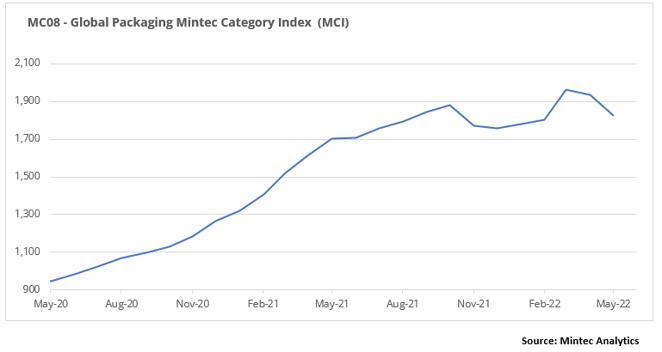

The Global Packaging Mintec Category Index (MCI) declined by 5.6% month-on-month (m-o-m) to USD 1,828/MT in May, primarily driven by easing prices in the metals market (steel, aluminium). However, the index was up by 7.4% year-on-year (y-o-y) and by 2.7% since the beginning of the year.

Plastics Market

In May 2022, most US plastic prices remained stable due to a balance in supply and demand conditions. However, the price trend in the EU plastics market was mixed, with the prices of some grades falling and others rising, albeit at a slower growth rate than the previous month.

US HDPE and LDPE prices stayed flat but declined by 12.7% y-o-y and 14.1% y-o-y to USD 2,116/MT and USD 2,557/MT, respectively, in May. This was due to a balance in supply and demand fundamentals during the month. Similarly, US PET prices were stable in May but remained elevated y-o-y on sustained robust demand amid elevated feedstock and monomer costs (paraxylene/PTA). Consequently, the US PET price was up by 65.5% y-o-y to USD 2,646/MT. US PP prices declined by 3% m-o-m to USD 3,075/MT due to muted demand from processors during the month but remained up by 27.1% y-o-y.

EU HDPE prices increased marginally by 0.5% m-o-m to EUR 2,163/MT in May (+14.4% y-o-y). Following a record high reached in April amid the Russia-Ukraine war and uncertainty about feedstock (crude oil and gas) supply, EU HDPE prices stayed steady into May and only began to decline in the last two weeks of the month. Conversely, EU LDPE prices fell to EUR 2,596/MT in May, down by 0.1% m-o-m but up by 13.3% y-o-y. This marginal decrease was due to a slight improvement in supply conditions despite the impacts of the ongoing Russia-Ukraine war on feedstock supply. Likewise, the EU PP price fell in May due to improvements in supply conditions and reduced demand as producers struggled for storage tankers during the month. The EU PP price was thus, recorded at EUR 2,092/MT (-1 % m-o-m but +12% y-o-y). The EU PET price continued its three-month upward trend in May, rising on high demand as processors continue to meet global sustainability initiatives. Additionally, lower EU PET production estimates for 2022 have continued to keep prices elevated (+36% y-o-y).

According to market sources, on the 14th of June 2022, Russia cut gas supplies via Nord Stream to Germany by 40%. The decline in gas deliveries to Germany and other EU countries, including France and Italy, high crude oil prices and sustained logistical disruptions are likely to keep EU plastic prices elevated.

Metals market

Steel and aluminium prices continued to ease in May 2022 as COVID-19 lockdowns in China, the war between Russia and Ukraine, and rising inflation heightened the uncertainty around demand levels. As of the 24th of May, Shanghai (China’s key financial hub) remained under lockdown, and restrictions and widespread testing were rolled out in Beijing. However, it remains unclear when normal economic activities would resume in China.

The CME's US steel hot-rolled coil (HRC) price decreased by 21.8% m-o-m and 31.9% y-o-y to a monthly average price of USD 1,161/MT in May. The US HRC steel price remains 31% beneath the all-time high reached in March 2022. This price decrease was attributed to a slowdown in demand. Nevertheless, activity should pick up again in June, when buyers will need to book and plan for the post-summer period. In May, the Northern Europe steel HRC price decreased by 13.6% m-o-m but increased by 8.7% y-o-y, to EUR 1,178/MT, due to weaker demand. According to market sources, buyers have shown limited interest due to adequate stock levels, uncertain consumption prospects and discounted imports.

In May, the LME aluminium (3-month) price decreased by 12.9% m-o-m but increased by 16.3% y-o-y, to a monthly average price of USD 2,855/MT. The price decrease was attributed to COVID-19 lockdowns in China (the largest aluminium producer and consumer), which significantly caused manufacturing and consumer demand to contract. Also, there is weaker demand from the automotive sector. In addition, record-high power prices in Europe have increased the cost of production for aluminium and have forced several companies to curtail their lossmaking aluminium smelter production.

Paper market

The EU paper packaging market prices stayed flat for most grades in May 2022 due to improved availability and lessened demand. There are no significant price changes expected in June.

In May, the French kraftliner 175gr price stayed flat m-o-m but increased by 33% y-o-y to EUR 1,060/MT. The price stability was attributed to increased kraftliner production in the EU and improved import volumes from the US. According to market participants, the lead times remain very long, but demand has started to ease. Overall, the entire market for corrugated case material is no longer as tight as it was a few months ago. Additional price hikes are not on the horizon.

The May price of French testliner 2 stayed flat m-o-m but increased by 37.7% y-o-y, to EUR 950/MT. The significant yearly price increase was primarily driven by brisk demand from the e-commerce sector and high production costs. No further price increases have been announced for June 2022. There are also a few new capacities in the European market; thus, this should ease the supply in the market.

The May price of GD2 stayed flat m-o-m and increased by 62.2% y-o-y to EUR 1,565/MT. Also, the May price of EU GC2 remained stable m-o-m but increased by 30.4% y-o-y, at EUR 1,825/MT. Both prices are at historically high levels. Producers report sizeable order backlogs amid long lead times. Some customers are building up stock to secure cartonboard and to avoid paying higher prices in the future. Although, most market players do not think there will be additional mark-ups in June.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)