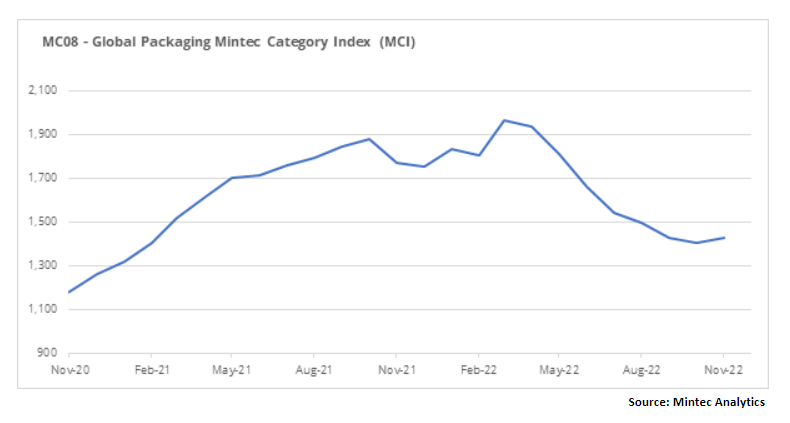

The Mintec Global Packaging Category Index (MCI) in November 2022 rose by 2% month-on-month (m-o-m) to USD 1,429/MT. The level of business activity in the market was sluggish, especially against the background of an uncertain macroeconomic outlook. Energy prices are declining, but most market players are of the opinion that price volatility will continue in the future, so the production costs of most materials used in packaging will fluctuate.

Plastics

Plastic prices in the US and European markets moved in different directions in November, although price dynamics were moderate and there were no major spikes. Rising interest rates are depressing business activity in the economy as a whole and this has a corresponding impact on the plastics segment. In the run-up to the new year, the outlook for the economy is unclear and therefore purchasing activity is minimal, because stockpiles are generally unwanted in such a situation. However, imports from Asia were still present in the markets and, after prices rose for many types of plastic in October in China, November prices declined again.

HDPE and LDPE on the EU market rose by 1% and 1.5%, respectively, in November from the previous month to EUR 1,698/MT and EUR 2,073/MT. The price fall in these markets, which has lasted for the past five months, has been replaced with a price correction. Production cuts reduced supply on the market, but demand was still weak and the situation will not change until the end of the year, according to market sources. In addition, the market continues to offer cheaper materials from Asia, which is unlikely to allow prices to rise further. LDPE in the US market stood at USc 95/lb in November, down 1% m-o-m. Ahead of the new year, buying activity is minimal as consumers do not want to end the year with high stocks. As prices have also continued to fall, this has held back purchases in the market. November HDPE prices have fallen 5% compared to the previous month, to USc 73/lb. The overall weakening of business activity in the market was further exacerbated by weak purchasing activity. The negative market picture is likely to persist until the end of the year.

PET in the EU fell by 7% in November m-o-m, to EUR 1,509/MT. The price decline, which started in September 2022, has continued due to low demand in the market. Despite production cuts in Europe, large import volumes have not allowed the market to balance. However, prices are still 3% higher compared to November 2021. The PP price in the EU in November 2022 was EUR 1,632/MT, up 2% m-o-m after a price stabilisation phase in October. A EUR 20/MT m-o-m increase in propylene (C3) contracts provided a positive impetus to prices. In addition, production cuts helped to balance the market and boost prices in the last week of November.

US PET prices remained relatively stable in November, averaging USc 86/lb for the month. Overall, business activity in the segment remains weak, so there are no indications of a resumption of growth. The US market price of PP fell to USc 86.2/lb, a decline of 9% m-o-m and 48% year-on-year (y-o-y). Despite production cuts by some PP producers, ExxonMobil doubled PP production capacity, so oversupply in the market persists.

Metals

On the steel market, prices continued to fall in November 2022, but in the last week of the month exporters attempted a bid price increase. Semi-finished and finished steel followed the price increase of the raw materials used in steelmaking. Aluminium on the LME climbed by 5% in November, but the prospects for further rises are weak.

