Introduction

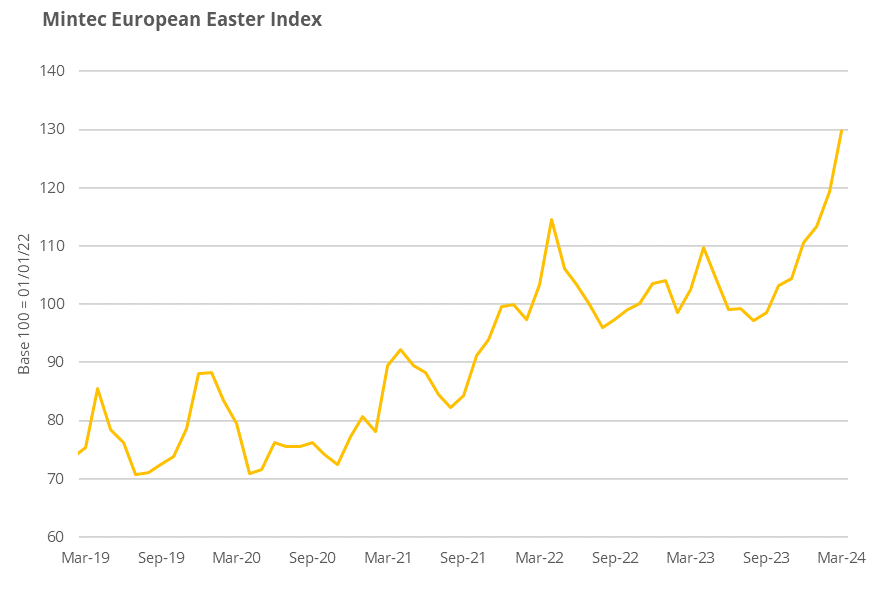

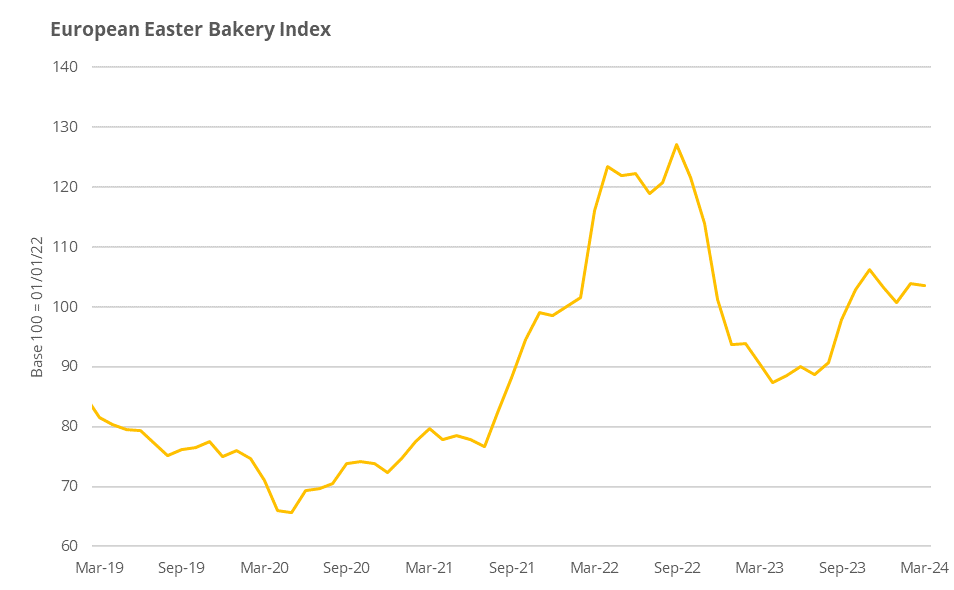

Mintec’s European Easter Index measures price fluctuations across essential food commodities typically consumed across the region during Easter. The Easter Index compares commodity prices in March 2024 against March 2023 to indicate the cost of consumers' meals and treats in the build-up to Easter. More recently, reports have been focused mainly on the high price of chocolates due to record-high cocoa prices, which has been a critical topic of discussion as Easter approaches. Mintec’s European Easter Index goes beyond chocolate prices and factors in the consumption of foods such as lamb, hot cross buns, and other proteins. Consequently, the index is comprised of three sub-indices: the Protein Index represents a selection of meats, fish and eggs that will typically be eaten as part of a main Easter dinner; the Chocolate Index compares the main ingredients used to manufacture chocolate Easter eggs, a traditional confectionery consumed across Europe; the Bakery Index covers various ingredients used to make pastries, hot cross buns and other baked treats consumed over Easter holidays.

