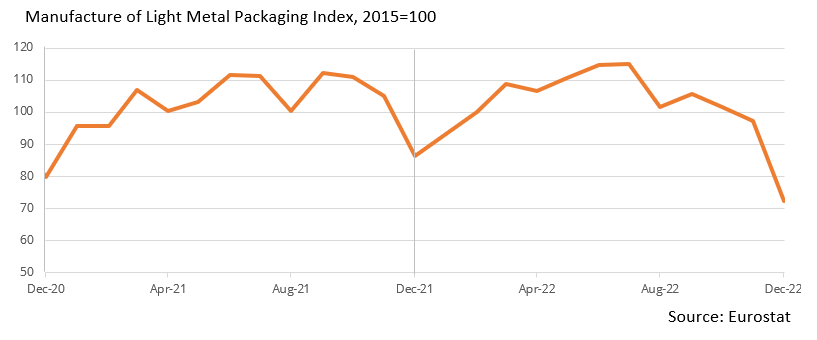

The Manufacture of Light Metal Packaging Index decreased seasonally in the EU in December 2022, according to Eurostat data. However, the decline was a record 26% month-on-month (m-o-m) and the index fell to its lowest level in three years. The decline for the 2022 calendar year (CY) was 1%. A similar trend was visible in the related segment of plastic, where the Manufacture of Plastic Packaging Goods Index fell by 17% m-o-m in December, but unlike metals, the size of the decrease was similar to the same period a year earlier.

Returning to metals, imports into the EU of aluminium products used as packaging fell by 15% m-o-m in December, down 2% for the 2022 CY. It is clear that the decline in domestic production has not been replaced by imports. Moreover, the drop in supply overtook the fall in demand, which helped to reduce stocks of finished products in anticipation of a seasonal recovery in demand, according to market participants.

Typically, market demand increases in the first half of the year, supporting the recovery in production, which seasonally peaks in July. Market players are still waiting for certainty in the market, but they state that it is most likely that final demand will rise. The impact of the cost-of-living crisis may weaken, as energy prices have collapsed and inflation growth in the Eurozone (as measured by the Harmonised Index of Consumer Prices) fell to 8.5% year-on-year (y-o-y) in January, down from 9.2% m-o-m. Furthermore, the European Commission expects the EU economy to grow by 0.8% in 2023, up from the 0.3% forecast in November. In addition, the winter is coming to an end and heating costs will be less of an issue for many households. On the back of the cost-of-living crisis, consumers have been postponing purchases, leading to pent-up demand.

Prices of metal products used for packaging in Europe are still moving in different directions. Aluminium foil prices have risen for three consecutive months, gaining 1.7% m-o-m in February, but aluminium can prices have been falling for four consecutive months, losing 1.5% m-o-m on average. However, prices for both products remain in the H2 2022 range, as the price bottom appears to have passed and the market has entered a stabilisation phase in anticipation of increased demand. Tinplate prices have been stable since July 2022.

Suppliers and consumers understand that the market is in a delicate balance and therefore do not expect prices to fall significantly. At the same time, there is a lack of confidence in Europe for a sustained recovery in demand.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)