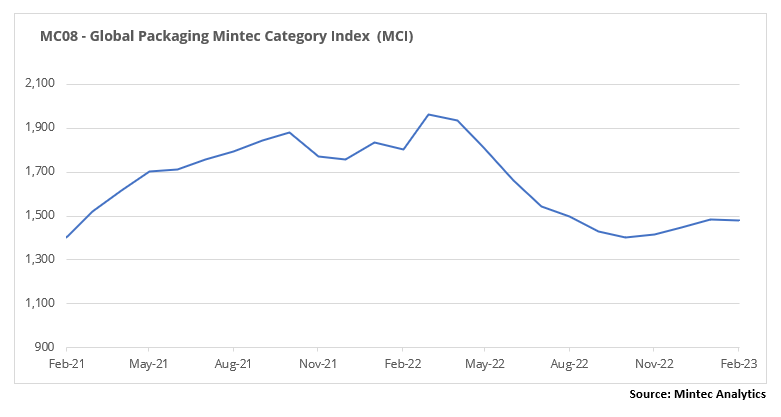

The Mintec Global Packaging Category Index (MCI) in February fell by 0.5% month-on-month (m-o-m), down 19% year-on-year (y-o-y), to $1,478/MT. Prices for packaging materials continued to move in different directions. Prices of most plastic products continued to fall amid weak demand, despite a rise in the price of raw materials. Steel rose in price as the market moved into deficit after production cuts in late 2022, but aluminium continued to decline. The market for packaging paper products remains weak in the EU, so prices declined or were stable in February.

Plastics

In February, prices for different types of plastics in the EU and US markets moved in different directions, but price movements were minimal. Demand in the market remains weak as customers are still unsure if the price bottom has been reached and are seeking to minimise purchases.

HDPE prices in the EU reached €1,573/MT, down 2.5% m-o-m. Weak market demand prevented producers from raising prices despite a 7% m-o-m increase in ethylene (C2) contract prices. EU LDPE prices fell by 2% m-o-m, to €1,944/MT, under pressure from weak market demand. Growth started to pick up in February and producers were able to raise US HDPE prices by 4% m-o-m, to USc 76/lb. US LDPE prices rose on average by 3% m-o-m in February, to USc 98/lb. Plastics producers were also spurred on by rising raw material prices. In addition, Formosa Plastics USA announced on 22nd February a force majeure on polyethylene supplies due to technical reasons.

EU PET prices were stable during February, but compared to January declined by 2% m-o-m to €1,311/MT. Many market players are hoping for a seasonal increase in demand for PET, as consumers see that prices bottomed out in February, as expected. PET prices in the US dropped to USc 83/lb, down 3.5% m-o-m. Demand in the market remained weak, so sellers were forced to make concessions by offering lower prices.

PP prices in the EU and the US started to rise in February on the back of rising propylene prices. PP (C3) contract prices on the EU market increased by €80/MT m-o-m in February. Plastics producers were thus forced to raise prices. EU PP prices rose in the second half of February to €1,518/MT, but due to the low prices at the beginning of the month, there was no average m-o-m increase. PP prices in the US market climbed by 13% m-o-m in February, reaching USc 79/lb on average for the month.

Metals

Steel and aluminium prices moved in different directions in February. Steel prices grew markedly, especially in the US, where capacity shortages have occurred due to shutdowns of some plants and facilities at the end of 2022. The European market lags the US market in terms of steel price growth, but it is still moderately positive. Producers are pushing hot-rolled coil (HRC) prices up one step at a time and consumers are accepting the new price levels. Aluminium prices declined amid weak demand and high inventory levels.

Since the beginning of February 2023, there has been a significant shortage of flat steel products in the US market. Consumers are actively starting to buy steel products, and with low inventories there was a shortage of products on the market. Domestic manufacturers cannot meet demand, and lead times for HRC orders have increased from five to eight weeks. As a result, the CME's USA steel HRC prices rose 14% m-o-m on average during February, to $1,003/MT. Tinplate prices on the US market increased by 4% m-o-m in January and remained stable in February. It is likely that tinplate prices will soon reflect the rise in HRC values in the US market. In the European market, HRC prices climbed by 7%, to €770/MT. The market is well balanced as consumer demand recovers and flat steel producers have received good order bookings. In terms of steel production costs, steel scrap has started to rise in price as prices of other raw materials for steelmaking were relatively stable in February.

The LME aluminium 3-month price fell in February by an average of 2.4% m-o-m, to $2,456/MT. Demand for aluminium products remains weak and the recovery in production in January was premature. Nevertheless, market players do not expect aluminium prices to collapse. On the contrary, after a downward correction, they believe that aluminium could appreciate following a gradual recovery in demand. For example, new orders (aluminium and non-ferrous metal products) were up 4% m-o-m in January, reaching a seven-month high. In the EU, however, a fall in electricity prices in Europe makes primary and secondary aluminium production much cheaper. Europe is the world's second largest aluminium-consuming region and reducing production costs in the region has a global impact on prices. Aluminium prices in the US have not yet reacted to the introduction of a 200% import duty on aluminium, and aluminium-derived products, from Russia.

Paper

The market for packaging paper in Europe is still in surplus. Despite reduced production, consumers are still minimising purchases in anticipation of further price reductions. The Manufacture of Paper and Paperboard Index in the EU in January was seasonally up 22% m-o-m, but down 18% y-o-y, indicating the depth of the decline in the industry.

French Kraftliner 175g and French Testliner 2 continued to fall in price on the EU market. The decline in demand is further exacerbated by the fact that some consumers tend to use substitutes. As a result, French Kraftliner 175g reached a monthly average price of €895/MT in February, down 5% m-o-m, representing a 10% y-o-y decline. The French Testliner 2 price was down by 7% m-o-m, a 15% y-o-y fall, to €720/MT. Some producers are opting to reduce production in anticipation of a stronger market.

The price of Semi-Chemical Fluting stabilised m-o-m at €898/MT in February. Market sources say that the market is consolidating, and the price reduction is unlikely to increase sales, so suppliers will probably try to hold back further price cuts until demand in the segment recovers.

GD2 and GC2 prices stabilised at €1,555/MT and €2,045/MT in February, respectively. Finnish logistics strikes ended without a significant impact on the wood and paper market. Market players were expecting the action in Finland in advance, so prepared a small stockpile. The market is still characterised by weak demand, but producers continue to keep production at a low level, which is preventing prices from falling. Demand is at a relatively high level from the pharmaceutical and beauty industries.

Please click here for a recording of the Metal Packaging Market Update H1 2023.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)