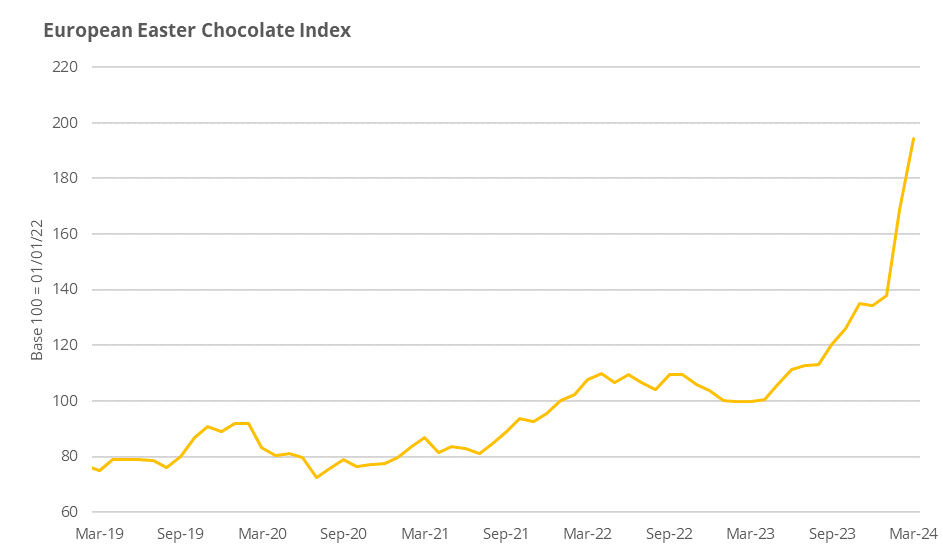

The overall inflationary environment within Europe has eased since the turn of the year, reflecting declining energy costs and comparatively stable interest rates. However, food inflation remains a key topic during the Easter period. Chocolate is commanding considerable media coverage due to surging cocoa prices, which have escalated over the last year, surpassing record highs monthly. Cocoa price inflation contributed to the European Chocolate Index surging by 95.2% year-on-year (y-o-y), which underpinned a 26.6% y-o-y rise in the overall European Easter Index.

The European Easter Protein Index rose 8.6% y-o-y, while the Bakery Index increased 14.4% y-o-y, indicating higher consumer prices this Easter compared to a year ago.

Mintec’s European Easter Index

The overall Easter Index for Europe increased by 26.6% y-o-y, reflecting inflationary pressures across all three sub-indices.

The Protein Index rose by 8.6% y-o-y, driven by a significant jump in the lamb price and a moderate increase in the cod price, which outweighed lower prices y-o-y for the other components.

Consumers are poised to pay substantially more for traditional chocolate Easter eggs this year, reflected in the Chocolate Index increasing by 95.2% year over year. This was underpinned by record-high cocoa prices more than offsetting weaker prices for the other chocolate constituents.

The Bakery Index compares the price of key ingredients used to manufacture cakes and pastries and rose by 14.4% y-o-y, supported by higher prices for dairy products and sultanas, contrasted against cheaper sugar and sultanas.

Source: Mintec Analytics

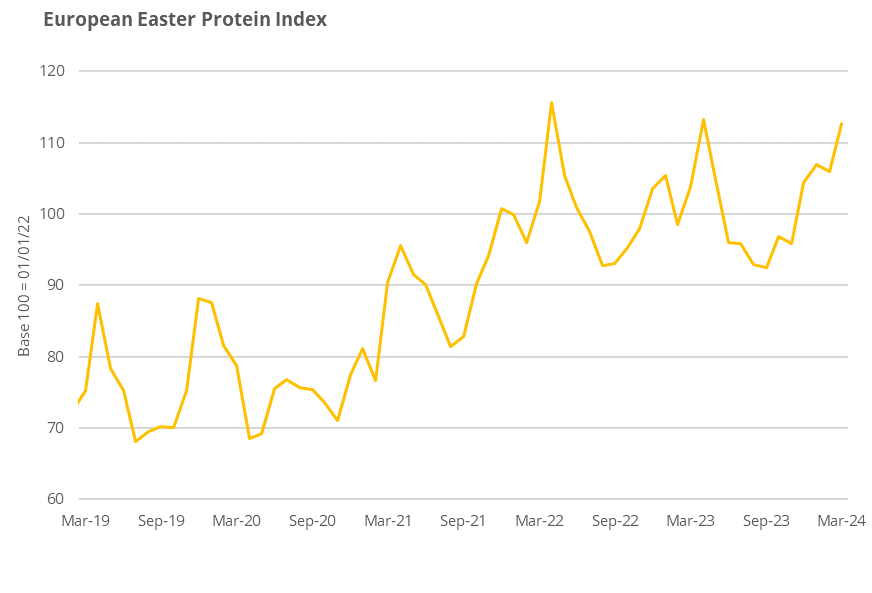

European Easter Protein Index (lamb, beef, pork, salmon, cod, egg)

Source: Mintec Analytics

The European Easter protein index commodities include meat (lamb, beef and pork), fish (salmon and cod), and eggs.

