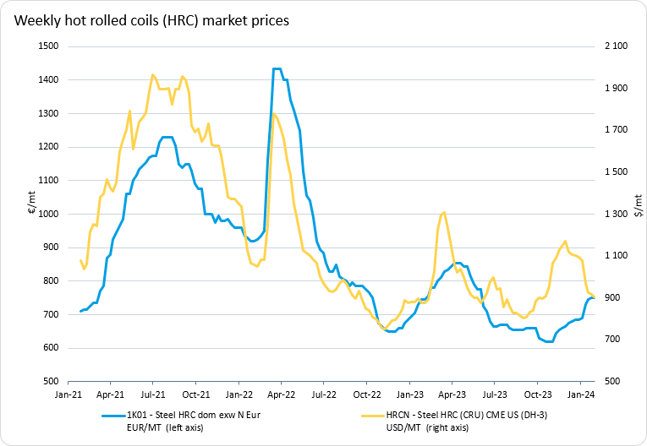

In January, steel prices moved in different directions in US and EU markets. However, a weak upward price trend is still in place. At the same time, global steel demand is traditionally weak in the winter months and raw materials prices have stagnated so many market players are doubt about further price increases. Most market sources are waiting for the end of February after which the price trend should become clearer. In February it is worth paying attention to the seasonal change of steel consumption in construction. Also market players want to look at business activity in China after the after the Lunar new year celebrations end on 17th February. Changes in Chinese buying patterns will directly affect the steel prices, most notably the raw materials used for steel production.

The CME's US steel hot-rolled coil (HRC) [Mintec Code: HRCN] 3-month price fell in January by 14% month-on-month (m-o-m) to $943/MT. In the US market, steel demand fell significantly, as in October-November rising domestic steel prices stimulated the growth of purchases, thus building up consumer steel inventories. Tinplate spot prices [Mintec Code: PA02] rose by 3% m-o-m and 8% y-o-y in December to $2,023/MT. In January, market demand was weak and, according to market sources, suppliers started to cut prices following HRC.

HRC prices in the EU [Mintec Code: 1K01] rose by 7% m-o-m in January to €729/MT. Producers continued to increase prices, although demand weakened in January. Many consumers accumulated sufficient stocks of flat products and stopped purchasing. In addition, the EU market continues to be pressurised by price competitive imports. Consumers are more focused on buying steel from domestic producers, but in negotiations they point to the large amount of imported steel in Europe, demanding a discount from the producer.

Source: Mintec Analytics

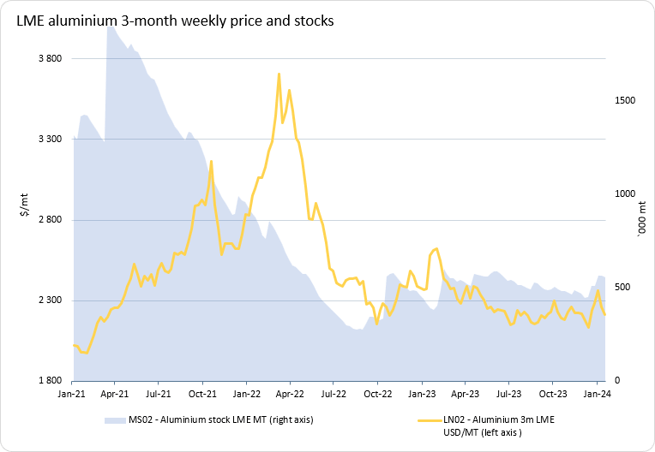

The LME aluminium 3-month price [Mintec Code: LN02] rose by 0.8% m-o-m to $2,244/MT in January. However, the price trend has remained relatively stable since the beginning of H2 2023 amid a global market surplus. Despite a recovery in global aluminium demand, primary aluminium production is growing more rapidly, creating a market surplus. Nevertheless, market sources suggest that it is possible that prices may reverse the flat trend in the coming months, pointing to increased LME price volatility from December 2023 inside month.

LME aluminium stocks are at historically high levels, however market sources say that Russia's share of LME stocks has increased from 40% to 90% over the year and that available aluminium from other countries is critically low.

Prices for aluminium packaging products in the EU continued to decline in December reflecting weak purchasing in the region: aluminium can warehouse prices [Mintec Code: PA25] decreased by 2% m-o-m and 5% y-o-y; aluminium foil prices in the EU [Mintec Code: PA30] decreased by 3% m-o-m and 9% y-o-y. According to market players statements, aluminium packaging materials prices stabilised in January.

Source: Mintec Analytics

In US market aluminium foil price [Mintec Code: PA28] were also under pressure, down 2% m-o-m and 5% y-o-y in December. Aluminium can prices [Mintec Code: PA27] fell by 2% m-o-m and 8% y-o-y, reflecting weak demand in the market. In the US, beer production, an industry that consumes a significant proportion of aluminium cans, fell by 6% y-o-y for the first nine months of the year.

For further insight sign up for early access to our H1 Industrial Materials 2024 eBook. Equip your business with strategic intelligence to navigate a challenging industrial materials market. This eBook delves into high-level macroeconomic trends, industry impacts, and the reflection of these dynamics on industrial commodity prices.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)