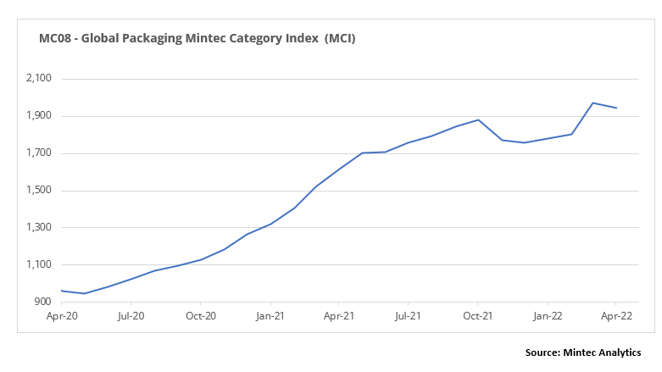

The Global Packaging Mintec Category Index (MCI) declined by 1.6% month-on-month (m-o-m) for the first time in three months to USD 1,943/MT in April. The index was primarily driven by falling prices in the metals market (steel, aluminium). The MCI, however, remained up by 20.1% year-on-year (y-o-y).

Plastics Market

In April 2022, prices across all grades of EU plastics continued to rise on limited feedstock (crude oil and gas) supply due to the Russia-Ukraine war. Similarly, US plastic prices rose on strong demand and limited supply. In addition, inflationary pressure, high input costs and logistical disruptions supported prices in the EU and US during the month.

EU HDPE and LDPE prices increased faster than the previous month at 13.8% m-o-m and 11.1% m-o-m to EUR 2,153/MT and EUR 2,599/MT, respectively, in April. According to market sources, several shutdowns in cracking facilities in the Netherlands reduced ethylene (by-product of crude oil) output in the month. High energy prices further exacerbated this situation. As a result of high prices, EU plastics converters are reportedly only purchasing the required quantities. EU PP prices also climbed by 9.4% m-o-m to EUR 2,113/MT in April on high feedstock prices. Additionally, imports of HDPE, LDPE, and PP that had helped alleviate supply conditions in the previous month were significantly reduced in April due to logistical disruptions. EU PET prices continued to rise in April to EUR 1,790/MT (up 8.1% m-o-m), attributable to continuous demand for a sustainable plastic alternative, high freight rates, and feedstock shortages. With the maintenance turnarounds underway, supply conditions are expected to worsen amid already limited feedstock supply.

US HDPE and LDPE prices increased to their highest level thus far in 2022 in April but remained lower compared to the same period in the previous year. US HDPE prices increased by 5.5% m-o-m to USD 2,116/MT while the US LDPE price stood at USD 2,557/MT (up 4.5% m-o-m). The m-o-m increase was mainly driven by strong demand from both producers and resellers and a lack of prompt supply due to the aftermath of winter storms in Houston and rising feedstock prices. US PP prices climbed by 8.3% m-o-m and 20.6% y-o-y in April amid strong demand, volatile feedstock prices and tight supply conditions in addition to a few producers issuing a force majeure due to logistical (railroad) congestions. US PET prices also continued to trend upwards in April, rising by 5.8% m-o-m and 79.1% y-o-y on robust demand as processors continue to meet global sustainability initiatives.

Logistical disruptions amid prolonged COVID-19 lockdown in China pose an upside risk to both EU and US plastics prices in the short term.

Metals Market

Steel and aluminium prices eased in April 2022 as COVID-19 lockdowns in China weighed on demand. China is currently fighting its worst phase of the COVID-19 pandemic since the virus emerged in late-2019. China has a strict “zero-COVID” policy, which has halted steel factory activity due to labour shortages and downstream consumption. Also, high energy costs in Europe led to curtailments of aluminium output.

The CME's US steel hot-rolled coil (HRC) price decreased by 11.6% m-o-m and by 4.1% y-o-y to a monthly average price of USD 1,485MT in April. This price decrease was attributed to a slowdown in demand due to COVID-19 outbreaks in China. According to market participants, mills are willing to negotiate lower prices again in the market. In April, Northern European steel HRC price increased marginally by 0.7% m-o-m and by 42.7% y-o-y, to EUR 1,362.5/MT, due to the Russia-Ukraine geopolitical conflict that has disrupted logistics, spurred sanctions and sent energy prices soaring. Russia is the world’s fifth-biggest steel producer, while Ukraine ranks 14th. The two countries account for a fifth of imports to the European Union.

In April, the LME aluminium (3-month) price decreased by 7.5% m-o-m, but increased by 40.4% y-o-y, to a monthly average price of USD 3,276/MT. The price decrease is attributed to soaring gas and power prices in Europe. Energy accounts for one-third of production costs for the aluminium market. Therefore, increasing electricity prices have forced several companies to curtail their lossmaking aluminium smelter production over the past couple of months. Also, the ongoing lockdown in Shanghai caused manufacturing and consumer demand to contract significantly, thus weighing on aluminium prices. In addition, the US interest rate hike has boosted the USD, and a rising USD makes USD-denominated metals more expensive for holders of other currencies, thus affecting demand.

Paper Market

EU paper packaging prices increased for most of the grades in April 2022. The price increase was mainly due to high production costs and the limited availability of certain grades. While the Russia-Ukraine geopolitical conflict is not currently directly impacting the European paper industry, market participants are concerned about how energy, transportation, and raw material markets will evolve in the coming months.

In April, the French kraftliner 175gr price increased by 6.3% m-o-m and 33% y-o-y to EUR 1,060/MT. The price increase was mainly attributed to high production costs and limited availability. Since a restriction was imposed on Russian paper deliveries, concerns of possible supply gaps have been growing, especially in the case of white-top kraftliner. Imports from the US and Brazil to Europe also remained limited.

The French testliner 2 price increased by 11.8% m-o-m and by 37.7% y-o-y, to EUR 950/MT in April. The price increase is primarily driven by brisk demand from the e-commerce sector and high production costs. No further price increases have been announced for May and June 2022. However, some producers are considering demanding higher surcharges.

The April price of GD2 increased by 6.8% m-o-m and by 62.2% y-o-y, to EUR 1,565/MT, driven by strong demand, high production costs, tight supply and long lead times. According to market participants, the shortage of raw materials has put the industry in a dire state; several cartonboard manufacturers can no longer produce at full speed. The April price of EU GC2 remained stable m-o-m but increased by 30.4% y-o-y, at EUR 1,825/MT. There are still limited imports from South America and Asia. Whilst Asian manufacturers could deliver more cartonboard to Europe, the scarcity of containers and hefty freight rates have made cartonboard transportation more expensive for consumers.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)