The European Easter Protein Index rose by 8.6% year over year in March, mainly influenced by firm lamb prices following supply tightness. The Atlantic cod price also increased due to quota reductions in key fishing nations Norway and Russia and EU sanctions on Russian seafood. These bullish drivers were partially mitigated by cheaper prices of beef (-12.4%), ham (-2.0%), salmon (-7.5%) and eggs (-13.1%).

Breakdown by Components

Easter Protein Index (lamb, beef, pork, salmon, cod, egg)

Source: Mintec Analytics

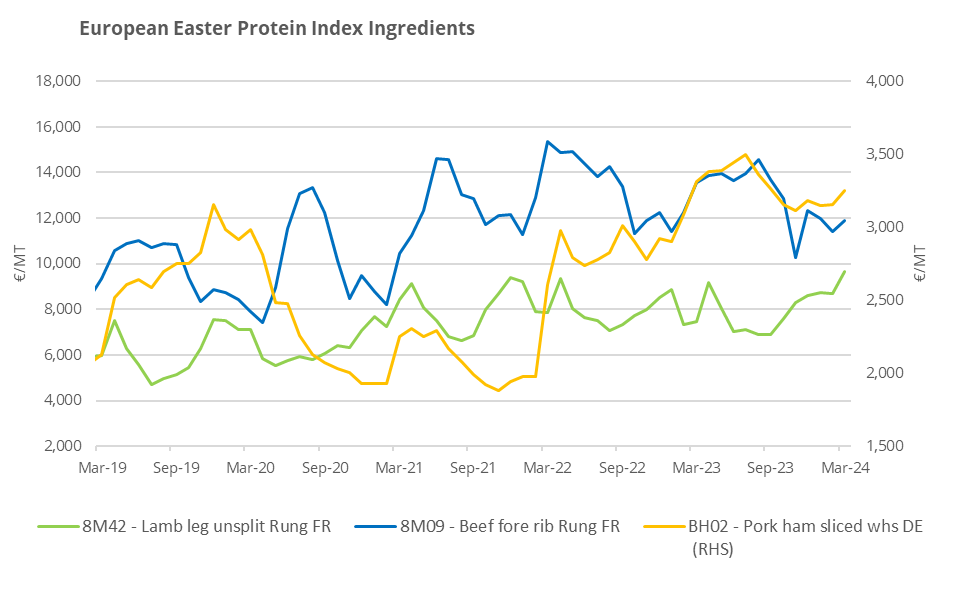

Lamb

In March, the EU lamb average price was recorded at €9,675/MT, up 11.5% m-o-m and 29.7% y-o-y. EU lamb prices are supported by solid demand for lamb due to consumption associated with religious festivals such as Easter and Ramadan, which occur in proximity each year. Traditionally, demand for lamb roasting joints increases between February and March as lamb roast forms the main part of the Easter Sunday meal. There’s also further demand during Ramadan amid tighter supply across the continent.

Beef

High EU beef prices also supported an overall increase in the European Easter protein index. The average price of beef in the EU increased by 4.4% m-o-m to €11,900/MT in March 2024 due to a seasonal rise in demand for certain beef cuts. Demand for roasting joints, mince, and burgers has been gaining momentum since late January 2024, with an increase in wholesale demand.

However, EU beef prices fell 12.4% y-o-y with stable supplies on the market compared to the same period last year. According to market sources, a declining trend in EU beef production will likely reverse in 2024. Beef output is expected to increase in 2024, underpinned by an increase in cattle slaughter weights due to market expectations of lower feed prices in the year. The cattle slaughter weights in 2023 were substantially low due to high feed prices.

Pork

The Mintec Benchmark Prices for Pork ham in Germany was reported up 2% m-o-m in March 2024 to €164.1/MT, which reflects a 3% decrease y-o-y.

German ham prices have been recently supported by a tight supply of live pigs, which can be linked to reduced pork production across the EU, as unprofitable prices resulted in a herd reduction throughout 2023. Steady demand, in combination with tight supply during the first quarter of 2024, added a slight bearish undertone to the German pork cuts market. However, prices decreased slightly compared to the previous year, which can be linked to weaker international and domestic demand.

