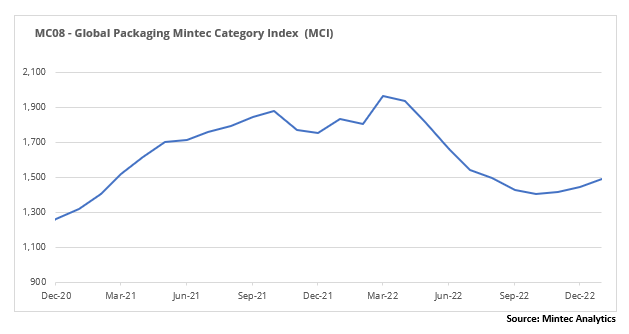

The Mintec Global Packaging Category Index (MCI) rose by 3% month-on-month (m-o-m) but was down by 18% year-on-year (y-o-y), to $1,493/MT in January 2023. There were mixed movements in the prices of packaging materials last month. Plastics prices were relatively stable in US, but were weak in the EU, and many market players believe there will be a price increase in February on the back of expected oil price increases. Metals continued to rise in price following a demand recovery and increased raw material costs. Finally, Europe's paper market continues to be characterised by weak demand, so prices continued to fall amid declining production costs.

Plastics

Prices in the plastics market fell again in January amid weak demand and cheaper raw materials. The contract price for ethylene (C2) and propylene (C3) fell by €95/MT amid decreasing oil prices, pushing down the price of various types of plastic. Nevertheless, for February, market players expect oil prices to be higher and the price of raw materials for plastics production to rise. Market participants do not anticipate a recovery in demand before Q2 2023. Due to weak demand prospects, raw materials are most likely to be the main driver in the price movements of plastics.

In the EU, HDPE and LDPE prices were down by 4% and 3% m-o-m to €1,613/MT and to €1,990/MT, respectively. Market supply was low, but demand was even lower, so the main factor behind the price decline was cheaper ethylene (C2). US HDPE and LDPE prices have been stable for three consecutive months, at USc 73/lb and USc 95/lb, respectively. Suppliers' efforts to raise prices were unsuccessful as demand was unusually weak, while supply dropped only towards the end of the month amid tornado action on 24th February, which temporarily paralysed operations at some plants in Texas.

PET prices in the European market continued to decline in January against the backdrop of cheaper propylene (C3). The price is down 6% m-o-m to €1,341/MT in January. Lower production in Europe has not helped to balance the market, as imports from Asia are resulting in oversupply. US PET prices have been relatively stable for four consecutive months and there are no obvious factors pushing the prices up or down.

EU PP prices fell by 6% m-o-m in January to €1,151/MT. Demand from refiners remains weak and, with production prices falling due to cheap raw materials and energy, a price reduction occurred. PP prices in the US dropped 4% m-o-m to a monthly average of USc 70/lb after a brief period of stabilisation in December and the first half of January. Many market players believe a price bottom has been reached, or will be reached, in the near future. Producers intend to reduce supply and increase sales margins. In addition, rising oil prices could be reflected in higher commodity prices and may reverse the current trend.

Metals

Steel and aluminium prices continued to rise in January. China continued buying iron ore and coking coal, thereby supporting raw material price increases, which were reflected in rising production costs around the world. Steel producers started to raise prices on products to recoup elevated input costs and increase margins, while buyers realised that prices are likely to have bottomed out and increased purchasing activity. Nevertheless, statistics from steel- and aluminium-consuming sectors are still in a downward trend, so there are no fundamental signs of demand changes for steel. A more severe situation exists in the construction industry, where about 50% of steel and 30% of aluminium is consumed. In the US, the number of building permits sits at the mid-2020 level, but in the last two months, the number of permits has stopped declining and stabilised. In the EU, the Business Confidence Index for the construction industry has been negative for three consecutive months.

The CME's USA steel hot-rolled coil (HRC) January average monthly price rose by 3% m-o-m, to $883/MT. In Europe, HRC prices accelerated by 7% to €719/MT in January, in contrast to the previous month when prices declined by 3% m-o-m. An important factor in the supply reduction was the decrease in steel production in December, which put a strain on the steel market. Thus, global steelmaking fell by 11% y-o-y in December 2022 and EU steelmaking was down 17% y-o-y. Steelmaking in other European countries fell 19% y-o-y, in Turkey it was down 20%, and production in the US fell 8%. In China – the biggest steelmaker in the world – production declined 10%. In January, some companies already started to ramp up production and bring back idle steelmaking capacity. Many market participants are hoping that after Chinese New Year celebrations, the Chinese government's consumer incentives policy will help revive demand for steel and steel production. As a result, it is likely that raw material prices may continue to rise, potentially pushing up production costs and steel prices in all regional markets.

The LME aluminium 3-month price in January slowed to 2% m-o-m (3% m-o-m in December) to $2,578/MT. The weekly trend saw a steady rise at the end of the month, with some market players suggesting that aluminium prices have increased too quickly. LME stocks dropped to the lows of October 2022 in mid-January, on the back of increased buying activity, but in the second half of January, traders started to replenish stocks and aluminium stock levels picked up again. Overall, the global aluminium market situation is positive. Many producers see good prospects for their products, at least in the short term, and have started to increase primary aluminium production. According to the International Aluminium Institute, all regions of the world increased production in December compared with the previous month. In particular, production in the US and Europe grew by 3.5-4%, ahead of China and other Asian countries. Aluminium prices have also been pushed up by rising alumina prices, with alumina in short supply. Mintec estimates that the increase in alumina prices in January was reflected in an average increase in aluminium production costs by $50/MT. There is also growing confidence in the market that Russian aluminium could be banned from EU and US markets, which could trigger a deficit in the global market and hence a potential price increase. The introduction of an import ban was one of the main factors behind the price surge when Russia launched military attacks against Ukraine in 2022. However, no safeguard measures are yet in place, and last year primary aluminium production rose by 18% y-o-y, according to Rosstat.

Paper

Prices on the European market for paper products continued to fall. The market situation is characterised by weak demand and oversupply. Lower production costs, on the back of cheaper raw materials and energy, is contributing to lower prices. However, the downward price trend appears to be slowing.

The French Kraftliner 175g price in Europe continued to fall in January at the same pace as last month's 3% m-o-m decline, to €945/MT. Market demand remains weak and no significant changes are expected in February. Lower energy prices are allowing producers to make concessions on sales. Prices for French Testliner 2 in Europe fell by 6% m-o-m, to €770/MT. The volume of orders remains low for testliner, so suppliers have been forced to reduce prices.

The Semi-Chemical Fluting price on the European market decreased by 3% m-o-m after nine months of stabilisation under the influence of the general trend on the paper market and was €898/MT in January. As expected, despite a narrow segment with a small number of producers and consumers, weak market demand affected this market segment. The outlook for the market remains poor and a recovery in the coming months is not expected.

The price of GC2 in January in the EU market has been stable for seven consecutive months, at €2,045/MT. In this segment, the market remains balanced with good demand and moderate supply. In the GD2 segment, the demand situation remains negative, so prices accelerated downwards in January by 5% m-o-m (3% m-o-m in December), to €1,555/MT. Producers cancelled energy surcharges in January due to lower electricity prices in Europe, which resulted in lower transaction prices and, consequently, led to a faster pace of price decline.

Please click here for a recording of the Metal Packaging Market Update H1 2023.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)