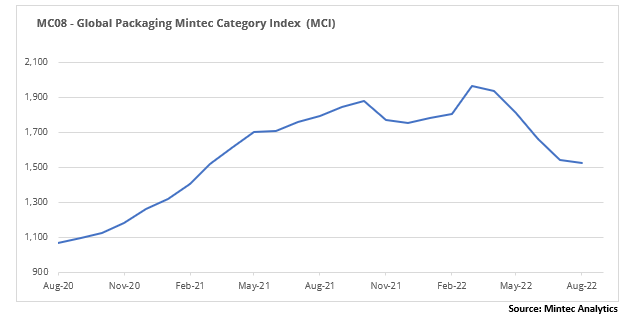

The Global Packaging Mintec Category Index (MCI) declined for the fifth consecutive month, to USD 1,525/MT in August 2022, down by 1.2% month-on-month (m-o-m) and 14.9% year-on-year (y-o-y), primarily driven by falling plastics and metals' prices in the EU and US. However, the index declined at a slower rate than the previous month, due to prices in the paper market remaining stable m-o-m.

Plastics Market

In August, EU and US plastics prices across all grades declined, except for the US PET price, which remained stable.

EU HDPE and LDPE prices declined for the third consecutive month, falling by 5.9% and 5.5% m-o-m to EUR 1,838/MT and EUR 2,197/MT, respectively. Also, the EU PP price was down on the month, to EUR 1,690/MT (-4.9% m-o-m and -8.8% y-o-y), reaching its lowest level since March 2021. The price declines in the EU PE and PP markets were due to weakened demand and ample supply conditions, on the back of large import volumes. According to market sources, trading activity was slow to resume, post-summer holidays. In the EU PET market, the price declined marginally by 0.5% m-o-m, to EUR 1,801/MT, due to subdued secondary demand resulting from record-high inflation and expectations of further declines in the coming months. Additionally, market participants reported the arrival of competitively-priced import cargos on the back of easing freight rates. However, while prices across all EU plastics grades were down in August compared to the same period in the previous year, the EU PET remained up by 49.6% y-o-y, due to comparatively higher demand and soaring input costs.

Similarly, many buyers in the US plastics market were reluctant to make purchases as they anticipated further price reductions, due to ample supply. Accordingly, the US HDPE and LDPE prices declined by 10.5% m-o-m and 10.4% m-o-m, to USD 1,914/MT and USD 2,310/MT, respectively. Producers have reportedly been seeking to balance supply and demand fundamentals as US PE inventories have reached a record high. Additionally, US PP prices declined in August, falling by 5.1% m-o-m, to USD 2,390/MT, due to high inventory and subdued demand. The easing of logistical concerns witnessed last year has led to the prices of both US HDPE and LDPE falling by 30.0% y-o-y, while the US PP price was down by 8.8% y-o-y in August. After a slight decline in July, the US PET price remained flat in August at USD 2,491/MT, up by 40.4% y-o-y.

Metals market

Steel and aluminium prices continued to ease in August 2022, due to increasing uncertainties over short-term demand and Europe's energy crisis.

The CME's US steel hot-rolled coil (HRC) price decreased by 12.2% m-o-m and 57.4% y-o-y, to a monthly average price of USD 886/MT in August. This price decrease was attributed to a slowdown in demand. The Midwest HRC lead times were flat at 3-5 weeks. In August, the Northern Europe steel HRC price decreased by 4.8% m-o-m and 33.6% y-o-y, to EUR 801.3/MT, due to weaker demand as the automotive industry is dealing with parts shortages. According to market participants, most purchasers had sufficient inventories and were in no rush to buy HRC.

In August, the LME aluminium (3-month) price decreased marginally by 0.7% m-o-m and by 6.8% y-o-y, to a monthly average price of USD 2,424/MT. This price decrease was attributed to recession fears, now the dominant theme in industrial metals, as surging energy prices translate into a manufacturing slowdown. In addition, the off-season on the demand side has not yet ended, and this is coupled with accumulating aluminium stocks. According to market sources, aluminium prices may increase over the medium term due to a surge in demand for green investments such as electric vehicles.

Paper market

Due to reduced demand, the EU paper packaging market prices stayed flat for most paper grades in August 2022. According to market participants, some paper manufacturers still had good activity levels but saw a slowdown in demand.

In August, the French kraftliner 175gr price stayed flat m-o-m but increased by 18.1% y-o-y, to EUR 1,060/MT. According to market participants, business activity has been slower than the same time a year ago, and demand has slowed down. In addition, the kraftliner market has been facing a much larger surplus than recycled paper, as more capacity has been added to the European market. Also, Russian kraftliner has been replaced by cheap imports from the Americas, notably from Brazil.

The August price of semi-chemical fluting stayed flat m-o-m but increased by 12% y-o-y, to EUR 928/MT. Semi-chemical producers have robust orders and report being fully booked for the coming months. Although declining demand is evident for these grades, market players still report having good order books with backlogs stretching into October.

The August price of EU GD2 stayed flat m-o-m and increased by 48.8% y-o-y, to EUR 1,585/MT. Additionally, the August price of EU GC2 remained stable m-o-m but increased by 25.9% y-o-y, at EUR 1,845/MT. Both prices are historically high since natural gas, recovered paper, and pulp prices rose again in August. According to producers, there is still a robust order intake but sluggish call-offs. In some cases, deliveries have been a month late, and wherever possible, customers have been cancelling orders, for instance, if price increases or surcharges are announced. According to market sources, cartonboard prices may increase again in September 2022.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)