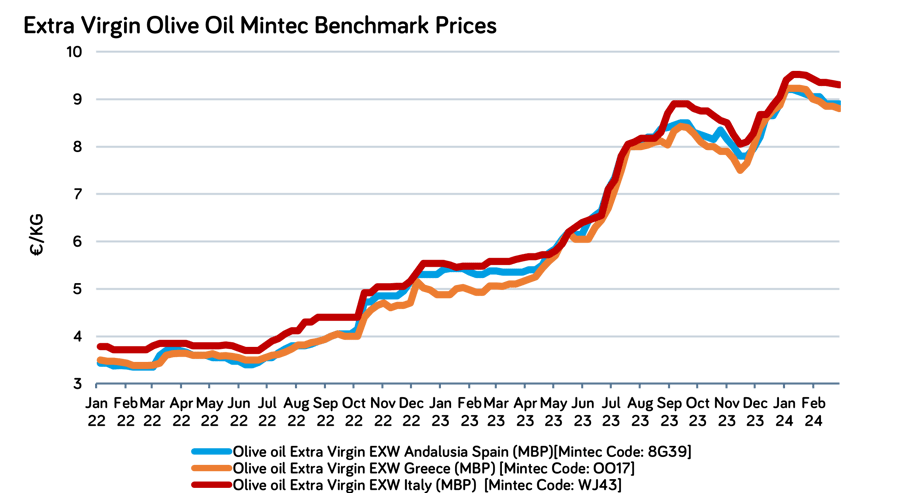

Olive oil prices have undergone a significant decline since reaching an unprecedented high of €9.20/kg for extra virgin olive oil from Andalusia, as indicated by the Mintec Benchmark Price (MBP) [Mintec Code: 8939]. According to Mintec's 20-year data, this record high has now moderated, with prices stabilising at €8.90/kg as of March 1st.

Currently, market dynamics reflect a 'tug of war' between buyers and sellers. Sellers have commented to Mintec that they anticipate limited olive oil supplies, citing potential scarcity and minimal carryover from the previous season which in their view could add upward pressure to prices in the coming weeks. In contrast, buyers foresee down-trending prices, attributing their stance to increased production estimates, especially for Spain, compared to earlier in the season. Consequently, buyers are adopting a cautious approach. They are only purchasing minimal volumes to fulfill immediate needs, resulting in a stagnant market where neither buyers nor sellers are willing to adjust their positions.

Concerns have emerged regarding consumption trends, with market players noting a decrease influenced by the elevated retail prices of olive oil compared to alternative cooking oils such as sunflower or rapeseed. This concern is compounded by fears of an economic recession within the EU, which historically leads consumers to seek more affordable alternatives, potentially dampening demand for olive oil at current price levels.

Market players have expressed these concerns, with one trader stating, "We are very worried about the price levels on the supermarket shelf, in some cases they are three or four times as expensive as sunflower or rapeseed cooking oils. The economy across Europe isn't faring too well, and we worry that these prices are simply too high for the average consumer."

Source: Mintec Analytics

The complexity of the olive oil market is further highlighted by mixed production estimates. Spanish production estimates for the 2023/24 season have been revised upwards to approximately 800,000 metric tonnes, an increase of circa 140,000 metric tonnes from the previous season. However, concerns persist regarding the lack of substantial carryover from the old crop, which could result in similar or diminished supplies compared to the previous year. In Italy, persistent drought conditions have led to lower-than-average output projections of 290,000 metric tonnes for the 2023/24 marketing year. Greece faces similar challenges, with industry insiders predicting production of around 120,000 metric tonnes, a significant decrease from the previous year. Additionally, Turkey, a key supplier to the EU in the prior season, is expected to produce as little as 180,000 metric tonnes of olive oil, compared to approximately 410,000 metric tonnes in the prior season.

It's worth noting that Turkey has maintained an olive oil export ban, originally set to expire in November 2023 but extended due to local pricing concerns. Market players had hoped for increased Turkish exports to the EU once the ban was lifted, but the significant decrease in production potential has made this scenario unlikely. Overall, the combination of varying production estimates and external factors such as export bans and economic conditions within the EU adds further complexity to the olive oil market outlook.

💡Do you want to explore this topic further?

Watch on demand our webinar "Steering the Olive Oil Landscape - Supply, Quality, and Sustainability Insights".

I delve into challenges in the olive oil market, providing valuable insights to help you navigate the changing market dynamics.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)