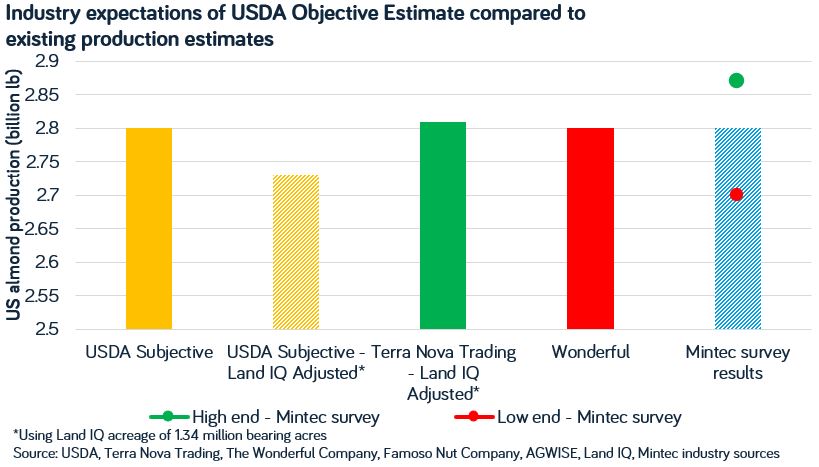

Market participants surveyed by Mintec in the last week of June expected the USDA Almond Objective Measurement, due for release on 8 July, to come in close to the previous subjective forecast of 2.80 billion pounds. Estimates of the USDA production figure ranged from 2.70-2.87 billion pounds, with the majority of respondents returning estimates clustered around 2.80 billion pounds.

The USDA Objective Almond Measurement provides an updated look at production for the coming crop and is the last “major” production estimate ahead of harvest. If the Objective measurement differs significantly from industry expectations, there will likely be a reactive shift in prices. This was last observed in the summer of 2021, when a lower-than-expected USDA Objective of 2.80 billion pounds led to a rally in prices following the release.

It is worth noting that current industry sentiment suggests that the USDA Objective release is likely to be higher than final production levels. Market participants pointed to the difficulty in estimating yields while crops are suffering severe drought stress, along with the belief that the USDA area multiplier did not reflect the situation on the ground.

On the topic of estimating yields, one US grower stated, “it’s next to impossible to get an accurate read on the crop when the trees are this stressed. I’ve normally got a good eye for our yields, last season I pegged it around 3,200 lb/acre and our final figure came in at 1,800 lb/acre. The issue is the nuts look fine on the tree, but it’s just water weight and the nuts aren’t developing due to the stress. Once harvest comes, they lose the water weight and just shrivel away on the ground”.

The USDA area multiplier of 1.37 million bearing acres is higher than the Land IQ release of 1.34 million bearing acres, and market participants are expecting the next Land IQ area release in November to revise this down further.

“They haven’t accounted for the sheer volume of trees that are getting pulled or abandoned at the moment. It’s the same with Land IQ - I’d expect to see the difference between the initial and final reports significantly higher than normal to capture this”, a US handler said.

To stay up to date on developments in the almond markets, subscribe to the Mintec Weekly Almond Report by emailing PRA@Mintecglobal.com. The report, which is released each Thursday, provides in-depth information on pricing and market dynamics.

.png?width=145&height=54&name=Mintec_Logo_Small_Use_Mono_RGB%20(2).png)