Latest MPOB report raises supply concerns and unveils unexpected trend in the global palm oil market

The latest Malaysian Palm Oil Board Report (MPOB) has sent shockwaves through the market, particularly regarding Malaysian palm oil end stocks for June 2023. MPOB's estimate of 1.72 million metric tonnes falls short of trade expectations (1.85-1.88 million metric tonnes), despite being higher than June 2022's end stocks (1.64 million metric tonnes).

Regarding production, the report indicates a modest decline of 4.6% compared to May, in contrast to lower estimates given by market players to Mintec which suggested of a nominal increase of approximately 0.1% to 0.4% pre-report. The production decline is partly attributable to water stress caused by early signs of an El Nino event in Sabah, Malaysia's largest palm oil-producing state. Reduced yields resulting from this unfavourable condition and issues like under-fertilisation and limited labour availability have intensified the impact on production.

Export performance has exceeded market expectations, with MPOB estimating exports at 1.17 million metric tons, an increase of 8.59% compared to May. This surprise surge in exports, particularly to key purchasing countries like India and China, is due to palm oil's competitive pricing and the reluctance of some players to switch to other raw materials. However, the potential tightening of palm oil stocks in the coming months, especially in light of the anticipated El Nino event, raises concerns about supply strain and the potential for continued upward price momentum, according to market players.

Historical data shows that moderate El Nino events have caused a 13-15% year on year (y-o-y) decline in Malaysia's and Indonesia's palm oil output. Considering this trend, there is a legitimate concern that a potential El Nino event in 2023 could lead to reduced Fresh Fruit Bunches (FFB) yields, further straining palm oil supplies.

Additionally, Mintec has learned that the current hot and dry weather in Indonesia and Malaysia has caused some palm trees to undergo an unusual transformation, changing from female to male, resulting in a lack of fruit production. Consequently, posing a significant challenge to palm oil production and thus lowering overall availability.

The MPOB report has a mildly to moderately bullish effect on the palm oil market. However, the market's trajectory will depend on the overall impact of the El Nino event and continued significant purchases from key buyers such as China and India in the coming weeks and months.

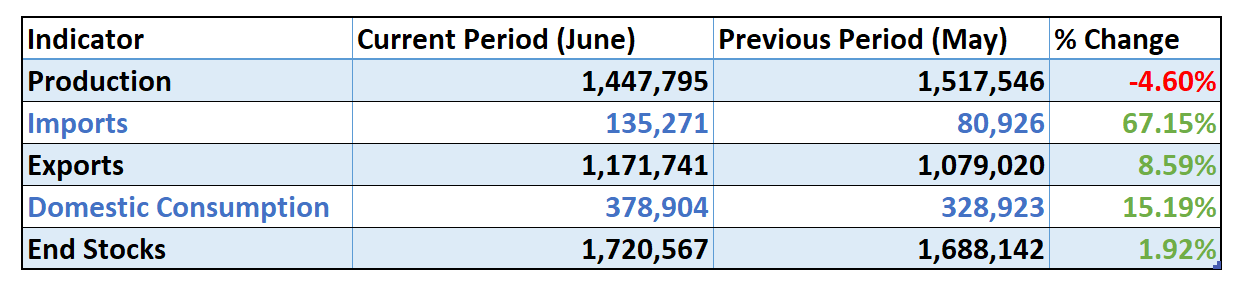

MPOB Figures and Month and Month Changes in metric tonnes:

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)