Source: Mintec Analytics

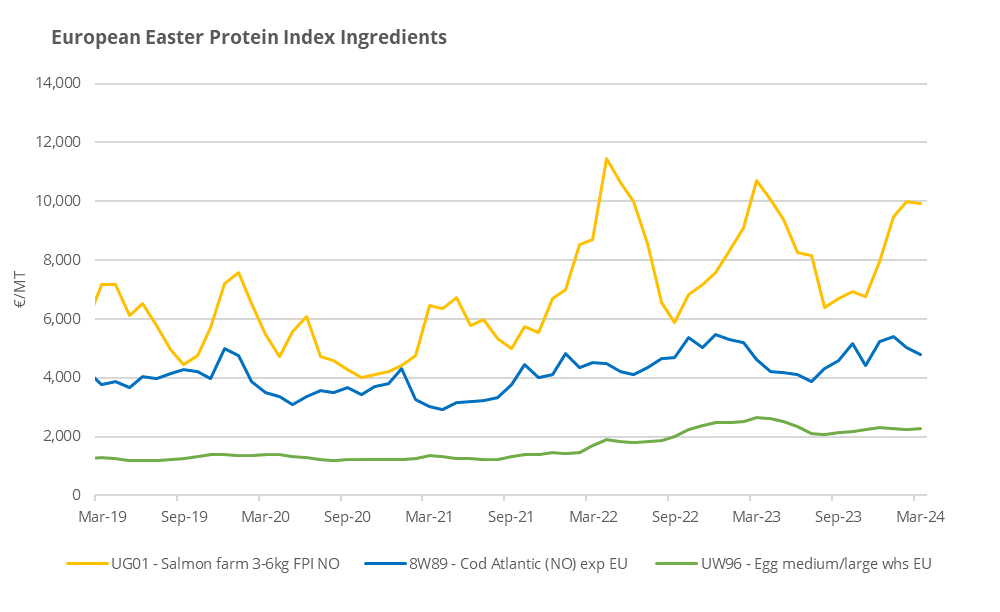

Salmon

The Norwegian salmon average price in March 2024 decreased by €805.92/MT (-7.5%) y-o-y to €9,910/MT. This price drop comes from the highest-ever March average of €10,716/MT in 2023, the second-highest monthly average on record. The decrease in value y-o-y can be attributed to a stronger NOK and a reduction in global demand for salmon, as observed across the seafood market. The historically higher prices of Norwegian salmon can be attributed to elevated production costs, influenced by aquafeed ingredients such as fishmeal and fish oil prices, and harvest disruptions caused by heavy storms. In addition, the Norwegian market has shown a higher proportion of fish production (lower-quality fish) than in an average year (10%) due to difficulties with sea lice, leading to early harvest. These factors have contributed to upward pressure on prices for larger-sized salmon.

Cod

The Norwegian Atlantic cod price increased by €154/MT (+3.3%) y-o-y in March 2024, while the price declined by 5% m-o-m, averaging €4,787/MT. The y-o-y price rise is attributed to a disruption in the cod supply chain because of the US bans on Russian-origin seafood and the new EU tariffs on Russian-origin pollock and cod. This has led to more interest among seafood exporters for cod from Norway. In addition, the supply of Norwegian Atlantic cod is likely to be relatively tight in 2024 due to rising demand and a 20% decline in the catch quota in the Barent Sea.

Egg

The average price of medium and large table eggs in the EU dropped 13.1% y-o-y, from €2,630/MT in March 2023 to €2,285/MT in March 2024. Such a decline can be attributed to a better supply position, including lower hen feed costs and no major disruption of the EU egg production this winter. The spring of 2023 saw record-high values of egg prices, with short supplies due to the loss of millions of hens to bird flu. As the EU egg production slowly recovered, prices have dropped gradually since then, but the retail demand for consumer eggs remains strong. As a result, the EU supply of graded shell eggs this month is barely adequate, which encourages imports on the egg processing side.

European Easter Chocolate Index (cocoa, milk, sugar)

Source: Mintec Analytics

The index price of Easter Chocolate commodities rose by 95.2% y-o-y in March 2024. The cocoa bean price soared by 189.3% y-o-y, offsetting weaker prices for skimmed milk powder (-3.7%), sugar (-31.3%) and vanilla (-74.0%). As chocolate prices have risen, manufacturers have scrambled to secure supply amid a reduction in bean – and thus product – availability.

