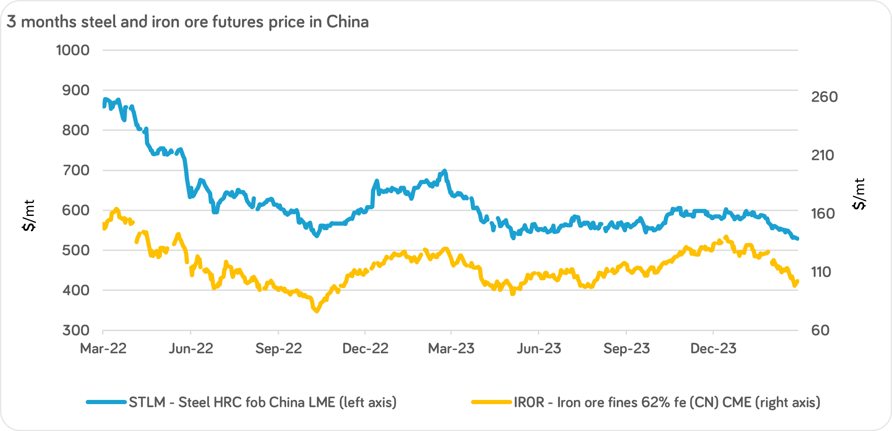

Steel prices in March are under pressure from falling iron ore prices. The iron ore market situation in Q1 2024 reflects weak Chinese demand due to high inventory levels, as evidenced by falling futures prices. The CME's Iron ore [Mintec Code: IROR] 3-month futures price on 15 March was at $98/MT, hitting its lowest level in nine months. The downward price trend started in January and continued during February-March. Since peaking on 3rd January, iron ore in China fell in price by 30% by 15 March.

Source: Mintec Analytics

The fall in prices is due to weaker demand from Chinese steelmakers. Ahead of the seasonal increase in steel demand from the construction industry in the spring, a large number of deals were made to buy iron ore at the end of 2023, resulting in a large amount of imports in January-February. The increase in imports led to an increase in stocks at ports to more than 140 million tonnes, close to the level of the figure in March of the previous year. At the same time, preliminary estimates by the China Iron and Steel Association (CISA) put the steelmaking figure for the first 10 days of March at 4.4% y-o-y lower as steelmakers take a bearish view on steel demand in the market. The poor demand is also supported by an 8% rise in steel inventories at the end of the first week of March relative to the end of February. As a result, with the same ore stockpiles as a year ago but significantly worse demand for steel, demand for iron ore in March is weak, which is reflected in falling prices.

The impact of low iron ore prices in China on other markets will be significant. Firstly, most iron ore purchase contracts in the world are centred on Chinese prices, so the cost of steel production due to the raw material component will fall globally. On the other hand, the weak demand for steel in China will encourage producers to continue the trend of increasing exports, which has been observed for the last 3 years. Given the falling cost of steel production in China, it is likely that the pressure of cheap steel imports from the country will intensify in Asia, Europe and the Americas.

For further insight sign up for early access to our H1 Industrial Materials 2024 guide. Equip your business with strategic intelligence to navigate a challenging industrial materials market. This guide delves into high-level macroeconomic trends, industry impacts, and the reflection of these dynamics on industrial commodity prices.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)