The CME's US steel hot-rolled coil (HRC) price declined on average by 3% m-o-m and 51% y-o-y, to USD 775/MT in November. In Northern Europe, the HRC price fell by 10% m-o-m and 34% y-o-y, to EUR 654/MT over the same period. But in November, global benchmark prices for raw materials used in steel production started to climb. A surplus in the steel market persisted, but after a surge in raw material prices, rising input costs began to drive global market prices upwards. Nevertheless, prospects for further price increases for raw materials are weak, because the US and Europe will see seasonally lower steel output over the Christmas holiday period. In addition, steelmaking plant shutdowns continue, with Liberty Galati, which shut down a blast furnace for maintenance, and US Steel Kosice, which shut down the second of three blast furnaces. US Steel Kosice announced in November that it will suspend production until 2023. In China, the world's largest consumer of raw materials, steel output will fall seasonally in January and February during the Chinese New Year.

In November, India abolished the 15% export duty on HRC and CRC, which had been in effect since May 2022. The imposition of the duty was reflected in a 55% drop in rolled steel exports for the April to November 2022 period. Now that the duty has been cancelled, the country will increase exports again, thus increasing the supply on the global market, which will generate a surplus on the market, and put downward pressure on world market prices.

The LME aluminium 3-month price in November increased by a monthly average of 5% m-o-m to USD 2,359/MT. The recovery in aluminium prices was driven by a slight improvement in the market balance. Global demand for aluminium remains weak, largely due to economic stagnation, but production cuts are bringing the market into balance. This year, an estimated total of 1.7 million tonnes of annual aluminium production capacity have been shut down in the US and Europe. In China, about 1.1 million tonnes of annual capacity have been shut down amid restrictions on electricity consumption in Q4 for the winter period. All of these capacity shutdowns and production cuts total around 4% of global aluminium consumption.

In contrast to the steel market, production costs have fallen in the aluminium market. The price of Australian alumina, the main raw material for aluminium production, decreased by an average of 1.4% m-o-m in November on the back of an oversupplied market and lower electricity prices. Indeed, the Mintec Electricity Index Europe fell by 27% m-o-m in November. Lower production costs are unlikely to result in the restarting of idle capacity, as volatility in electricity prices is expected to be high, but operating plants are likely to be able to ramp up production.

Paper

Prices on the paper market decreased slightly in November for various products. Weak demand has prompted suppliers to discount the price of their offers. Falling production costs have given producers the opportunity to adjust prices downwards.

The price of French Kraftliner 175g fell by 2.4% m-o-m in November, to EUR 1,005/MT. Sluggish trading activity in the segment led to a price drop. Market players are also not expecting a surge in buying activity in the run-up to Christmas, so they are making concessions in sales. The price of French Testliner 2 fell in November in Europe to EUR 890/MT, down 6% m-o-m, after stabilising for the previous six months. One of the fundamental factors is that production costs in Europe have fallen due to lower electricity tariffs. According to the Mintec Electricity index Europe, electricity prices have been declining down for the last three months.

The price of semi-chemical Fluting has not changed since May 2022 and stood at EUR 928/MT in November. On a y-o-y basis, it has risen by 5.6%. It is a fairly narrow market segment, with limited supply and demand. Thus, the supply and demand balance in the market is maintained.

The price of GС2 in November on the EU market has been stable since September, at EUR 2,045/MT. However, market participants do not believe there is scope for further stabilisation. Overcapacity within Europe, and pressure from cheap imports, will put pressure on prices in the coming months. GD2 prices, meanwhile, fell by EUR 100/MT, or 5.6% m-o-m, to EUR 1,685/MT. The market was in a state of shaky equilibrium, but suppliers started to offer discounts to their nominal prices towards the end of the year, in a bid to sell off as much stock as possible. This led to lower prices on the market.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)