Cocoa

Source: Mintec Analytics

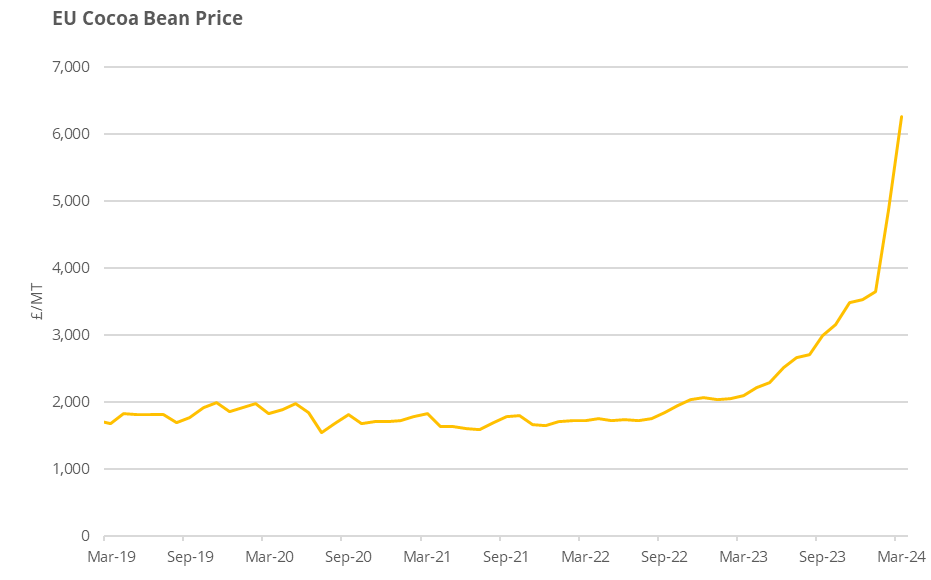

Cocoa bean futures on the spot ICE London exchange shot well beyond the previous all-time high set back in 1977. The previous high of £3,076MT, set in July 1977, was surpassed in October 2023, and spot prices have continued their meteoric rise to trade at around £6,940/MT as of late March. The rise has been attributed to several factors, chiefly the drop in production so far this year, with Mintec sources estimating that production for 2023/24 is likely to be some 10-15% lower than 2022/23. Much of this drop can be attributed to an increase in instances of the Swollen Shoot Virus (SSV), which destroys tree productivity in West Africa. In addition, other factors such as neglect, a lack of fertilisers and other inputs, low and delayed farmgate payments to farmers, new EU deforestation legislation, and robust consumer demand have all contributed to higher cocoa bean prices over the past year.

In addition, the two key cocoa components of chocolate – cocoa butter and cocoa liquor – have seen their increases far surpass those of the cocoa bean due to pricing ratios set by major processors. These ratios have seen the price increases for butter and liquor nearly double those of the cocoa bean. Ratios have moved higher since early 2024 due to higher bean costs, rising interest rates and storage costs, higher overall costs of production, and consistent demand from manufacturers with very low levels of coverage for chocolate and cocoa products. Mintec is now hearing from many manufacturers and retailers that few offers are available in the market due to a lack of supplies of chocolate and cocoa products, despite most buyers having minimal cover on hand, which is causing some switching and reformulation away from traditional chocolate products and towards alternatives like compound, where cocoa fats such as cocoa butter are substituted with vegetable oil. “Shrinkflation” is becoming an increasingly common way to mitigate the rising price of chocolate.

