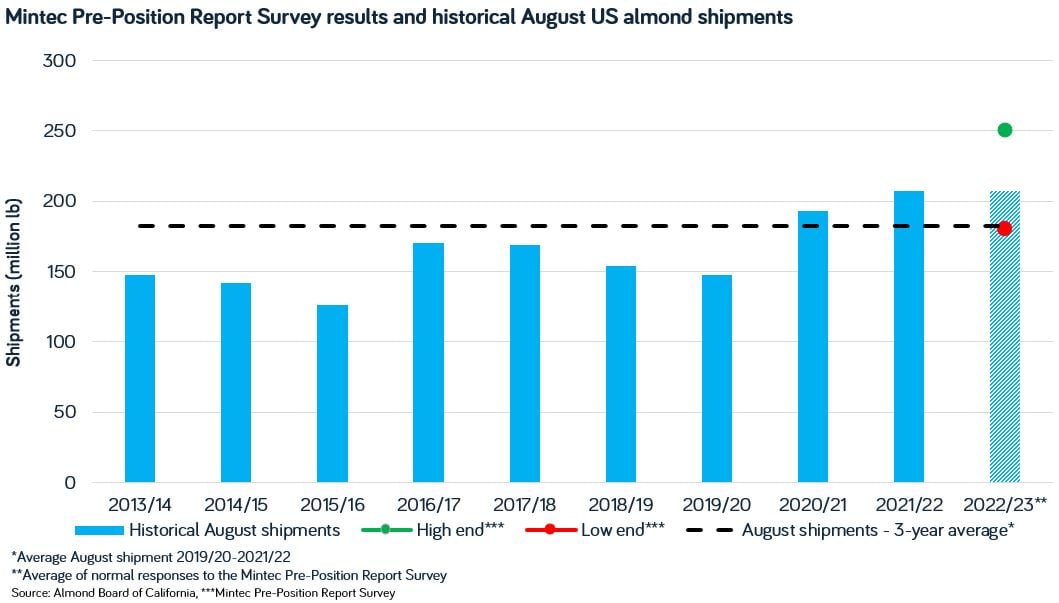

Market participants surveyed by Mintec, ahead of the official release of the August position report on September 9th, are expecting a strong start to the 2022/23 season as sellers looked to empty stores ahead of harvest. Additionally, pushed shipments from July, as a result of the Oakland Port closures (read more here), were expected to add additional volume to the final August figures.

Estimates were reported in a range of 180-250 million pounds, with most market participants returning figures of 200-215 million pounds. The wide range in responses was explained by several market participants as a result of the size of old crop stocks at the start of the season, with one exporter saying to Mintec, “it’s very hard to estimate shipments this month. Those who were under committed have been moving old crop out the door as fast as possible and those who had less stock have seen slower shipments in August. It’s hard to see where the balance is, but the consensus seems to be around 210 million pounds at the moment.”

The majority of the August shipments were expected to be made up of a mixture of old crop kernels and new crop inshells as sellers look to free up storage space as crops come in.

“We are worried about bin space over harvest and just want to get as much stock out of the door as possible to ease pressure on storage space. We’ve been fairly aggressive at offering inshell, and it has translated into more sales,” a US handler disclosed to Mintec.

While a strong start to the season would typically be bullish news, several traders stated they did not believe this would be the case.

“August shipments are likely to be high as the prices for old crop were so low that if you had any warehouse space it makes sense to stock up now. However, the fact that stocks at destination are high at the moment, means that demand for the remainder of the year is likely to fall off a cliff. We saw this last season where the size of the carry-out reduced demand for new crop supplies until well into January,” a US based trader stated.

Due to this, new commitments are expected to be fairly low compared to historical norms for this point in the season.

To stay up to date on developments in the almond markets, subscribe to the Mintec Weekly Almond Report by emailing PRA@Mintecglobal.com. The report, which is released each Thursday, provides in-depth information on pricing and market dynamics.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)