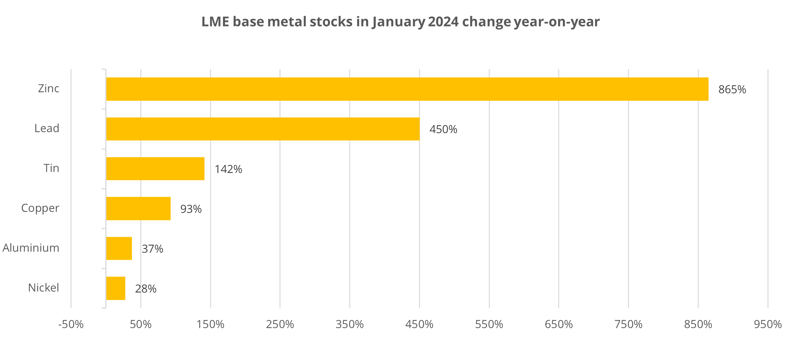

Accumulated LME base metal inventories at the end of 2023 put pressure on the market. Zinc and Lead in focus.

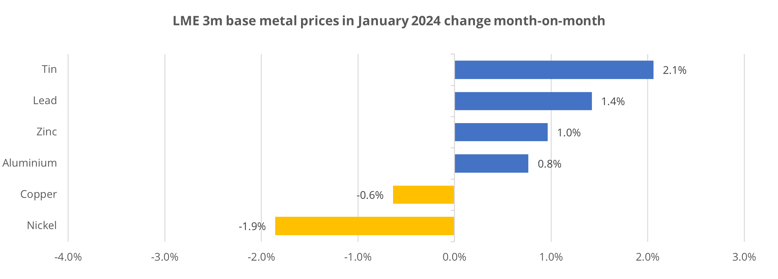

In January, the base metals market was under pressure from high LME inventories accumulated during December. Demand in the market remains weak, so the inventory reduction in January was relatively muted. Metal suppliers reported that procurement activity in Europe and the US was weak, and China also showed slow business activity in the run-up to the Lunar New Year holidays in February. In addition, the weakening macro indicators of the Chinese economy are a source of concern for global market players.

Source: Mintec Analytics

Some market sources point out that, due to logistical problems in the Red Sea, the delivery time of metals from Asia to Europe has been lengthened by more than 15 days and thatlarger inventories will be a buffer to prevent disruptions in the supply chain, as Asia is a key supplier of base metals. Although it is also worth considering the highly speculative component of LME inventory build-up, especially in Zinc and Lead.

Source: Mintec Analytics

Zinc [Mintec Code: LN20] and Lead [Mintec Code: LN14] prices showed an upward trend in 2023 due to speculative demand growth. Zinc consumption declined steadily in 2022-2023 as most of the metal is used for galvanising steel, which is mainly used in construction. The construction industry stagnated globally in 2023. However, zinc suppliers reduced supply, resulting inmarket deficit in H2 2023. Stock building towards the end of the year accelerated global demand for the metal.

Global lead demand was consistently high in 2023, primarily due to the automotive industry, where lead is used in batteries. However, since the end of 2023, automotive metal suppliers have reported weak consumer demand. According to market sources, car sales stopped growing steadily in Q1 2023, so the outlook for automotive metal consumption is uncertain in February.

Market players expect that price trends in the base metals market are likely to take shape after early-year statistics on the economy and consuming industries become available. Attention will also focus on Chinese economy, which is expected to increase activity in the second half of February after the New Year holiday period. If Chinese demand fails to pick up, the global market will likely face an oversupply of base metals.

For further insight sign up for early access to our H1 Industrial Materials 2024 eBook. Equip your business with strategic intelligence to navigate a challenging industrial materials market. This eBook delves into high-level macroeconomic trends, industry impacts, and the reflection of these dynamics on industrial commodity prices.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)