Milk

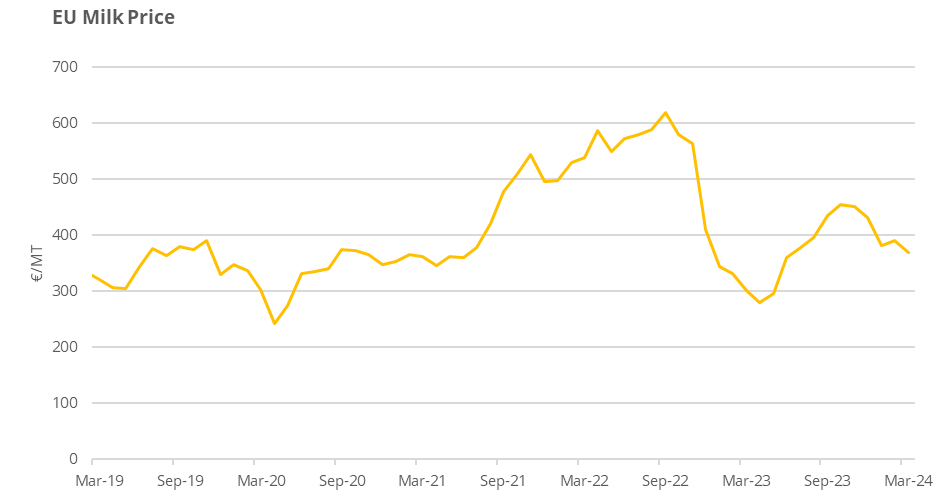

Source: Mintec Analytics

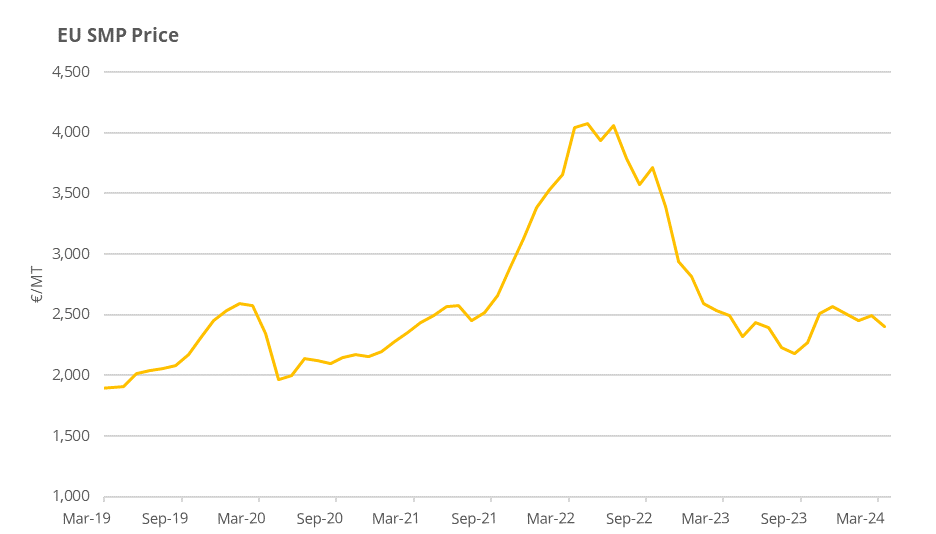

The Mintec Benchmark Price for Skimmed Milk Powder EXW Europe was assessed at €2,400/MT during March, down 4% on the month, which reflects a decrease of 3.7% on the year.

Increasing milk intakes across the EU in combination with weak domestic and international demand weight EU SMP prices throughout the first quarter of 2024, adding a bearish tone. Milk production has been supported by mild weather contention throughout February and March. While supply increased, demand has been reported as muted throughout the first quarter of the year. Domestic buyers have been postponing their buying in anticipation of price decreases following the milk flush (April-May), while international buyers covered their Q1 2024 demand already in Q4 2023 and early January 2024. Additionally, the strong price decrease in the SMC (Skimmed Milk Concentrate) market is putting more downward pressure on prices, which dropped significantly during March due to improved availability and several technical issues that reduced processing capacity in a major manufacturing facility. This substantial price decrease for SMC resulted in some manufacturers using SMC instead of SMP in their production, if possible.

Sugar

Source: Mintec Analytics

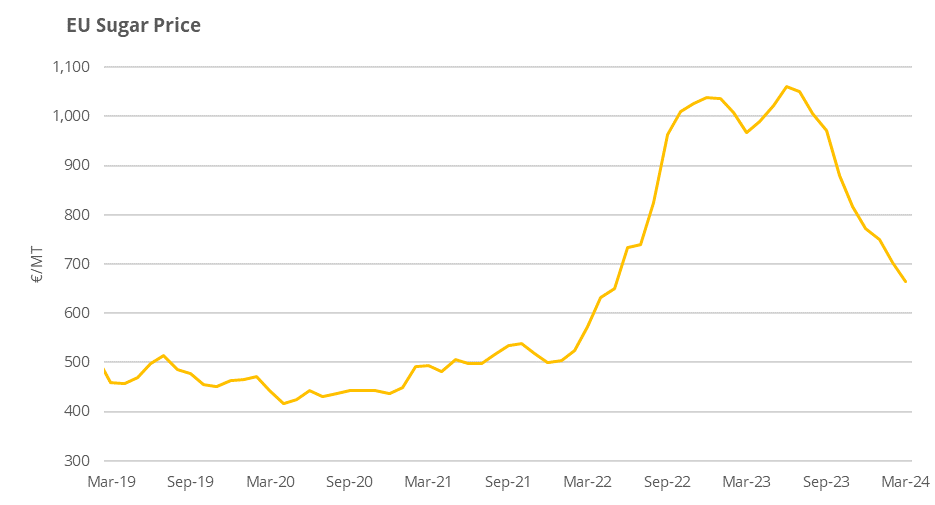

The price of granulated white sugar (ex-works, EU region 2) fell by 32% y-o-y based on surplus supply. The softening prices represent a sharply declining premium over ICE London #5 world market futures prices. In March 2023, EU spot prices were twice as high as world market prices, an EU premium of 100%. Today, that premium is just 10% or 20% of global prices, barely enough to cover the freight differential from FOB world market ports to EXW EU sugar factories. Also, after Russia invaded Ukraine in February 2022, the prices of European natural gas and fertilisers spiked, and with it, the costs of growing and processing beet sugar. Also, after Russia invaded Ukraine in February 2022, the prices of European natural gas and fertilisers spiked, and with it, the costs of growing and processing beet sugar. In September 2022, the white sugar premium (the premium above the #5 futures contract) reached $222/MT, and spot EU sugar prices rose above €1,000/MT, remaining for about a year until October 2023 before starting to fall. Today, the world #11 raw spot price has fallen by 15% from 28¢/lb to 24¢/lb, the white premium is now just above $100/MT, natural gas prices have fallen to below €25/MWh – well below the levels seen before the Russian invasion – and EU spot market prices have fallen by around 30% since the invasion due to a surplus of Ukrainian sugar entering the EU market.

European Easter Bakery Index (wheat, butter, sugar, sultanas, milk, egg)

Source: Mintec Analytics

The Easter Bakery Index includes the commodities used to make hot cross buns, cakes, and pastries. The Index rose by 14.4% year over year, with dairy price inflation as a key driver. European milk and butter production has been under pressure from supply tightness, partially related to a diminished cow herd. Sultana production has also been impacted by poor weather in key growing regions. These upside price drivers were partially mitigated by cheaper wheat sugar and eggs, which are benefitting from improved supply fundamentals.

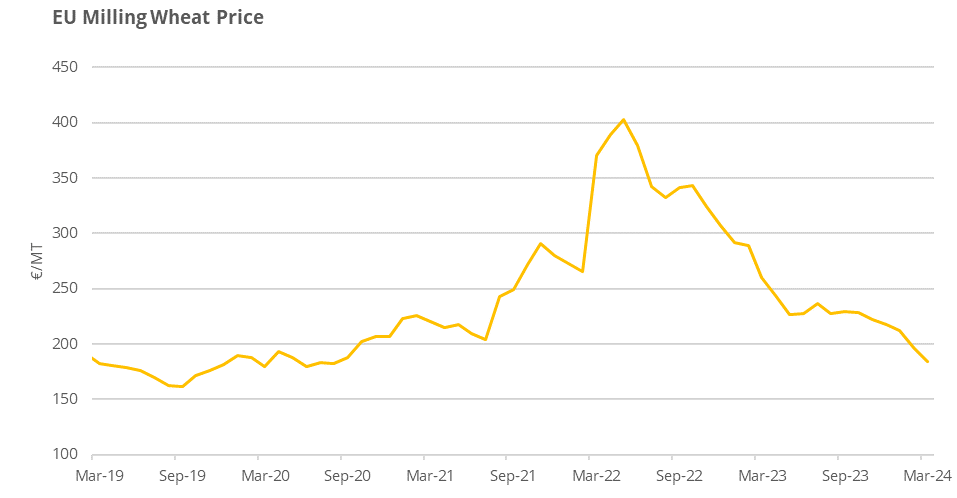

Wheat

Source: Mintec Analytics

In March, the average price of French milling wheat dropped by 2.6% compared to the previous month and by 23% compared to the same period last year, settling at €188/MT. This decline was driven by ample supply and decreasing Russian export prices, which pushed wheat futures to multi-year lows. Despite the dominance of abundant old crop stocks from the EU and Russia in shaping price trends, concerns arise as the northern hemisphere enters a new growing season, with various weather issues threatening global stocks. Moreover, ongoing efforts by Russian and European exporters to clear excess inventory are expected to limit short-term price hikes. The persistent availability of wheat from these regions has significantly constrained significant price fluctuations, with market attention now turning to weather patterns as a primary determinant of future market dynamics.

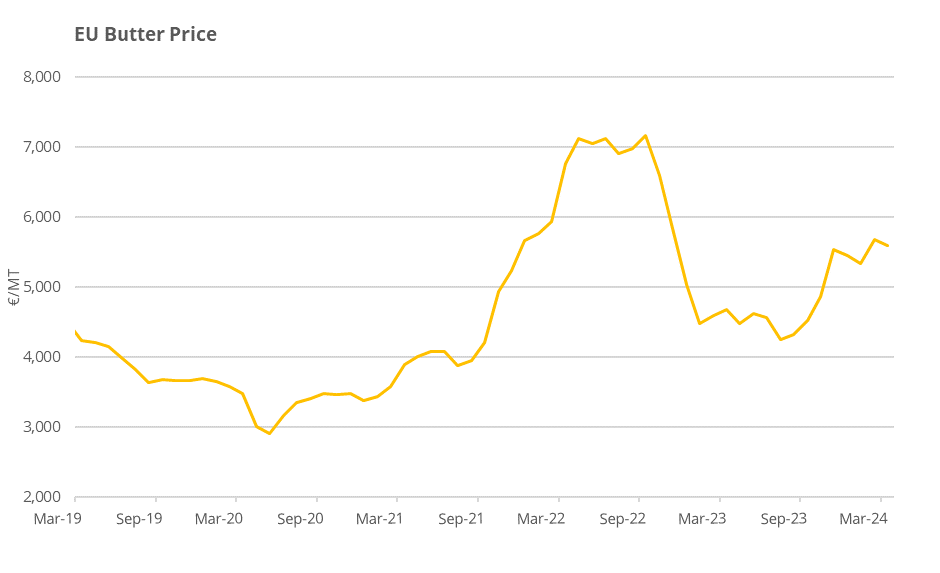

Butter

Source: Mintec Analytics

The MBP for unsalted Butter EXW EU was made at €5,590/MT in March, down 1.5% m-o-m, which reflects a 19.3% increase y-o-y. Butter supply has been tight since August 2023 as producers channelled milk into more profitable dairy commodities, such as cheese. Reduced production and steady demand have limited the availability of butter stocks throughout the EU. Increasing milk intakes and weaker demand have changed the market sentiment on the EU butter market during late February and March, with prices starting to decline. However, this recent decline could not offset the price gains reported since August 2023, as Butter stocks remain tight.

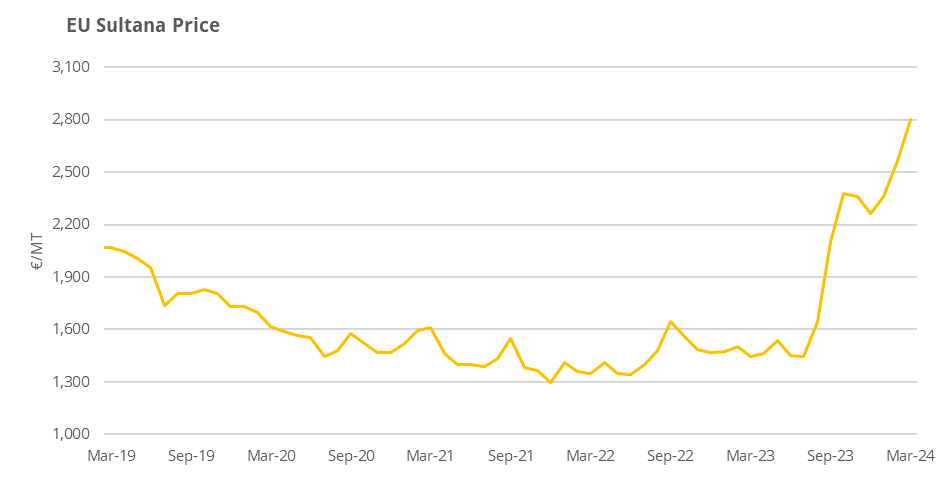

Sultanas

Source: Mintec Analytics

The MBP for Turkish sultanas (FOB Turkey) rose sharply by 94% y-o-y in March 2024 to €2,800/MT. This follows a shortfall in Turkish 2023/24 sultana production, officially estimated at 206,000 tonnes, a decrease of 36% on the previous campaign after areas of western Turkey received excessive precipitation in May and June last year.

Market sources told Mintec in March that securing good-quality material in Turkey is increasingly problematic. The availability of lighter-coloured fruit is reportedly tight, with some processors in Turkey managing low inventory levels.

Exports from Turkey totalled 134,000 tonnes between 1st September 2023 and 9th March 2024, according to the Association of Exporters of the Aegean Sea (Ege İhracatçı Birlikleri, EIB), down only 3% on the previous campaign. Interestingly, since the start of 2024, exports have been steady over the last year, with around 40,800 tonnes of sultanas shipped from Turkey between 1st January and 9th March. Amid the inflated market prices, a slowdown in exports was widely anticipated, although this has not yet materialised.

Milk

Source: Mintec Analytics

The MBP for Milk EXW Germany [Mintec Code: ED24] was assessed at €370/MT during March, a decrease of 5.1% on the month and an increase of 22.5% on the year. German and general EU milk prices have been increasing from the end of April to mid-October 2023, supported by tighter milk intakes across Germany and the EU and steady demand on both domestic and international markets. The supply was tightened by a slightly reduced cow herd and unfavourable weather conditions during Q3 2023. Since the middle of October, milk prices have started to decrease, driven by increased availability and slightly weaker demand. With the start of the milk season approaching in Europe, market sources expect to see further downward pressure on German milk prices up until the peak of milk production in April – May.

Conclusion

Mintec’s 2024 Easter Index for Europe shows that the average European household is likely to pay more for traditional food and confectionary this Easter than Easter 2023. Inflation has been the key macroeconomic theme of the past year. While several indicators have slowed since the turn of the year, including energy, alcohol and tobacco, food prices remain volatile. The blended cost of chocolate ingredients in March 2024 is almost double that of last Easter, which is entirely attributable to the record high prices of cocoa evident since Q3 2023. Given the high cost of chocolate, it remains to be seen whether households will reduce Easter egg consumption this year, completely abstain from or indulge in the tradition. While chocolate manufacturers are already responding to the high ingredient prices through strategies such as shrinkflation, some consumers might still look to alternative cheaper sweets in grocery stores, while others will be encouraged towards home-baked treats as more cost-effective options this year or seek healthier options, such as fruit.

Among the protein category, pork is likely to be the winner this Easter, when considered against lamb and beef. As a cheaper meat, pork has cost advantage over the other meats and the pork price is also cheaper y-o-y in 2024. In contrast, the lamb price has risen by almost 30% y-o-y, while beef, despite falling in price y-o-y, remains the most expensive meat. Fish is traditionally eaten on Good Friday and supply tightness supports a more expensive cod price y-o-y in 2024, which may weigh on demand, although the Norwegian salmon price remains close to record high levels, suggesting buyers will reduce salmon consumption this year. As such, cod and other white fish are likely to face robust demand this Easter, potentially accelerating upward price movements.

The European Easter Bakery Index increased by 14.4% y-o-y, indicating that consumers may bake less this Easter than last year. However, baking represents a considerable cost saving compared to buying chocolate-based confectionary, which could fuel the substitution effect toward home-made treats among cash-squeezed households.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)